NextEra Energy, Inc (NEE Stock) earnings outlook

It may not be a household name, but NextEra is one of the biggest North American energy companies with more than 10,000 employees. It is also the largest American electric utility holding company by market capitalization.

NextEra Energy, Inc. (NEE) will publish its fourth quarter earnings report ahead of the market open on Tuesday January 26. The report will be for the fiscal quarter ending Dec 2020. Zacks Investment research (based on only 5 analysts’ forecasts) for fourth-quarter earnings and revenues have earnings pegged at 39 cents per share and revenue at $4.94 billion. The projected revenues and earnings indicate an improvement of 7.7% and 8.3%, respectively, from the same quarter last year. (Zacks).

What points should we pay attention to?

NextEra is one of the leading companies which are trying to shift to renewable energies, which has now become an even higher priority given the effects of the pandemic on the market. The growing economy in the last quarter of 2020 meant more demand for energy, which was also good for the company. On the other hand, “in the fourth quarter, the company took initiatives to redeem hybrid securities and carried out other potential refinancing activities to take advantage of the low-interest rate environment, which is likely to have a negative impact of 20 cents on earnings”. (Yahoo Finance)

Even though the business activity and production levels are lower than a year ago, we are talking about the fourth quarter and our expectation from that – and the company has a good growth rate from its past quarters overall. Now what is important is that we have to wait and see that if the report will match market expectations.

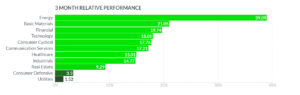

Looking at the different groups’ performance in the past 3 months will give us a clear idea of what we can expect from the earnings report, as illustrated below on Finviz.com:

Technical review

Technically in both the H1 and H4 charts the main technical indicators are supporting the uptrend, while the stock’s all-time high is getting full support from the EMA crossing strategy in H1, H4, and even the Daily chart. 20 DMA at 79 is the main support and trading above this level, clearly supporting the bulls while crossing under this level, will help bears to control the market in short term.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.