Nasdaq March futures: Structure holds as the market searches for resolution

Price behaviour remains centred on the mid-structure pivot as the market searches for a resolution.

Nasdaq March Futures (NQH) — Daily & Intraday Structure Desk Update

London & New York | December 20

Market Context

Nasdaq March futures continue to trade within a well-defined structural framework, with both daily and intraday price action compressing around a central pivot. Rather than signalling directional commitment, recent sessions have been characterised by rotation and consolidation, keeping focus on acceptance and rejection at key reference levels as the New York session develops.

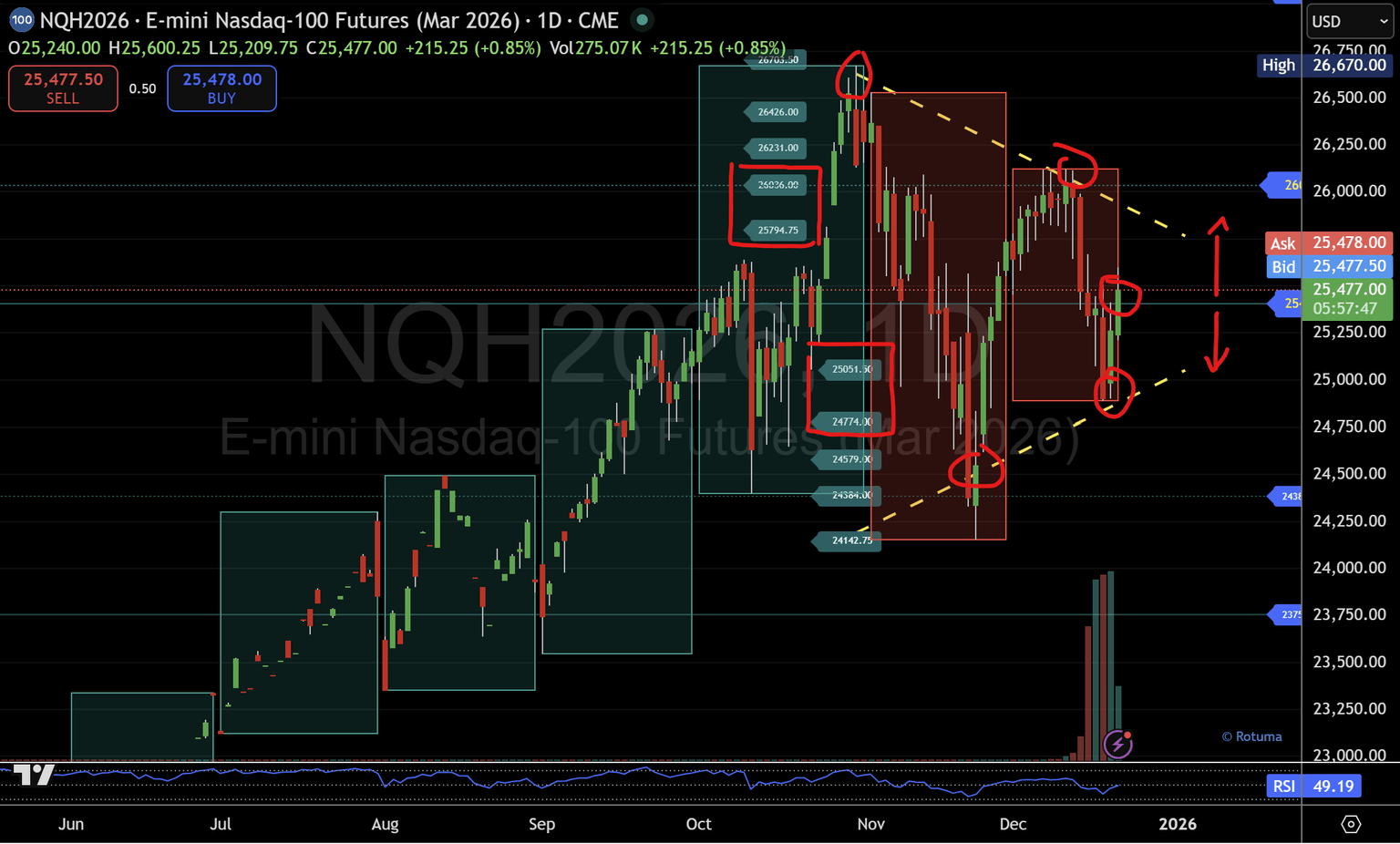

Daily Structure

On the daily timeframe, price continues to hold above the 25,405 central pivot, following the earlier rebound from Micro-5 support at 25,051. The reclaim of this level has returned price to the upper half of the daily structure, keeping upper reference levels in play.

From a structural perspective:

- Acceptance above 25,405 maintains the rotation framework toward the upper structure, with Micro-1 at 25,794 and Micro-2 at 26,036 acting as the next daily reference levels.

- Failure to maintain acceptance would return focus to the centre of the structure without altering the broader daily framework.

Importantly, the overall daily structure remains unchanged. Price continues to compress rather than expand, suggesting the market is still searching for directional resolution as we approach month-end.

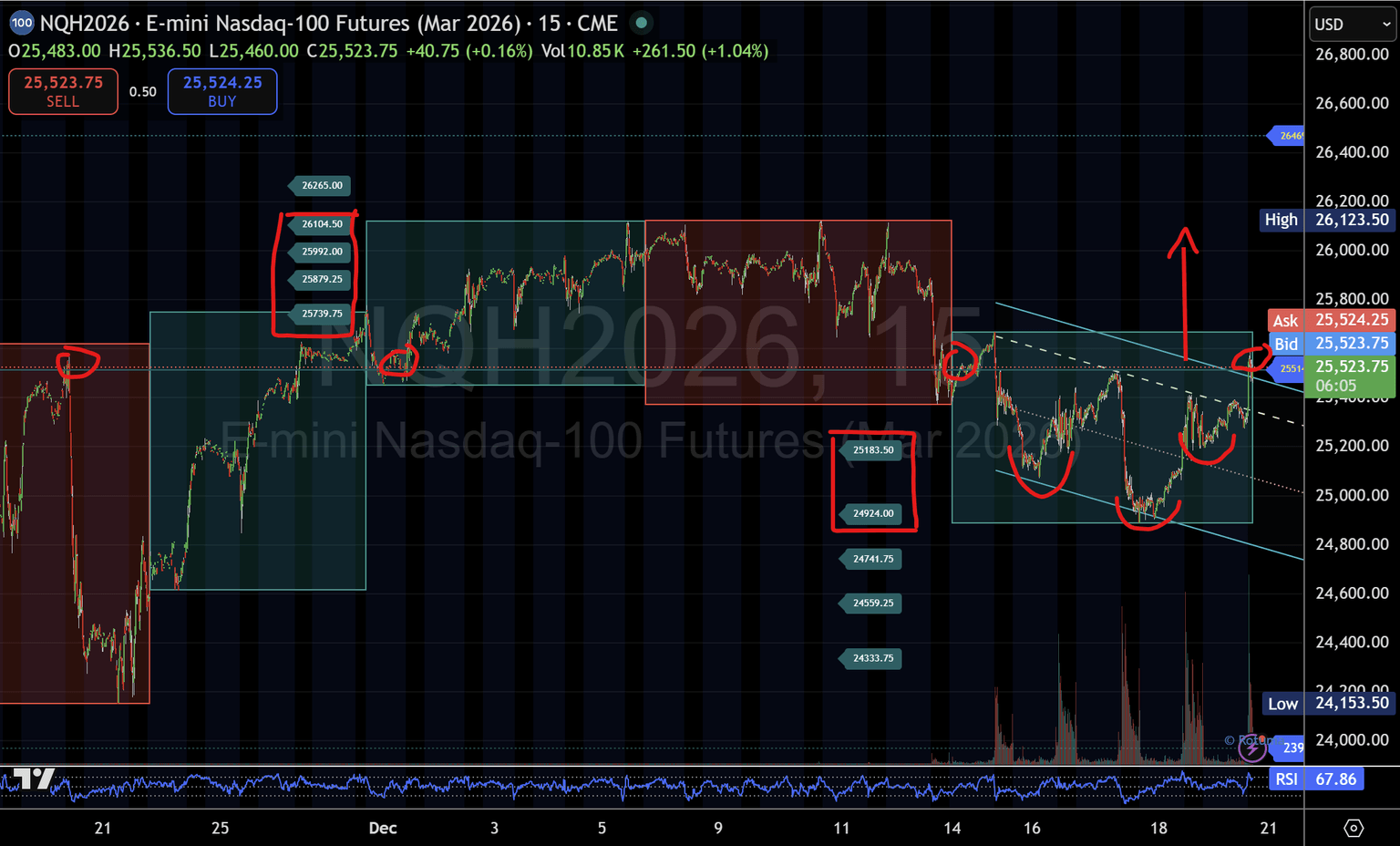

Intraday Structure (15-Minute)

On the 15-minute timeframe, intraday price action continues to reflect and respect the daily structure.

Following the earlier rejection from the upper intraday range, price rotated lower into the lower intraday structure, finding support between 24,924 and 25,183, where buyers successfully defended the structure during the prior sessions.

From there, momentum built steadily, driving a recovery back toward the 25,514 intraday pivot, which represents the centre of the current intraday structure.

At the time of writing, price is holding around this level, placing emphasis on behaviour rather than momentum:

- A clean break and sustained acceptance above 25,514 would support a rotation back toward the upper intraday structure, with Micro-1 to Micro-5 between 25,739 and 26,265 acting as reference levels.

- Failure to establish acceptance would keep the two-way structure intact and maintain the risk of rotation back toward the lower intraday structure.

Key Levels to Monitor

Daily

- 25,405: Central daily pivot/balance point

- 25,794 – 26,036: Upper daily micro structure

- 25,051: Daily Micro-5 / lower structure reference

Intraday

- 25,514: Central intraday pivot/decision point

- 25,183 – 24,924: Lower intraday structure support

- 25,739 – 26,265: Upper intraday structure reference zone

Desk Takeaway

Both daily and intraday structures remain aligned, keeping attention firmly on the centre of the structure rather than short-term price fluctuations.

The next phase of rotation will be dictated by acceptance or rejection around the central pivots, with structure continuing to define the battlefield as the market works through late-December conditions.

Structure defines the battlefield.

Price behaviour confirms it.

Levels exist before prices reach them; this desk documents responses, not reactions.

This analysis is for informational purposes only and does not constitute investment advice. Markets involve risk, and past performance does not guarantee future results.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.