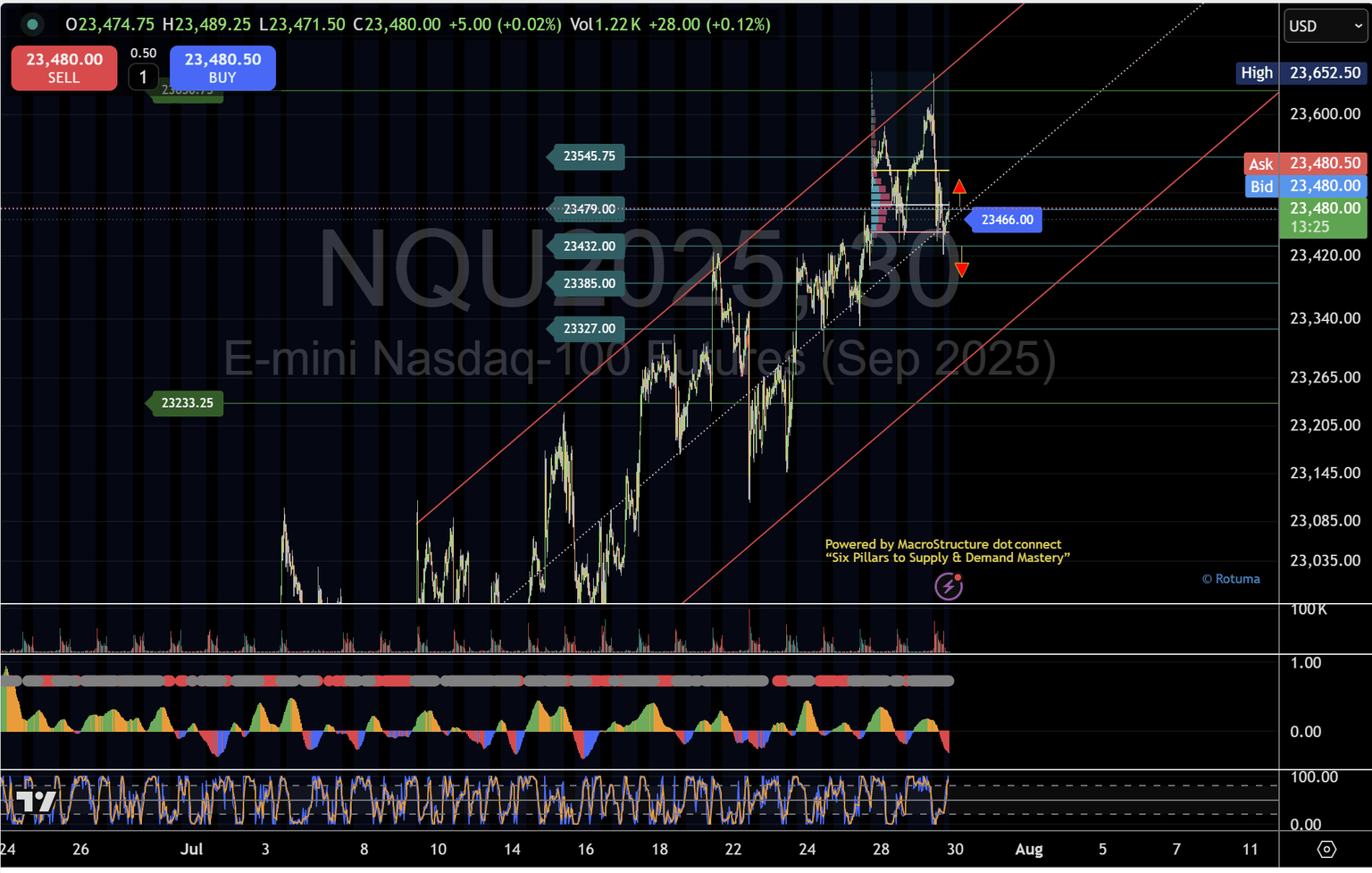

Nasdaq futures stumble at channel ceiling, bulls rally to defend mid‑channel pivot

Holding 23,432 is critical for a relief rally toward 23,545; failure risks a deeper slide into the 23,385–23,327 support zone.

Price action recap

- 29 July opening: After a strong push to channel resistance at 23,652, the index stalled and reversed from the 23,630 pivot, retreating to the middle of its ascending channel (micro 3 at 23,432).

- Asian session defence: Early buyers stepped in at 23,432, coinciding with the weekly POC and VWAP zone, successfully fending off further declines and stabilising the price.

Key technical levels

23,652 – Upper channel line / micro 5 pivot – short-term cap; failure triggered yesterday’s pullback

23,479 – Micro 4 pivot / weekly POC – break and hold above here confirms bullish control

23,432 – Micro 3 pivot / channel midpoint – immediate battleground; holds swing high support

23,385 – Micro 2 pivot – first stop if 23,432 gives way

23,327 – Micro 1 pivot / lower channel line – key long-term support; losing this risks deeper sell-off

Chart-based insights

- Ascending channel intact: Price remains within a well-defined rising channel since early July. A sustained move back above 23,479 would signal a resumption of that uptrend.

- Volume profile confluence: The weekly POC sits at 23,479, layering extra significance on the micro 4 pivot—this zone often attracts sizable order flow.

- Momentum oscillators: The TTM Squeeze histogram has flipped back to blue after yesterday’s red, suggesting the pullback may be exhausted and a short-term bounce is probable.

- Stochastic dynamics: Fast %K/%D lines are rebounding from oversold territory, supporting the view that buyers are regaining control at the mid-channel level.

Trading scenarios

- Bullish continuation:

- Trigger: Clean break and close above 23,479 (micro 4), ideally with increased volume.

- Targets: First 23,545 (micro 5), then channel top around 23,652.

- Invalidation: A reversal back below 23,432 undermines this view.

- Bearish reversal:

- Trigger: Failure to hold 23,432, especially on a London open sweep.

- Targets: 23,385 (micro 2), then 23,327 (micro 1) at the lower channel boundary.

- Alternate support: The weekly VAL near 23,333 could arrest a deeper slide.

By combining channel structure, volume-based pivots, and momentum indicators, this update highlights the pivotal role of 23,432. Maintaining that level keeps bulls in charge; a clear breach shifts momentum swiftly toward the lower channel edge.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.