Nasdaq futures rebuild value above pivot as New York tests upper structure

A structure-first view of how Asia, London, and New York sessions aligned around key Nasdaq futures levels.

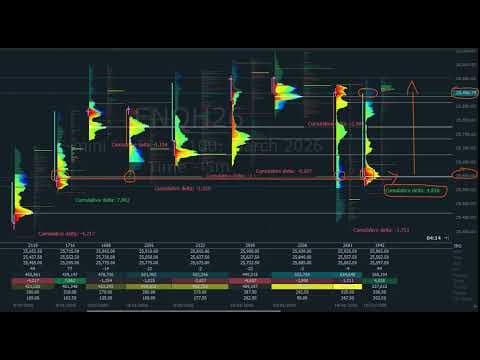

This desk video documents how Nasdaq futures transitioned from the Asia session through London and into the New York open, rebuilding value above the intraday pivot after bouncing from the daily central pivot during the prior session.

The Asia recovery was anchored by the January sixth Point of Control, which then guided the London transition as price reclaimed the intraday central pivot and rotated into the upper-structure support band. That acceptance laid the groundwork for New York’s opening, push toward the micro-five and the upper resistance zone.

As the New York session develops, price is now testing whether this higher band can be accepted or rejected. Holding above the upper structure would signal a transition into the next expansion phase, while failure would bring the central pivot back into focus as the market’s rotational midpoint.

This video shows how predefined structure, volume, and session flow continue to guide Nasdaq futures, using a structure-first approach where the environment is defined before price reacts.

Structure provides context. Price provides confirmation.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.