Nasdaq eyes all-time highs amidst govt shutdown – US still closed [Video]

- Nasdaq 100 builds pressure for another breakout above 25,392, eyeing new all-time highs as tech optimism and liquidity demand continue to support risk assets.

- However, the ongoing U.S. data blackout caused by the prolonged government shutdown keeps uncertainty elevated and volatility risk high.

- The index remains bullish while holding above H4 Fair Value Gaps (FVGs). These levels act as short-term support zones, but if invalidated, they could open the door for deeper retracements.

![Nasdaq eyes all-time highs amidst govt shutdown – US still closed [Video]](https://editorial.fxsstatic.com/images/i/Equity-Index_Nasdaq-1_XtraLarge.jpg)

Market narrative: A market rally running on technicals

The Nasdaq 100 continues to hover just below record highs as traders await clarity from a U.S. government still in partial shutdown. With economic data releases suspended, including CPI, PPI, and retail sales, the market is trading purely on price action, liquidity zones, and sentiment.

Despite the information vacuum, the bullish tone remains intact—supported by resilient corporate earnings, steady tech demand, and easing global trade tensions. Yet the lack of fresh economic data means volatility could spike sharply once data flow resumes.

Technical outlook: Still longs on NQ

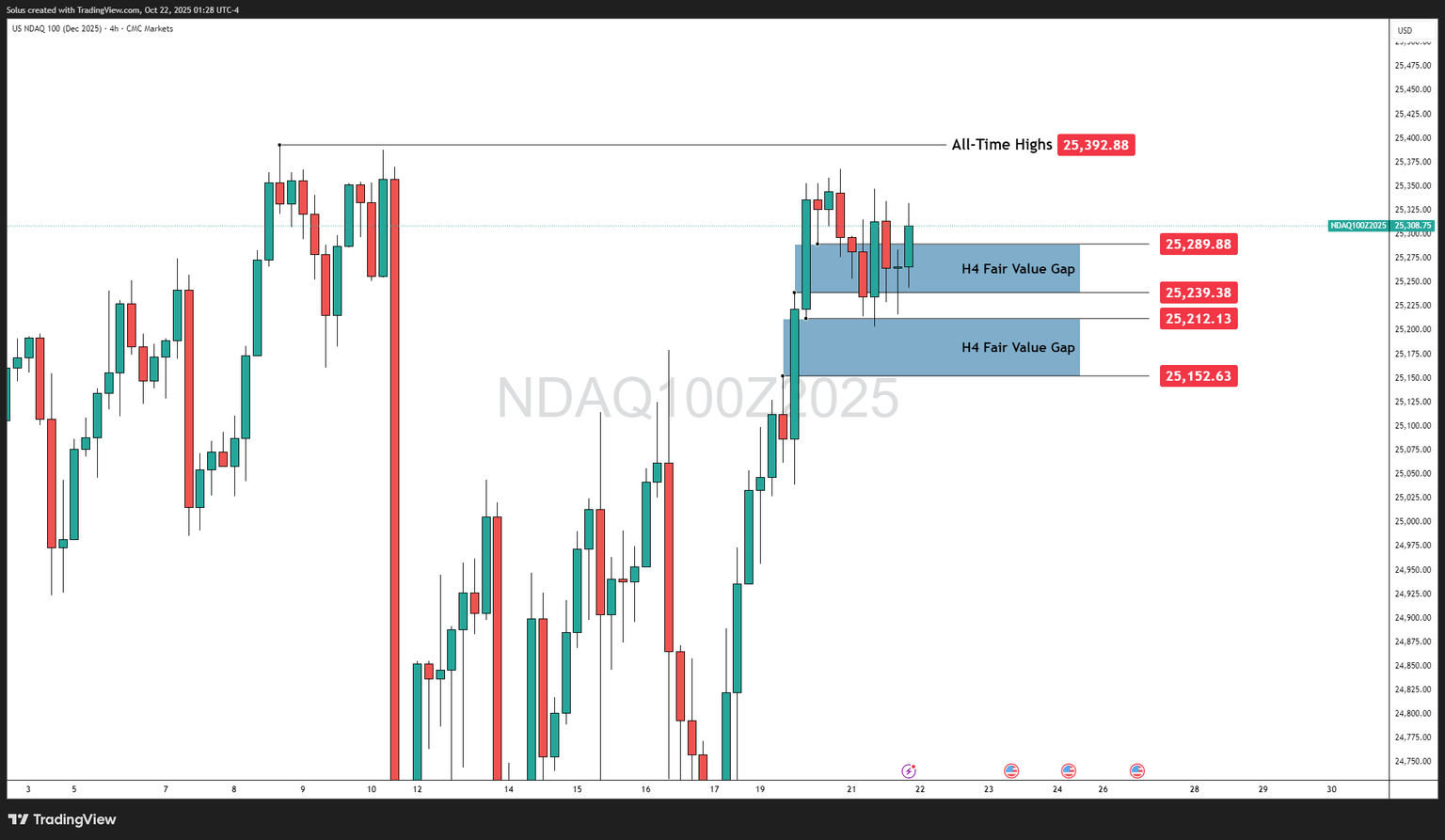

The Nasdaq 100 (December 2025 contract) remains in a tight consolidation phase below its all-time high at 25,392.88, forming a structure supported by two H4 Fair Value Gaps.

- Upper H4 Fair Value Gap: 25,289.88 – 25,239.38

- Lower H4 Fair Value Gap: 25,212.13 – 25,152.63

These imbalances highlight areas where institutional buying previously occurred—serving as potential liquidity pools and support zones for the next market leg.

However, if these gaps fail to hold, they could also act as magnets for liquidity sweeps and deeper downside continuation.

Bullish scenario: FVGs hold and propel the breakout

Price action currently shows compression within a developing flag pattern.

If the upper FVG (25,289–25,239) continues to hold, price could retrace briefly before reclaiming momentum toward the all-time high at 25,392.88.

A breakout above that resistance would confirm bullish continuation, potentially targeting 25,700–25,800 next.

Technical key points

- Both FVGs act as liquidity support layers; holding above them confirms institutional strength.

- Structure remains bullish while price sustains above 25,212.

- Once the all-time high is breached, the move could accelerate due to trapped shorts and breakout traders adding exposure.

Upside targets

- 25,392 – 25,700 – 25,800.

Bearish scenario: FVGs invalidation triggers correction

If price fails to sustain above the upper or lower FVG, the structure risks flipping short-term bearish.

A close below 25,212 would signal an FVG invalidation, exposing 25,152 and potentially 25,000 as downside targets.

In this case, what once served as support (the FVGs) could become zones of resistance during any relief bounce.

Technical key Points

- FVG invalidation typically signals a loss of institutional order flow support.

- Rejection from all-time highs, followed by a break below both FVGs, would mark a short-term top.

- With the ongoing data blackout, a sudden sentiment shift or risk-off flow could trigger this scenario faster than expected.

Downside targets

- 25,212 – 25,152 – 25,000.

Final thoughts: Trading in the dark

With the U.S. government shutdown extending into another week, the Nasdaq 100’s next move may hinge entirely on technical precision rather than fundamental catalysts.

The H4 FVGs are the battlefield between bulls defending structure and bears eyeing a deeper pullback.

Until data resumes:

- Treat FVGs as the critical control zones.

- Breakout above 25,392 opens trend continuation.

- Breakdown below 25,212 warns of distribution.

In the absence of data, price action is the only narrative that matters—and right now, the chart suggests tension building for the next major directional move.

Author

Jasper Osita

Independent Analyst

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.