MULN Stock Forecast: Mullen Automotive soars ahead of merger vote on Wednesday

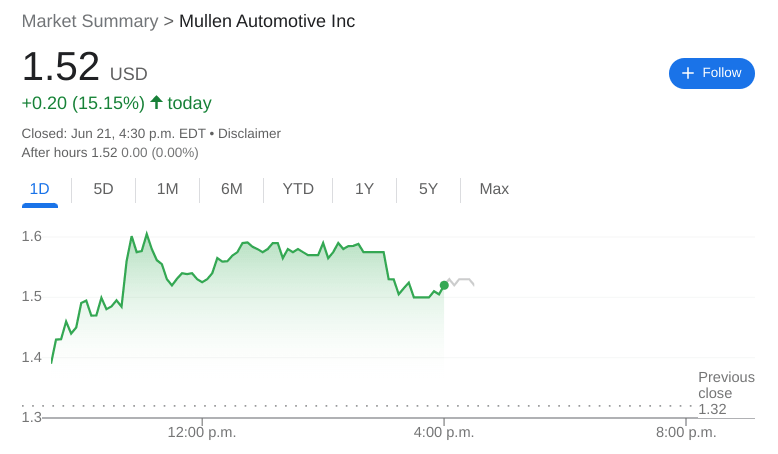

- NASDAQ:MULN gained 15.15% during Tuesday’s trading session.

- Mullen extended the maturity of its senior secured convertible note.

- Elon Musk confirms that Tesla will be cutting 10% of its workforce.

NASDAQ:MULN revved higher out of the Juneteenth holiday weekend as the electric vehicle startup prepares for its merger vote on Wednesday. On Tuesday, shares of MULN jumped higher by 15.15% and closed the trading session at $1.52. US stocks rose higher as well on Tuesday with the broader markets coming off their worst performance in more than two years. A total of 441 of the stocks in the S&P 500 were trading higher at the closing bell. The Dow Jones rebounded by 641 basis points, the S&P 500 gained 2.45%, and the NASDAQ added 2.51% during the session.

Stay up to speed with hot stocks' news!

Mullen took steps to secure its cash flow for the next couple of years at a crucial time for the business. On Tuesday, the company announced that it had extended the maturity date of its senior secured convertible note to July of 2024. The note is for $28 million and helps Mullen to maintain a strong cash position as it approaches its potential public listing on the NASDAQ exchange. Mullen is set to undergo its recently announced Strikingly Different US tour which will showcase its FIVE crossover EV in 19 cities across the country.

Mullen stock price

In other EV news, Tesla (NASDAQ:TSLA) CEO Elon Musk finally clarified that the company would be cutting 10% of its workforce over the next three months. Tesla is also trading higher after Musk issues three things that need to happen before he continues his pursuit of trying to acquire Twitter (NYSE:TWTR). EV stocks were higher in general on Tuesday with Lucid (NASDAQ:LCID) gaining 7.64%, Nio (NYSE:NIO) up by 9.10%, and Tesla gaining 9.35% during the session.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet