MULN Stock Forecast: Mullen Automotive sinks further as Tesla layoffs derail EV stocks

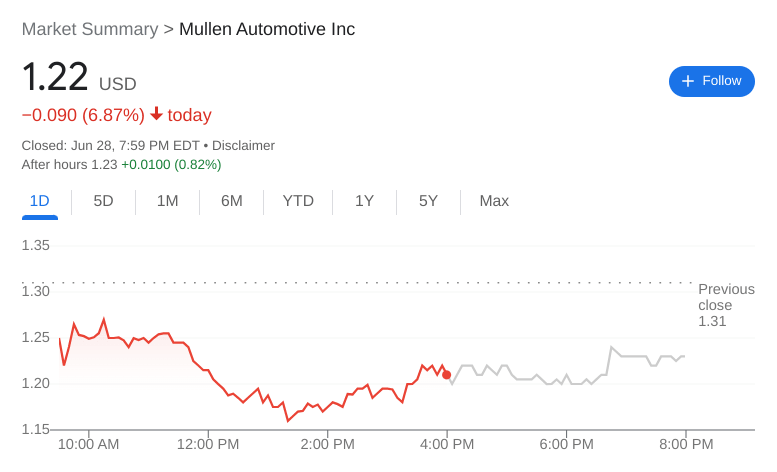

- NASDAQ:MULN fell by 6.87% during Tuesday’s trading session.

- EV stocks tumble as markets fall for a second straight day.

- Tesla lays off 300 more workers and is closing its San Mateo office.

NASDAQ:MULN dropped lower for the second straight day to start the week as the broader markets failed to rebound from Monday’s losses. On Tuesday, shares of MULN fell a further 6.87% and closed the trading session at $1.22. Tuesday’s losses proved that last week’s gains were likely just a bear market rally and that until there is evidence that inflation is retreating in the economy, the near-term trend will continue to be downward. The Dow Jones lost 491 basis points, the S&P 500 fell by 2.01%, and the NASDAQ posted a 2.98% loss during the session.

Stay up to speed with hot stocks' news!

It was another bleak session for EV stocks and other growth sectors alike. Most of the major EV makers were in decline yet again, led by Tesla (NASDAQ:TSLA) which saw a 5.0% loss on Tuesday. Other EV stocks that were below water include Lucid (NASDAQ:LCID), Rivian (NASDAQ:RIVN), and General Motors (NYSE:GM). All three major Chinese EV makers were also in the red as Nio (NYSE:NIO), Li Auto (NASDAQ:LI), and XPeng (NYSE:XPEV) also posted losses at the closing bell.

Mullen stock price

As is usually the case, Tesla had a major part in dictating the direction of EV stock trading on Tuesday. The industry leader took a major hit after announcing it would be laying off a further 200 workers in its Autopilot division, as well as closing an office in San Mateo, California. It’s not the first round of layoffs for the company, and CEO Elon Musk has been adamant about trimming costs ahead of what he anticipates will be a recession in the US economy.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet