Mexican Peso slumps, vulnerable to further Banxico's easing

- Mexican Peso treads water as inflation figures hint at further easing by Banxico.

- Despite US payrolls falling short, a lower unemployment rate boosts the USD against the Peso.

- Interest rate forecasts suggest further easing in Mexico, with the Fed maintaining a cautious outlook for 2025.

The Mexican Peso (MXN) reversed its course and depreciated against the Greenback on Friday after inflation data in Mexico justified the 50 basis points interest rate cut by Banco de Mexico (Banxico) on Thursday. In the United States (US), job data was mixed, as payrolls missed the mark but the Unemployment Rate edged lower. The USD/MXN trades at 20.60, up 0.86%.

Inflation in Mexico edged lower in January, exceeding estimates revealed by the Instituto Nacional de Estadistica Geografia e Informatica (INEGI). Headline and core inflation remained within the Banxico 3% plus or minus 1% range, and improved compared to the latest report, opening the door for further easing by the Mexican central bank.

On Thursday, Banxico lowered borrowing costs from 10% to 9.50% and hinted that it could lower rates by the same magnitude in further meetings. Banxico’s officials added that inflation would converge to 3% in the third quarter of 2026.

The USD/MXN pair extended its gains after the release of the last US Nonfarm Payrolls report. Although the figures came short of expectations, an improvement in the Unemployment Rate spurred a leg-up in the exotic pair.

Furthermore, the interest rate differential between Mexico and the US will narrow. Banxico is expected to drop the primary reference rate to 8.50%, according to the cCentral bBank’s latest private economist poll. Conversely, the Federal Reserve (Fed) paused its easing cycle and projected two rate cuts in 2025, as revealed by last December’s Summary of Economic Projections (SEP).

Daily digest market movers: Progress on Mexican inflation, weighs on Mexican Peso

- Mexico's Consumer Price Index (CPI) for January increased by 3.53% YoY, down from 4.21% the previous month and beneath estimates of 3.61%. Core CPI rose by 3.66% YoY, up from 3.65%, but below forecasts of 3.70%.

- The evolution of the disinflation process in Mexico and last quarter's economic contraction of -0.6% QoQ were the main drivers of Banxico’s 50 bps reduction in borrowing costs.

- Banxico’s decision was not unanimous, as Deputy Governor Jonathan Heath voted for a 25-bps cut. Currently, the board is split between four doves, and Heath is the only “hawk.”

- US Nonfarm Payrolls in January dipped from 256K to 143K, missing the mark of 170K. The Unemployment Rate slid from 4.1% to 4%.

- Trade disputes between the US and Mexico remain in the boiler room. Although countries found common ground, USD/MXN traders should know that there is a 30-day pause and that tensions could arise throughout the end of February.

- Money market fed funds rate futures are pricing in 39 basis points (bps) of easing by the Federal Reserve in 2025.

USD/MXN technical outlook: Mexican Peso poised for further losses

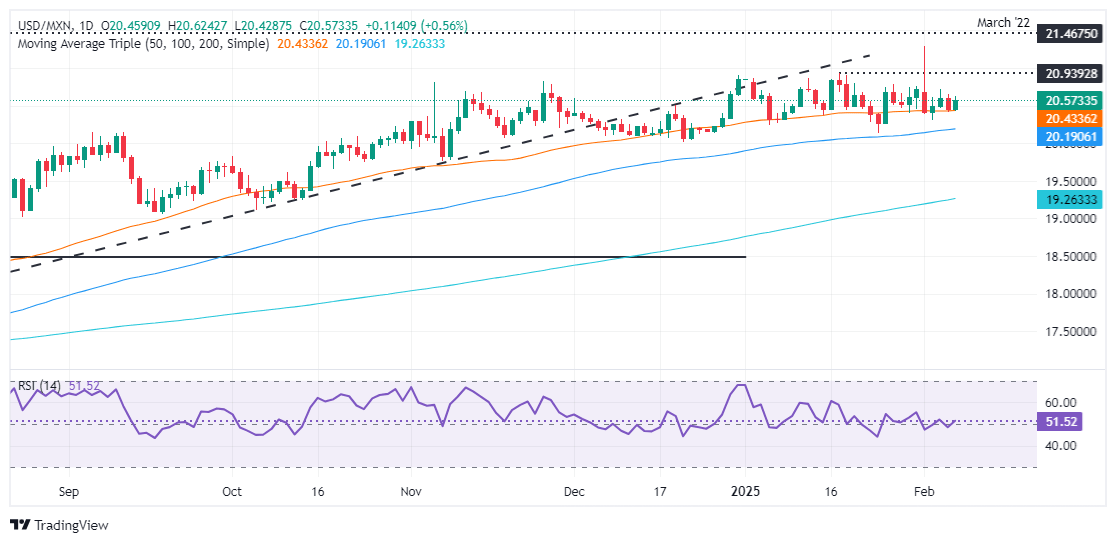

USD/MXN has consolidated within the 20.30 – 20.70 area for the last four days, following Monday’s volatile session due to Trump’s tariffs on Mexico. The pair remains upward biased, with strong support at the 50-day Simple Moving average (SMA) at 20.57.

If USD/MXN rises past 20.70, the next resistance would be the January 17 daily peak at 20.90 before testing 21.00 and the year-to-date (YTD) high at 21.29.

Conversely, if USD/MXN drops below the 50-day SMA, the next support would be the 100-day SMA at 20.22. Once cleared, further downside is seen, and the pair could challenge 20.00.

Economic Indicator

12-Month Inflation

The 12-month inflation index released by the Bank of Mexico is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchase power of Mexican Peso is dragged down by inflation. The inflation index is a key indicator since it is used by the central bank to set interest rates. Generally speaking, a high reading is seen as positive (or bullish) for the Mexican Peso, while a low reading is seen as negative (or Bearish).

Read more.Last release: Fri Feb 07, 2025 12:00

Frequency: Monthly

Actual: 3.59%

Consensus: 3.61%

Previous: 4.21%

Source: National Institute of Statistics and Geography of Mexico

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.