Mexican Peso holds ground as US data signals slowdown

- Mexican Peso suffers as safe-haven US Dollar status keeps USD/MXN supported near 19.50.

- Mexico surprises with Q1 growth, dodging recession as US economy contracts sharply.

- Weak US manufacturing and jobless claims boost recession fears, lifting demand for the Greenback.

The Mexican Peso posted slight losses against the US Dollar on Thursday after economic data in the United States (US) suggested slowing manufacturing and a cooling labor market. The USD/MXN trades at 19.58 after hitting a daily low of 19.57.

Market mood has improved as US trade-related news shows some progress in some Asian countries. Even though it doesn’t include China, rumors that Washington contacted Beijing keep investors’ hopes high for a deal between both countries.

Wednesday data revealed Mexico’s economy grew, surprising most analysts who expected a contraction and a technical recession. In the US, the first quarter of 2025 contracted, mostly supported by a rise in imports ahead of the effect of tariffs proposed by the Trump administration.

Although this was positive for the Peso, the USD/MXN seems to have found its footing, bottoming near the 19.50 area after clearing below the 20.00 figure since mid-April.

US economic data revealed on Thursday that the odds of a recession had increased. The US labor market is cooling as Initial Jobless Claims rose above estimates. At the same time, business activity in manufacturing has plunged, according to the ISM Manufacturing PMI.

Although economic growth divergence favored the Peso, other US data sparked a flight to the Greenback’s safe-haven status. Ahead in the week, USD/MXN traders are eyeing the release of April’s US Nonfarm Payroll figures.

Daily digest market movers: Mexican Peso stays flat amid soft US data

- Mexico’s Gross Domestic Product (GDP) in Q1 2025 rose 0.2% QoQ, above forecasts of 0% and improved after shrinking Q4 2024 -0.6% contraction.

- Economic data revealed on Monday showed that the Balance of Trade printed a surplus and that labor market conditions remain solid as the Unemployment Rate ticked lower in March compared to February

- In the US, the economy shrank as the GDP came at -0.3% in Q1 2025, missing expectations for a 0.4% expansion and marking a sharp slowdown from Q4 2024’s 2.4% growth, according to the Commerce Department.

- The Institute for Supply Management (ISM) Manufacturing PMI was higher than estimates of 48 and came in at 48.7, down from March’s reading of 49.

- Initial Jobless Claims for the week ending April 26 rose by 241K, much higher than the 224K expected and up from 223K revealed a week ago.

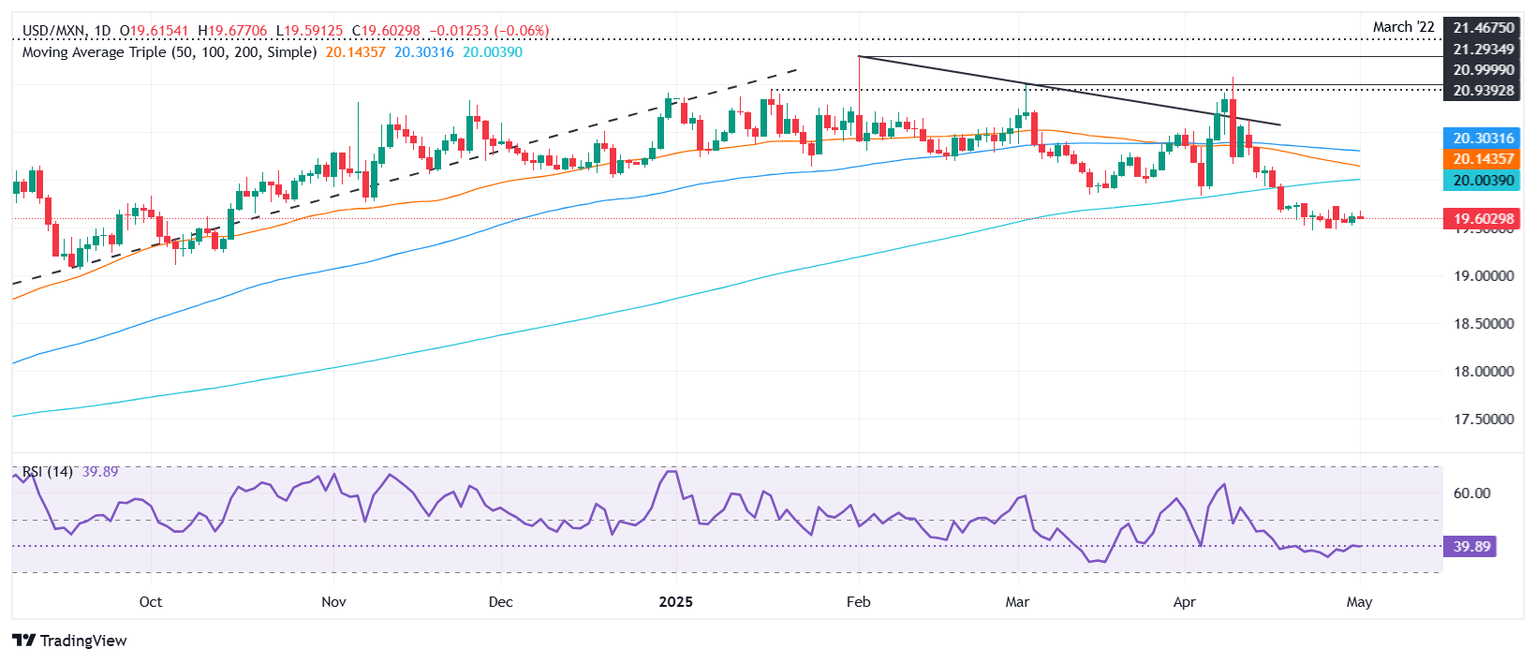

USD/MXN technical outlook: Mexican Peso remains bullish as USD/MXN stays below 200-day SMA

The USD/MXN is downward biased, though it seems to have bottomed out near the 19.46-19.50 range during the last two weeks. The reason behind this is that the Relative Strength Index (RSI), which is glued near the 30 level, flatlines, an indication that sellers lack the strength to push the exotic pair lower.

If USD/MXN falls below the current year-to-date (YTD) low, the first support would be the 19.46 mark; once surpassed, the 19.00 figure would follow. A breach of the latter would expose the June 28 high, which turned support at 18.59.

Conversely, if USD/MXN rallies past the 20-day SMA at 19.88 and the 200-day SMA near 19.97, the pair would be poised to challenge the 20.00 figure. Up next lies the 50-day SMA at 20.12.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.