Mexican Peso extends rally for three weeks amid soft US Dollar

- Mexican Peso climbs sharply as USD/MXN surpasses 2023 low of 16.62.

- Banxico's Deputy Governor Irene Espinosa's comments on rate cuts support Peso's rally.

- US inflation data sparks speculation of Fed rate cuts,with futures market indicating 41 bps reduction by year-end.

The Mexican Peso continues to record gains versus the US Dollar, refreshing its four-week high as the rally continued. In an interview, Bank of Mexico (Banxico) Deputy Governor Irene Espinosa was hawkish, boosting the Mexican currency. Meanwhile, US inflation data revealed during the week was mixed, though it reignited speculation that the Federal Reserve (Fed) would lower interest rates in September. The USD/MXN trades at 16.61, below the 2023 low of 16.62.

Mexico’s economic docket featured Banxico’s Deputy Governor Espinosa, who said the March rate cut was premature and would delay inflation’s convergence to the bank’s target. “The monetary restriction that was needed to maintain convergence (of inflation to the target) within the horizon that we had planned was reduced,” Espinosa said.

In the meantime, US inflation resumed its downtrend after stalling for six months, according to the US Bureau of Labor Statistics (BLS). The core Consumer Price Index (CPI) ebbed lower from 3.8% to 3.6% YoY in April, easing pressure on the Fed.

After the data, US equities rallied to new all-time highs, while the Greenback tumbled sharply, following the path of US Treasury yields. According to the fed funds rate December 2024 futures contract, expectations that the Fed would lower rates jumped from 36 basis points (bps) to 41 bps toward the end of the year.

Data from the CME FedWatch Tool shows odds for a 25 bps rate cut at the September meeting remain at 83%, lower than Thursday’s 87%.

Data-wise, the US Conference Board revealed the Leading Economic Index continued to fall in April. “Another decline in the U.S. LEI confirms that softer economic conditions lay ahead,” said Justyna Zabinska-La Monica, senior manager of business cycle indicators at The Conference Board.

Daily digest market movers: Mexican Peso surges amid Espinosa’s hawkish stance

- Banxico is beginning to split among its members. Governor Victoria Rodriguez Ceja said on Monday that the bank would discuss lowering rates in the upcoming meeting on June 29. Deputy Governor Espinosa commented that lowering rates in March might have delayed inflation convergence toward the central bank’s target by two quarters.

- Mexico’s economic docket next is expected to release Retail Sales on May 20, followed by the Gross Domestic Product (GDP), inflation figures and Banxico’s minutes on May 23.

- April's data show that Mexico’s headline inflation is reaccelerating. However, core prices are falling. This spurred Banxico’s revision to its inflation projections, with the bank expected to hit its 3% target toward the last quarter of 2025, later than March’s estimates for Q2 2025. Core inflation is projected to hit 3% in Q2 2025.

- The CB Leading Index decreased by 0.6% in April to 101.8 (2016=100) after diminishing by 0.3% in March. Over the six-month period between October 2023 and April 2024, the LEI contracted by 1.9% — a smaller decrease than its 3.5% decline over the previous six months.

- The US jobs market continues to slow down after the Nonfarm Payrolls report for April. This, along with the last two Initial Jobless Claims reports, suggests the labor market is cooling, helping the Fed to curb inflation.

- Investors have become optimistic that the Fed may cut rates this year after US inflation data showed the downtrend is resuming, while Retail Sales remained unchanged.

- Richmond Fed President Thomas Barkin stated that inflation is coming down, but that it will “take more time” to hit the Fed’s target.

Technical analysis: Mexican Peso climbs sharply as USD/MXN falls below 2023 low

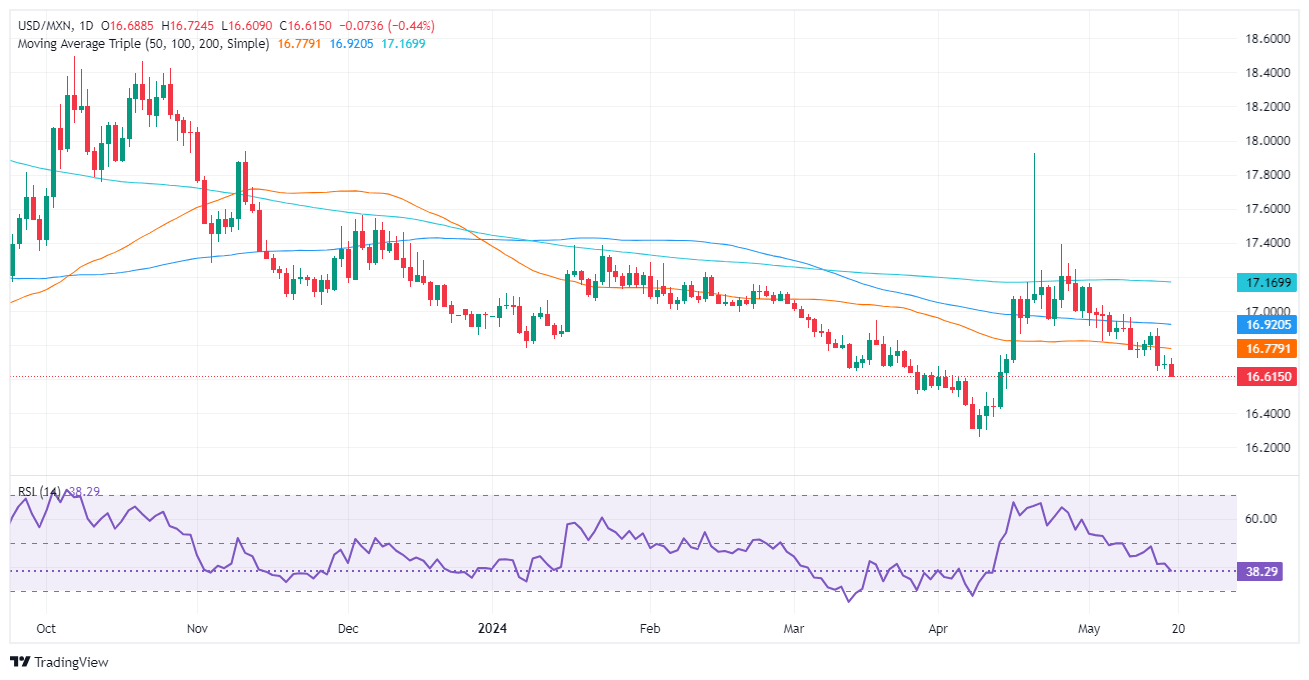

The USD/MXN downtrend continues even though buyers pushed the exchange rate past close to the 50-day Simple Moving Average (SMA) near 16.77. Momentum favors Mexican Peso holders as the Relative Strength Index (RSI) remains in bearish territory, aiming downwards.

If USD/MXN extends its losses beneath the psychological 16.50 figure, that could open the door to test the current year-to-date low of 16.25.

Conversely, if buyers reclaim the 50-day SMA at 16.78, it could exacerbate a rally toward the 100-day SMA at 16.92. Once cleared, the next supply zone would be the 17.00 psychological level. In that event, the next stop would be the 200-day SMA at 17.17.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.