Mexican Peso extends rebound after US CPI inflation cools

- The Mexican Peso chalked in a second day of gains against the Greenback on Wednesday.

- Mexico’s recent rate cut despite an uptick in inflation has left Peso markets in a bind.

- US CPI figures cooled to expected levels, but investors were hoping for more post-PPI.

The Mexican Peso (MXN) found extra room on the high side on Wednesday, bolstered by a lopsided US Dollar (USD) after US Consumer Price Index (CPI) inflation figures cooled to the expected levels. However, markets were hoping for firmer signs of easing inflation pressure after this week’s US Producer Price Index (PPI) showed a steeper-than-expected decline in business-level price growth.

Mexico continues to grapple with inflation pressure of its own, but the Mexican Central Bank (Banxico) delivered a recent rate cut anyway. Banxico Governor Victoria Rodriguez Ceja cited an 18-straight month decline in core price inflation as an impetus for the quarter-point rate cut earlier this week, stating that an uptick in headline inflation to nearly 5.6% should get smoothed out “at the end of 2025”.

Daily digest market movers: Odd expectations deliver odd market flows post-US CPI

- US CPI inflation broadly printed as markets expected, with core CPI inflation ticking down to 3.2% YoY from the previous 3.3%.

- Both headline and core CPI ticked up to 0.2% MoM, also as-expected.

- Annualized CPI also shifted lower to 2.9% in July, below the forecasted hold at 3.0%.

- Despite continued easing in YoY CPI inflation figures, investors were broadly expecting a more significant decline after this week’s US PPI inflation print showed a steeper decline in upstream cost growth. However, declining cost pressures don’t appear to be getting passed onto consumers as fast as many had hoped.

Mexican Peso price forecast: Peso still struggling to find a recovery despite near-term reprieve

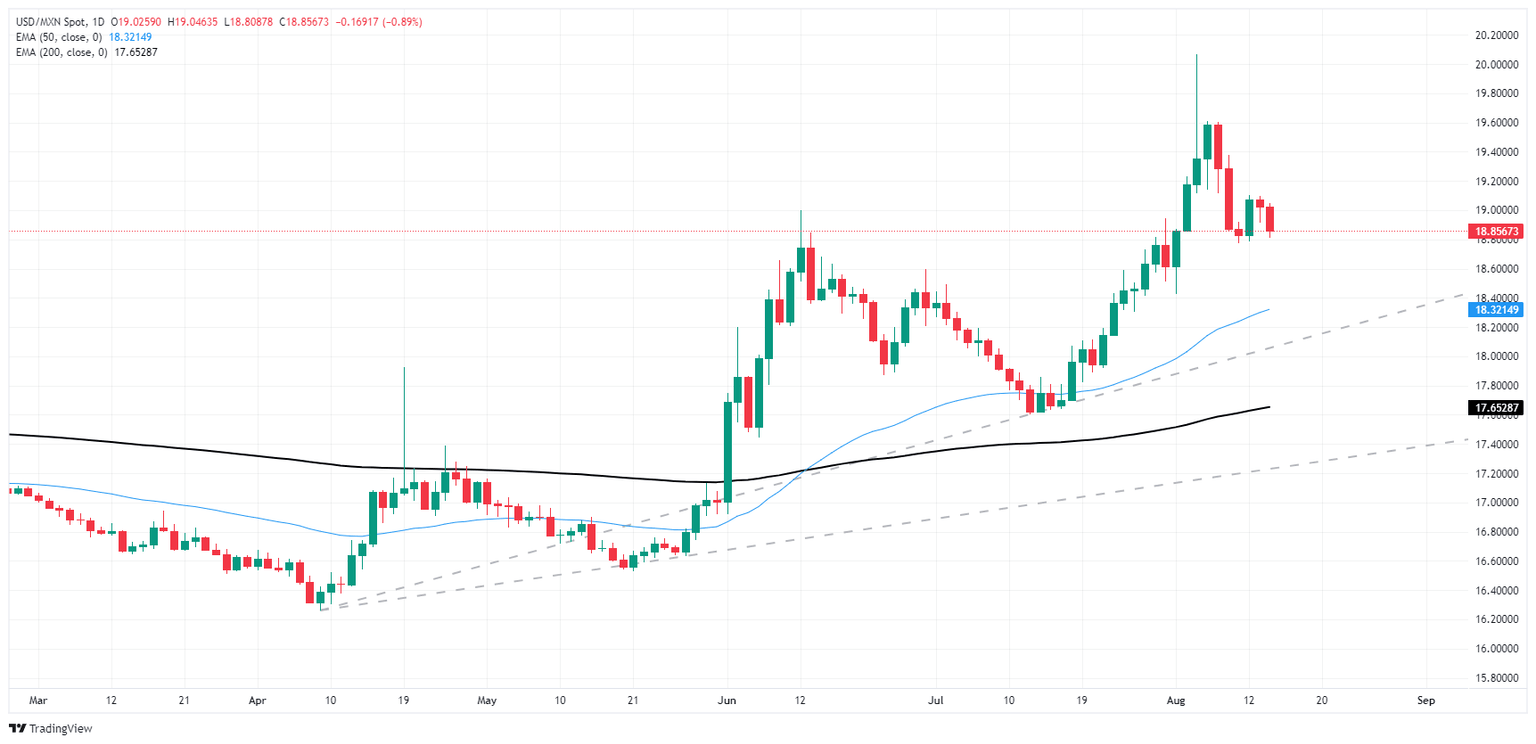

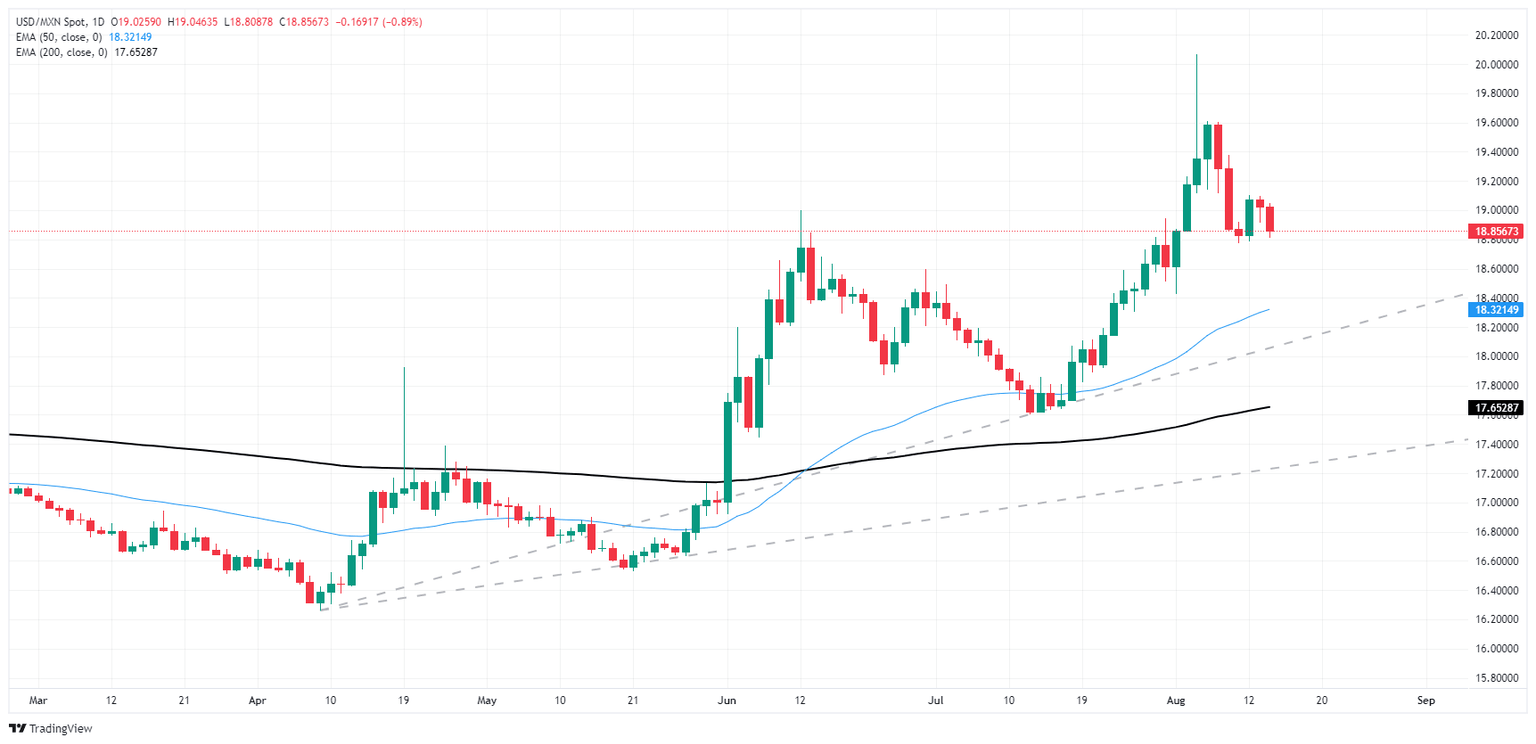

The Mexican Peso (MXN) clawed back roughly nine-tenths of one percent against the Greenback on Wednesday, dragging USD/MXN below 19.00 before running into a technical floor near 18.80. The Peso has recovered over 6% after hitting a 22-month low against the US Dollar that sent USD/MXN above the 20.00 handle earlier this month.

Despite a near-term recovery in Peso bids, USD/MXN still leans heavily in favor of Greenback buyers as the pair trades well north of the 200-day Exponential Moving Average (EMA) at 17.59. The pair is also still up nearly 16% from the year’s bottom bids of 16.26.

USD/MXN daily chart

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.