Mastercard (MA) should pullback soon to provide next opportunity

Mastercard Incorporated (MA), provides transaction processing & other payment-related products & services in the United states & internationally. The company offers payment related products to integrated products & value-added services for account holders, merchants, financial institutions, digital partners, businesses, governments & other organizations. It is headquartered in New York, comes under Financial Services sector & trades as “MA” ticker at NYSE.

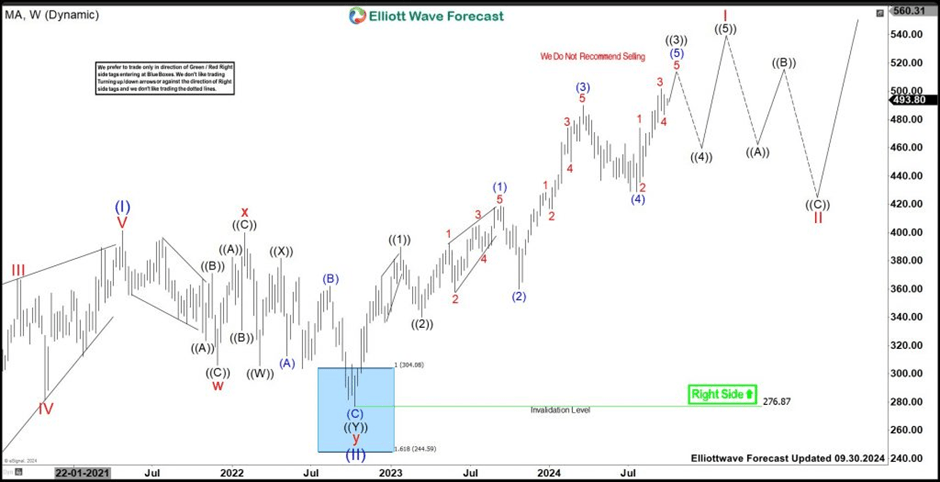

As expected from the previous article, MA continue rally in ((3)) of I started from March-2023 low after (4) correction ended at $428.86 low. It already made new high in weekly within ((3)) of I soon expect to pullback in 3, 7 or 11 swings in ((4)) correction.

MA – Elliott Wave latest weekly view

In Weekly sequence, it ended (I) at $401.50 high as impulse sequence from the all-time lows in April-2021 high. Below there, it placed (II) as double correction at $276.87 low in -October-2022. Within (II) correction, it placed w at $306 low & x at $399.92 high in January-2022. Finally, it ended y of (II) at $276.87 low in October-2022 low. Above there, it favors upside in I of (III) & expect further rally before correcting in II.

MA – Elliott Wave weekly view from 4.29.2024

Within wave I, it placed ((1)) at $390 high & ((2)) at $340.21 low. Above there, it favors upside in ((3)), in which it ended (1) at $418.60 high, (2) at $359.77 low, (3) at $490 high & (4) at $428.86 low. Currently, it favors upside in 5 of (5), while dips remain above $483.54 low to finish ((3)) between $480.28 – $523.60 area. Later, it should pullback in ((4)) in 3, 7 or 11 swings before final push higher to finish I sequence. We like to buy the pullback in 3, 7 or 11 swings at extreme areas, when reached.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com