Mastercard Inc. (MA) Elliott Wave technical analysis [Video]

![Mastercard Inc. (MA) Elliott Wave technical analysis [Video]](https://editorial.fxsstatic.com/images/i/General-Stocks_3_XtraLarge.png)

MA Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Minor wave 5.

Direction: Top in wave 5.

Details: Here we are presenting the possibility of further upside into wave 5 as we could be in the making of wave {ii} of 5, or else we could have a top in wave 5 of (3) in place and we are looking for a larger pullback in wave (4).

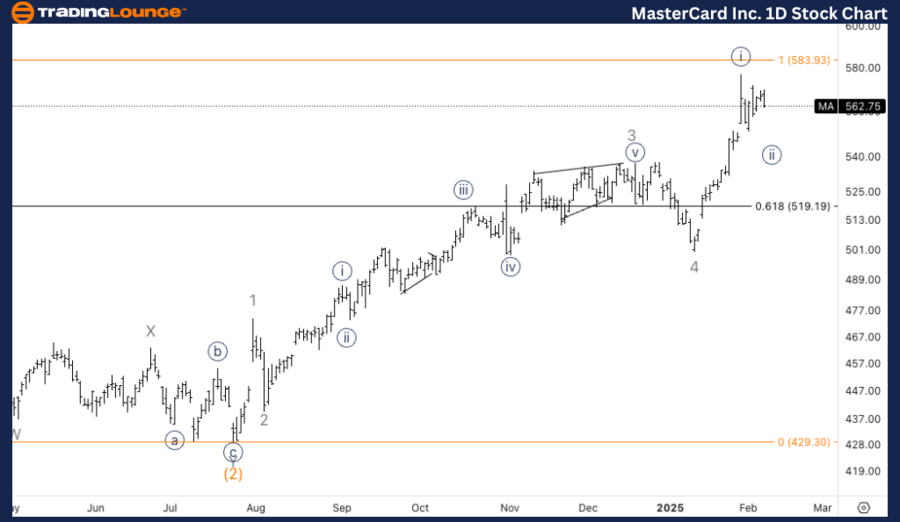

MA Elliott Wave technical analysis – Daily chart

Mastercard Inc. (MA) is currently unfolding in an impulsive structure, with the focus on minor wave 5. There are two potential scenarios for wave 5: either we are still progressing higher, and currently in wave {ii} of 5, indicating further upside to come, or we have already completed wave 5 of (3) and could be facing a larger pullback in wave (4). Monitoring the price action near key resistance levels will be crucial to determine the dominant scenario.

MA Elliott Wave technical analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave (b) of {ii}.

Direction: Downside into wave ©.

Details: We are looking for a top in wave {i} as we seem to be correcting in wave {ii}. We are looking for further developments in wave {ii}, specifically the end of wave (b) and then a down move in wave (c). The increase volume on the top could suggest the alternate count is in place and we have a top in wave 5.

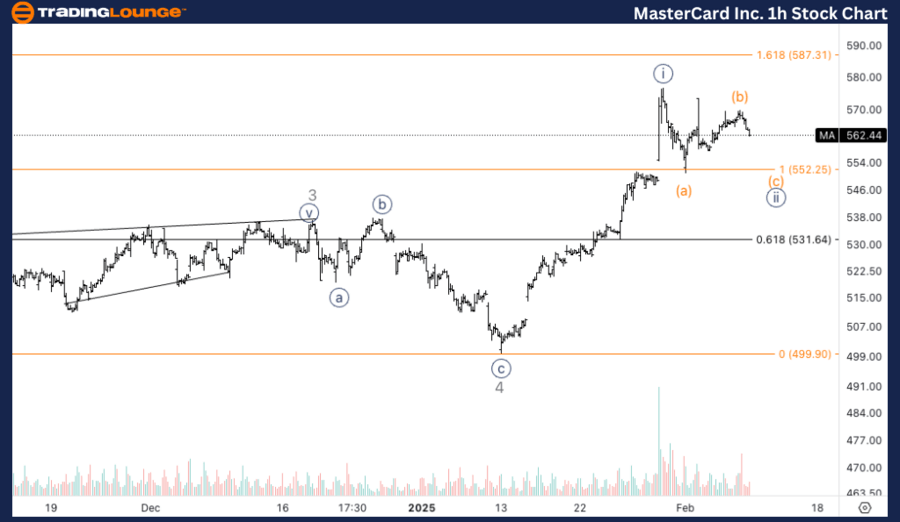

MA Elliott Wave technical analysis – One-hour chart

In the 1-hour chart, MA is likely correcting in wave {ii}, having just completed wave {i}. We are now anticipating further downside development into wave (c) of {ii}, as wave (b) seems to be nearing completion. The recent volume spike at the top may suggest that the alternate count could be in play, meaning wave 5 has already completed, signaling a more significant correction may be underway.

This Elliott Wave analysis for Mastercard Inc. (MA) examines both the daily and 1-hour charts to assess its current market trend, utilizing Elliott Wave Theory to anticipate potential future movements.

Mastercard Inc. (MA) Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.