LCID Stock News: Lucid Group Inc rises as all EV boats rise with Tesla’s tide

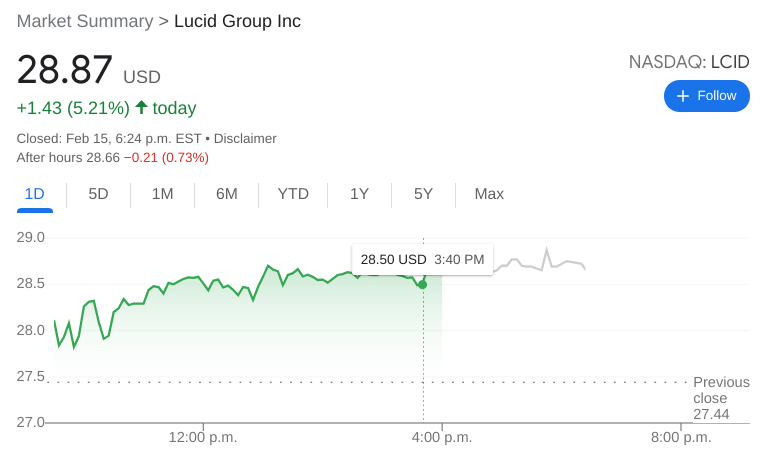

- NASDAQ:LCID gained 5.21% during Tuesday’s trading session.

- The EV sector surged on Tuesday led by Tesla, Rivian, and Nio.

- Reports are that the Austin GigaFactory is close to delivering vehicles.

NASDAQ:LCID extended its gains this week with a second straight positive session on Tuesday. Shares of Lucid jumped by 5.21% and closed the trading session at $28.87. Global markets were upbeat on Tuesday as it was reported that Russian troops moved away from the Ukraine border and back to their bases in Russia. It wasn’t an official announcement that the attack had been called off but it was enough for investors to buy back into the recent weakness. The NASDAQ led the way as the tech-heavy index gained 2.53%, while the S&P 500 climbed by 1.58%, and the Dow Jones added 422 basis points after snapping its recent three-day slide.

Stay up to speed with hot stocks' news!

Electric Vehicle stocks were amongst the big winners on Tuesday led by industry leader Tesla (NASDAQ:TSLA) which jumped by 5.33%. Electric truck maker Rivian (NASDAQ:RIVN) also gained after another major hedge fund added a significant stake in the company, following in the footsteps of George Soros. Finally, Chinese EV makers also rebounded, particularly Nio (NYSE:NIO) which announced a third new model, the ES7 SUV, to be released by the end of the year.

Lucid Motors stock forecast

Tesla’s gains were what buoyed the EV sector on Tuesday, as the EV maker had a couple of positive headlines. First, CEO Elon Musk reportedly donated $5 billion worth of Tesla shares to charity during his stock sell off earlier this year. In addition to this, it has been reported that Model Y vehicles have been spotted leaving Tesla’s new Austin GigaFactory. Once Austin and Berlin’s GigaFactories are online, Tesla anticipates growing its production by 50% per year for the foreseeable future.

Like this article? Help us with some feedback by answering this survey:

Author

Stocks Reporter

FXStreet