Japanese Yen seems poised to appreciate further vs. USD amid divergent BoJ-Fed expectations

- Japanese Yen struggles to lure buyers amid the uncertainty over the timing of the next BoJ rate hike

- A positive risk tone further undermines the safe-haven JPY, though intervention fears limit losses.

- The divergent BoJ-Fed outlooks also benefit the lower-yielding JPY and weigh on the USD/JPY pair.

The Japanese Yen (JPY) reverses a modest intraday dip against a broadly weaker US Dollar (USD) and looks to build on the overnight bounce from a nearly two-week low, touched the previous day. Speculations that Japanese authorities will step in to stop the domestic currency from weakening too rapidly and prospects for further Bank of Japan (BoJ) policy tightening turn out to be key factors that continue to act as a tailwind for the JPY.

Meanwhile, hawkish BoJ expectations mark a significant divergence in comparison to bets for more interest rate cuts by the US Federal Reserve (Fed), which keeps the USD depressed and further benefits the lower-yielding JPY. However, the uncertainty about the likely timing of the next BoJ rate hike might cap the JPY. Moreover, fiscal concerns and a positive risk tone warrant caution before placing aggressive bullish bets around the JPY.

Japanese Yen retains bullish bias vs. USD amid BoJ rate hike bets

- Investors seem uncertain about the pace of policy tightening by the Bank of Japan amid expectations that energy subsidies, stable rice prices, and low petroleum costs would keep inflation low into 2026. This, along with fiscal concerns due to Prime Minister Sanae Takaichi’s large-scale spending plans to stimulate growth, fail to assist the Japanese Yen to capitalize on Monday's bounce from a two-week low against the US Dollar.

- Bank of Japan Governor Kazuo Ueda said on Monday that the central bank will continue to raise interest rates if economic and price developments move in line with its forecasts. Ueda added that adjusting the degree of monetary support will help the economy achieve sustained growth, and that wages and prices are highly likely to rise together moderately. This keeps the door open for further BoJ policy normalization.

- The hawkish outlook pushed the rate-sensitive two-year Japanese government bond yield to its highest level since 1996. The yield on the benchmark 10-year JGB reached its highest point since 1999 on Monday. The resultant narrowing of the rate differential between Japan and other major economies could help limit any significant decline for the JPY amid speculations about a possible government intervention.

- Meanwhile, the US Dollar is looking to extend the previous day's retracement slide from a nearly four-week top amid rising bets for further policy easing by the Federal Reserve. In fact, traders are pricing in the possibility that the Fed will lower borrowing costs in March and maybe deliver another rate cut later this year. The bets were further reaffirmed by the mixed US PMI data for December 2025 released on Monday.

- In fact, the S&P Global US Manufacturing PMI held steady at 51.8 and indicated continued expansion. In contrast, the Institute for Supply Management's (ISM) Manufacturing PMI showed signs of persistent contraction and declined to 47.9 from 48.2 in November. This keeps the USD bulls on the defensive through the Asian session on Tuesday and further contributes to capping the upside for the USD/JPY pair.

- Traders keenly await the release of the US Nonfarm Payrolls report on Friday, which, along with this week's other important US macro data, will be looked upon for cues about the Fed's rate-cut path. This, in turn, will play a key role in determining the USD trajectory and provide a fresh directional impetus to the USD/JPY pair. Nevertheless, the broader fundamental backdrop seems tilted in favor of the JPY bulls.

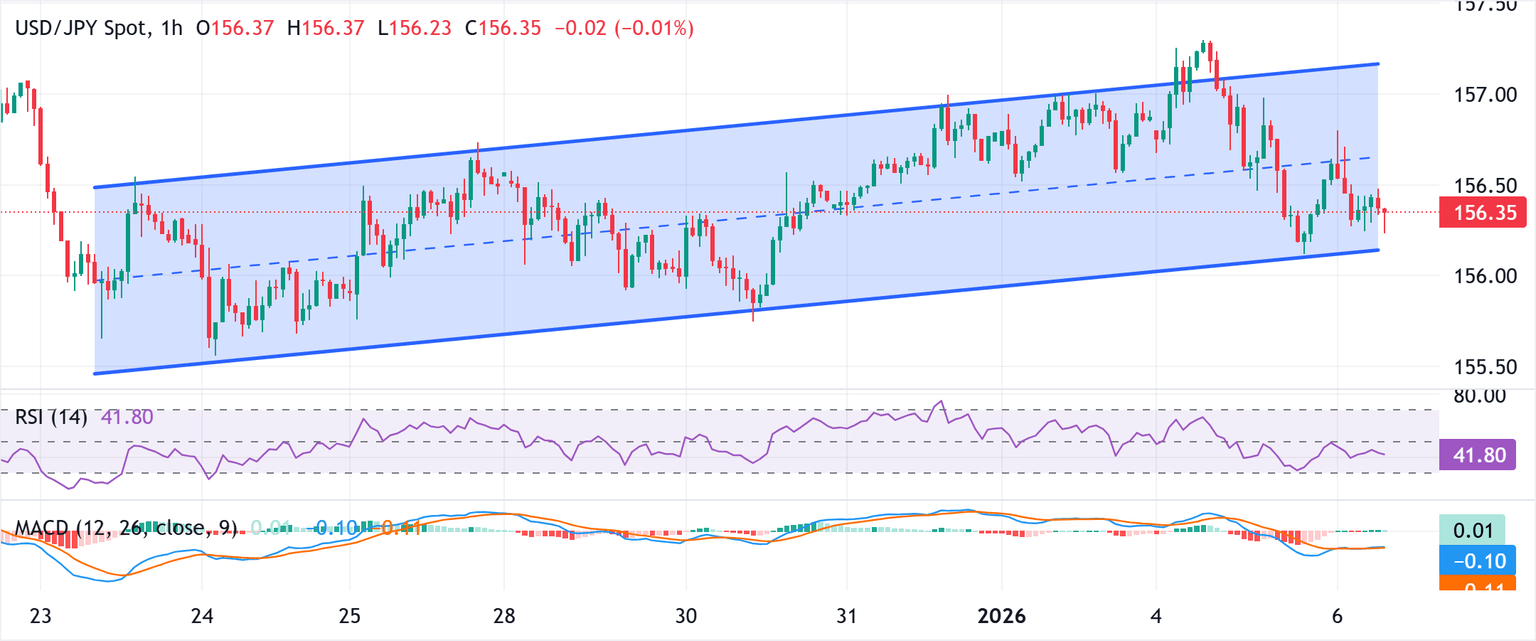

USD/JPY bears might await break below ascending channel support near 146.00

The ascending channel from 155.46 supports the uptrend, with the lower boundary near 156.13 cushioning pullbacks. Short-term moving averages have flattened, reflecting consolidation within the rising structure. The Moving Average Convergence Divergence (MACD) edges just above the zero line, suggesting fading bearish pressure. The RSI prints 43 (neutral), which keeps upside contained without signaling oversold conditions. A break above the channel cap at 157.16 would open the next leg higher, while failure to attract follow-through bids could drag the USD/JPY pair back toward the lower boundary of the channel.

(The technical analysis of this story was written with the help of an AI tool)

US Dollar Price This week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.07% | -0.62% | -0.31% | 0.11% | -0.81% | -0.79% | -0.14% | |

| EUR | 0.07% | -0.56% | -0.18% | 0.18% | -0.75% | -0.72% | -0.07% | |

| GBP | 0.62% | 0.56% | 0.28% | 0.75% | -0.19% | -0.16% | 0.49% | |

| JPY | 0.31% | 0.18% | -0.28% | 0.41% | -0.53% | -0.50% | 0.20% | |

| CAD | -0.11% | -0.18% | -0.75% | -0.41% | -0.77% | -0.91% | -0.25% | |

| AUD | 0.81% | 0.75% | 0.19% | 0.53% | 0.77% | 0.02% | 0.68% | |

| NZD | 0.79% | 0.72% | 0.16% | 0.50% | 0.91% | -0.02% | 0.66% | |

| CHF | 0.14% | 0.07% | -0.49% | -0.20% | 0.25% | -0.68% | -0.66% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.