Japanese Yen retains intraday bearish bias; USD/JPY jumps closer to mid-147.00s

- The Japanese Yen continues to be weighed down by diminishing odds for a BoJ rate hike in 2025.

- Strong CPI prints from Japan and the upbeat PMIs do little to provide any respite to the JPY bulls.

- A modest US Dollar uptick also contributes to the USD/JPY pair's move closer to the mid-147.00s.

The Japanese Yen (JPY) selling remains unabated through the early European session on Monday as traders continue to push back their expectations about the likely timing of the next interest rate hike by the Bank of Japan (BoJ) to Q1 2026. Adding to this worries about the potential economic fallout from existing 25% US tariffs on Japanese vehicles and 24% reciprocal levies on other imports undermines the JPY. This, along with a modest US Dollar (USD) strength, lifts the USD/JPY pair to a fresh high since May 14, closer to mid-147.00s in the last hour.

The JPY bulls, meanwhile, seem to have digested Friday's release of Japan's annual National Consumer Price Index (CPI), which remained well above the BoJ's 2% target in May. Moreover, the better-than-expected PMI prints from Japan give the BoJ more impetus to hike interest rates again in the coming months. This, however, does little to provide any respite to the JPY bulls. Even rising geopolitical tensions in the Middle East fail to benefit the JPY's relative safe-haven status, suggesting that the path of least resistance for the USD/JPY pair is to the upside.

Japanese Yen bears retain intraday control despite the global flight to safety

- The Bank of Japan last week decided to slow the pace of reduction in its bond purchases from fiscal 2026. Moreover, the gloomy economic outlook and concerns about the potential economic fallout from US trade tariffs suggest that the BoJ could forgo raising interest rates in 2025.

- Data released on Friday showed that Japan's core inflation remained above the central bank's 2% target for well over three years and rose to a more than two-year high in May. This keeps the door open for further rate hikes by the BoJ, though it fails to boost the Japanese Yen.

- Furthermore, the au Jibun Purchasing Managers' Index (PMI) showed on Monday that Japan's manufacturing moved back into expansion territory for the first time since May 2024. The Manufacturing PMI rose sharply from the 49.4 seen in the previous month to 50.4 in June.

- Adding to this, the gauge for the services sector climbed to 51.5 during the reported month from 51.0 in May, while the Composite PMI advanced to 51.4 in June from 50.2 in May. This was the third straight month of growth in private sector activity and the fastest pace since February.

- Meanwhile, the Federal Reserve projected two rate cuts this year. However, Fed officials forecast only one 25-basis-points rate cut in each of 2026 and 2027 amid worries that the Trump administration's tariffs could push up consumer prices, which underpins the US Dollar.

- On the geopolitical front, the US joined Israel in the military action against Iran and bombed three nuclear sites on Sunday. The US launched 75 precision-guided munitions, including more than two dozen Tomahawk missiles, and more than 125 military aircraft in the operation.

- Moreover, US Defense Secretary Pete Hegseth warned Iran against following through with past threats of retaliation. Adding to this, Vice President JD Vance said that the US was not at war with Iran but rather its nuclear program. Investors now await Iran's response to US strikes.

USD/JPY could extend the momentum once 147.40-147.45 hurdle is cleared

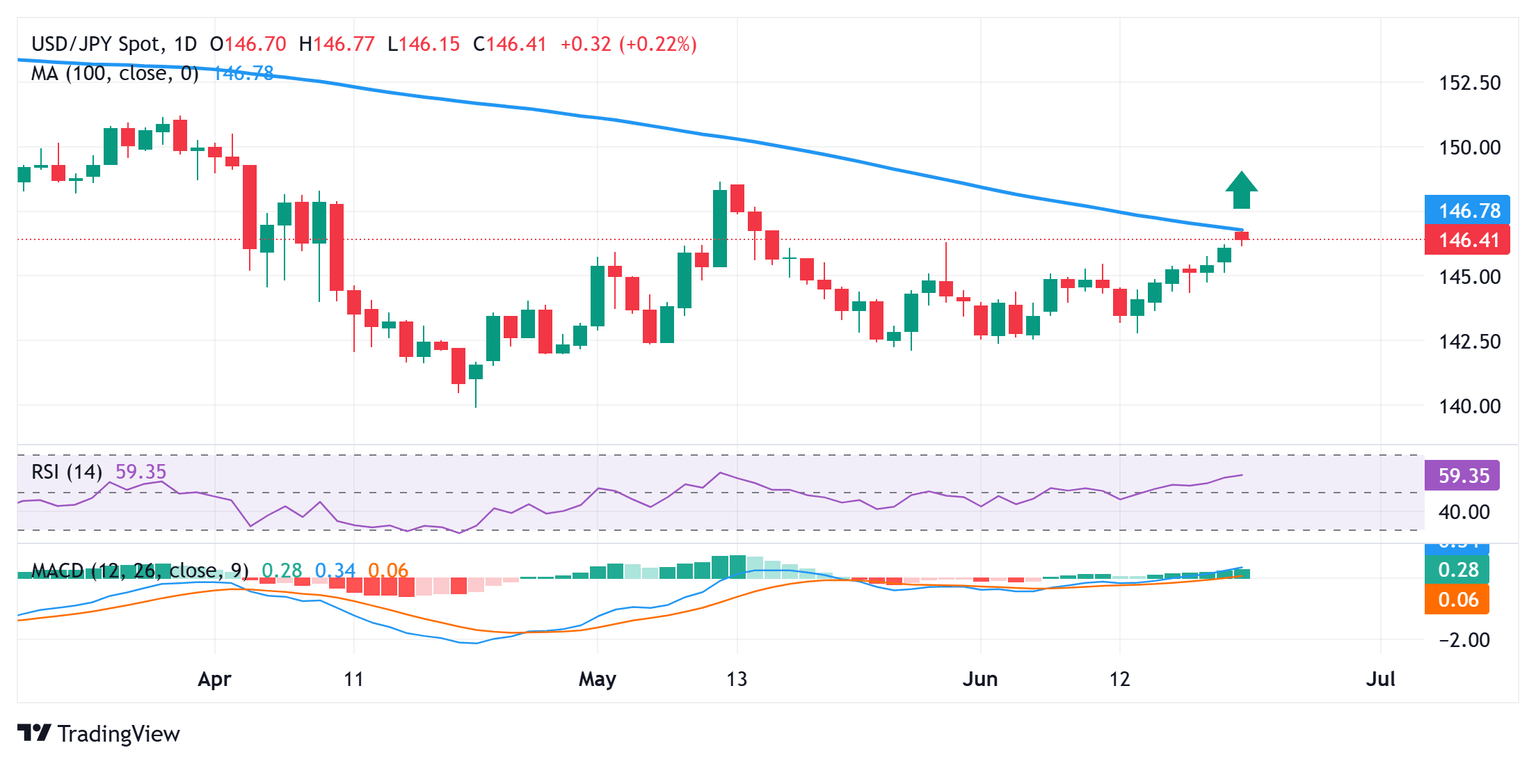

From a technical perspective, the USD/JPY pair needs to make it through the 100-day Simple Moving Average (SMA) barrier around the 146.80 region for bulls to retain short-term control. Some follow-through buying beyond the 147.00 mark will confirm a positive outlook and lift spot prices to the 147.40-147.45 intermediate hurdle en route to the 148.00 round figure and 148.65 region, or the May monthly swing high.

On the flip side, any corrective pullback below the 146.00 mark is more likely to attract fresh buyers and find decent support near the 145.30-145.25 area. This, in turn, should help limit the downside for the USD/JPY pair near the 145.00 psychological mark. The latter should act as a strong base for spot prices, which if broken decisively might prompt some technical selling and shift the near-term bias in favor of bearish traders.

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.41% | -0.24% | 0.35% | 0.06% | 0.21% | 0.37% | -0.01% | |

| EUR | 0.41% | 0.15% | 0.80% | 0.48% | 0.59% | 0.79% | 0.37% | |

| GBP | 0.24% | -0.15% | 0.69% | 0.33% | 0.44% | 0.65% | 0.22% | |

| JPY | -0.35% | -0.80% | -0.69% | -0.31% | -0.17% | 0.08% | -0.45% | |

| CAD | -0.06% | -0.48% | -0.33% | 0.31% | 0.20% | 0.32% | -0.11% | |

| AUD | -0.21% | -0.59% | -0.44% | 0.17% | -0.20% | 0.19% | -0.23% | |

| NZD | -0.37% | -0.79% | -0.65% | -0.08% | -0.32% | -0.19% | -0.42% | |

| CHF | 0.00% | -0.37% | -0.22% | 0.45% | 0.11% | 0.23% | 0.42% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.