Japanese Yen sticks to modest intraday losses; USD/JPY remains below 144.00 ahead of US NFP

- The Japanese Yen ticks lower as a US-Vietnam trade deal undermines safe-haven assets.

- BoJ rate hike expectations should limit deeper JPY losses amid a bearish USD sentiment.

- Traders await the US NFP report before placing fresh directional bets around USD/JPY.

The Japanese Yen (JPY) remains on the back foot against a mildly positive US Dollar (USD) for the second straight day, pushing the USD/JPY pair back closer to the 144.00 mark heading into the European session on Thursday. The global risk gets a minor lift as a trade agreement between the US and Vietnam eased concerns over prolonged trade tensions, which, in turn, undermines the safe-haven JPY. Furthermore, US President Donald Trump's threat to impose more tariffs on Japan over its alleged unwillingness to buy American-grown rice turns out to be another factor weighing on the JPY.

However, the growing acceptance that the Bank of Japan (BoJ) will hike interest rates again amid the broadening inflation in Japan should act as a tailwind for the JPY. The USD, on the other hand, struggles to attract any meaningful buyers and remains well within striking distance of a multi-year low touched earlier this week amid dovish Federal Reserve (Fed) expectations. This might further contribute to limiting losses for the lower-yielding JPY and cap the USD/JPY pair. Traders might also opt to wait for the US Nonfarm Payrolls (NFP) report before placing fresh directional bets.

Japanese Yen remains depressed amid positive risk tone

- Bank of Japan Governor Kazuo Ueda said on Tuesday that the current policy rate was below neutral and additional interest rate hikes will depend on inflation dynamics. Consumer inflation in Japan has exceeded the BoJ's 2% target for more than three years as companies continue to pass on rising raw material costs. This backs the case for further tightening by the central bank and acts as a tailwind for the Japanese Yen.

- In contrast, Federal Reserve Chair Jerome Powell, when asked if July was too soon to consider rate cuts on Tuesday, answered that it’s going to depend on the data. Traders ramped up their bets and are now pricing in nearly a 25% chance of a rate cut by the Fed at the July 29-30 meeting. Moreover, a 25 basis points rate cut in September is all but certain, and expectations for two rate reductions by the end of this year are high.

- Meanwhile, US President Donald Trump escalated his attacks on Powell and called for the Fed chief to quit immediately. This further raises concerns about the central bank's independence and keeps the US Dollar bulls on the defensive. Also weighing on the US currency is the disappointing release of the US ADP report on Wednesday, which showed that private payrolls unexpectedly lost 33,000 jobs in June.

- Moreover, the previous month's reading was revised down to show an addition of 29,000 jobs compared to 37,000 reported initially. The data suggested a sluggish hiring environment and fueled speculations that the US Unemployment Rate might tick up to at least 4.3% in June from 4.2% in May. Hence, the market focus will remain glued to the closely-watched US Nonfarm Payrolls (NFP) report due later this Thursday.

- On the trade-related front, Trump expressed frustration over stalled US-Japan trade negotiations and cast doubt about reaching an agreement before the July 9 deadline. Furthermore, Trump suggested that he could impose a tariff of 30% or 35% on imports from Japan, above the tariff rate of 24% announced on April 2, in retaliation for the latter's alleged unwillingness to buy American-grown rice.

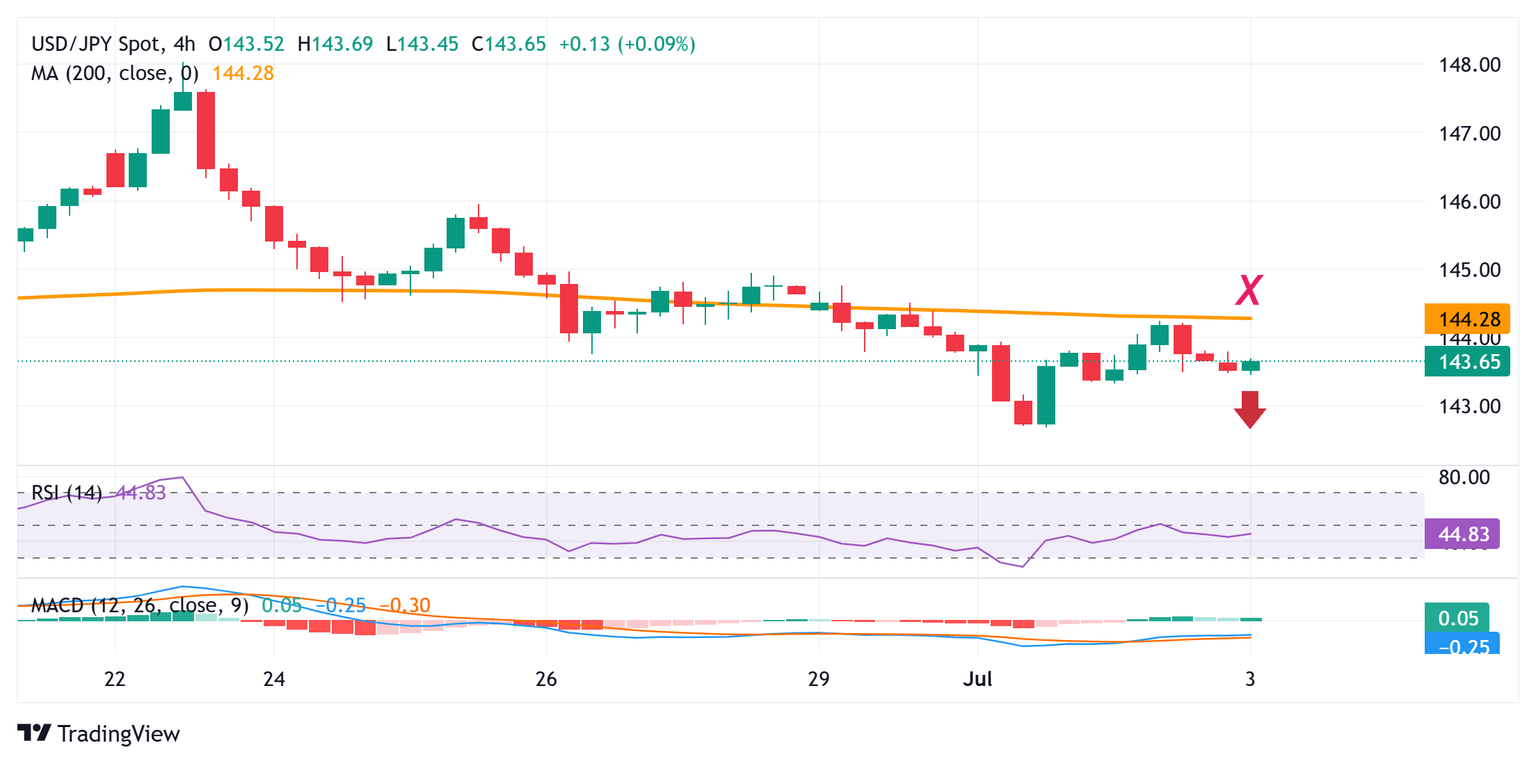

USD/JPY might struggle to move beyond 200-SMA on H4

From a technical perspective, the overnight rejection near the 200-period Simple Moving Average (SMA) on the 4-hour chart and negative oscillators suggest that the path of least resistance for the USD/JPY pair is to the downside. Some follow-through selling below the 143.40-143.35 area would reaffirm the bearish outlook and drag spot prices further towards the 143.00 round figure. This is followed by the weekly low, around the 142.70-142.65 region, which, if broken, should pave the way for a fall towards the May monthly swing low, around the 142.15-142.10 region.

On the flip side, any positive move back above the 144.00 mark might continue to face stiff resistance near the 200-period SMA on the 4-hour chart, currently pegged near the 144.30 region. A sustained strength above the latter, however, could trigger a short-covering move and lift the USD/JPY pair beyond the 144.65 horizontal zone, towards the 145.00 psychological mark. The momentum could extend further towards the 145.40-145.45 supply zone, which, if cleared decisively, might shift the near-term bias in favor of bullish traders.

Economic Indicator

Unemployment Rate

The Unemployment Rate, released by the US Bureau of Labor Statistics (BLS), is the percentage of the total civilian labor force that is not in paid employment but is actively seeking employment. The rate is usually higher in recessionary economies compared to economies that are growing. Generally, a decrease in the Unemployment Rate is seen as bullish for the US Dollar (USD), while an increase is seen as bearish. That said, the number by itself usually can't determine the direction of the next market move, as this will also depend on the headline Nonfarm Payroll reading, and the other data in the BLS report.

Read more.Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.