Innocan Pharma boasts impressive achievements in efficacy tests, commercialization and IP

Innocan Pharma Corporation (CSE: INNO, FSE: IP4), a pharmaceutical tech company, has announced significant achievements over the past few weeks in drug delivery platform technologies, efficacy tests, commercialization and intellectual property (IP) development in the cannabis industry.

The company has filed a joint patent application with Ramot at Tel Aviv University with the World Intellectual Property Organization to develop a drug delivery platform that maximizes the activity of loaded cannabinoids. Innocan's innovative platform aims to load cannabinoids on exosomes to expand the IP space for cannabis-based products. Innocan's CEO, Iris Bincovich, noted that the joint application reflects the strength of their collaboration and the potential of their partnership.

Innocan Pharma's portfolio of targeted healing products continues to expand, positioning the company as a leader in the field of cannabis-based therapeutics. The company has reported successful results of an efficacy test for its vaginal derma product that contains cannabinoids, phytoestrogens, hyaluronic acid, and probiotics. The product offers a healthy alternative for women seeking relief from vaginal discomfort and has been proven effective in a 56-day trial conducted with a group of female volunteers.

The pharmaceutical tech company has also launched a CBD veterinary commercialization team dedicated to licensing and commercializing their CBD therapy in the veterinary field. The company plans to engage with prospective clients to explore potential collaborations and commercialization opportunities. The company believes that the veterinary market represents a significant opportunity for growth and expansion.

Moreover, Innocan Pharma has received a Notice of Allowance from the United States Patent and Trademark Office for its patent application related to a combined cannabis and magnesium topical pain-relief technology. The patent covers breakthrough technology designed to relieve pain and itching topically using spray, roll-on, or lotion. The patent approval would aid the company's commercialization efforts.

Innocan is a pharmaceutical tech company that operates under two main segments: Pharmaceuticals and Consumer Wellness. The Pharmaceuticals segment focuses on developing innovative drug delivery platform technologies, comprising cannabinoids science, to treat various conditions to improve patients' quality of life. The Consumer Wellness segment develops and markets a wide portfolio of innovative and high-performance self-care products to promote a healthier lifestyle.

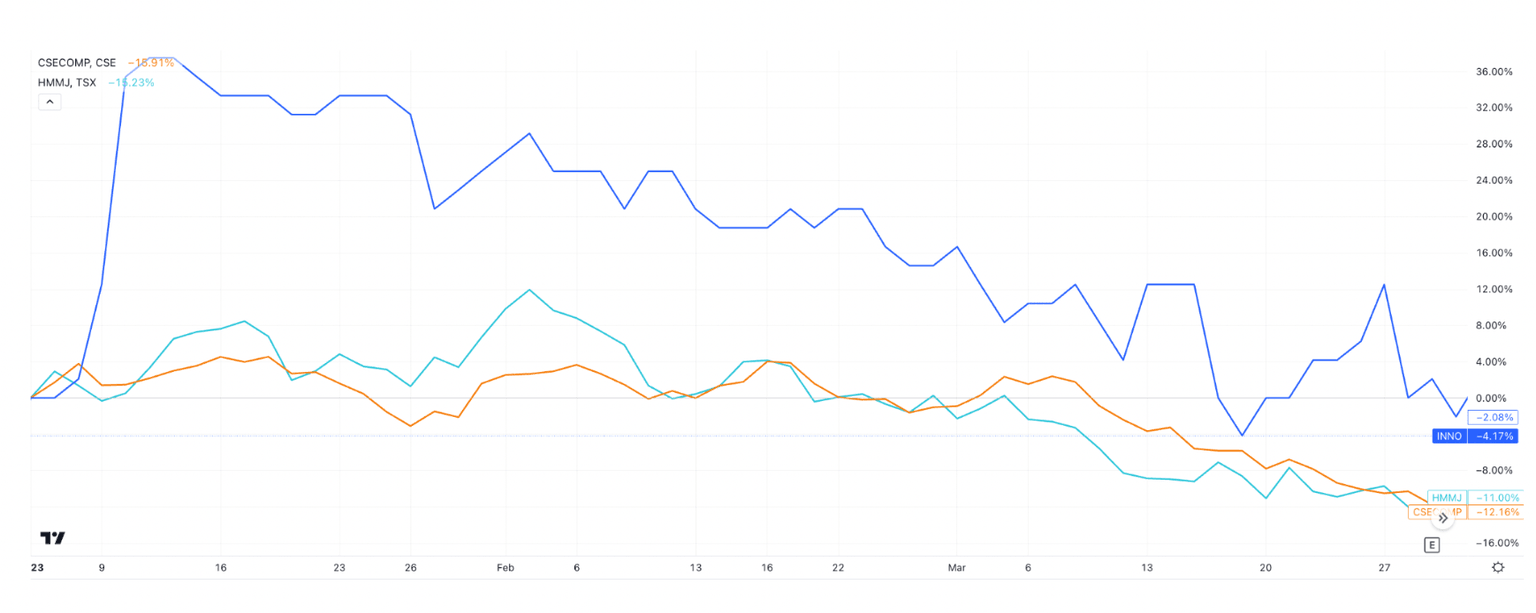

While Innocan has outpaced the CSE and HMMJ (Horizons Marijuana Life Sciences Index) over the past three months, it still seems that there is potentially substantial room for gains given its impressive milestones.

Innocan Pharma's recent achievements in drug delivery platform technologies, efficacy tests, commercialization, and IP development in the CBD and Pharma industry are impressive. The company's dedication to improving patients' quality of life through innovative technologies and consumer wellness products positions Innocan as a leader in the CBD-based therapeutics and care markets. As the company continues to expand its portfolio of targeted healing products and patent application filings, it's exciting to see what other breakthroughs Innocan Pharma will bring to the cannabis industry in the near future.

Author

Ronald Kaufman

Independent Analyst

Ronald Kaufman a writer and blogger active in the fields of foodtech, pharma, cyber, biotech and more. Ronald writes for leading publications about a number of topics.