Gold prices steady as the US Dollar softens, Fed Powell's remarks in focus

- Gold heads toward $3,400 as the US Dollar turns cautious ahead of the Fed.

- Fed policy projections may outweigh geopolitical concerns if officials signal a 'higher-for-longer' stance.

- Ongoing tensions between Israel and Iran continue to support safe-haven demand, lifting XAU/USD.

Gold (XAU/USD) is holding steady near $3,392 on Wednesday, supported by persistent geopolitical tensions and investor caution ahead of the Federal Reserve’s (Fed) policy decision.

At the time of writing, XAU/USD is trading just below the $3,400 level, with price action largely rangebound as markets await fresh guidance from the Federal Reserve.

Economic figures released earlier in the session point to a moderation in US growth momentum. May housing starts declined by 9.8% to 1.256 million, falling short of expectations, while initial jobless claims registered at 245,000. Continuing claims stood at 1.945 million, indicating a gradual cooling in labor market conditions. These data points collectively reinforce the argument for a cautious policy approach from the Fed.

Traders are now focused on the Fed’s rate outlook, updated economic projections, and Powell’s tone.

According to the CME FedWatch Tool, analysts expect the Fed to keep interest rates steady, remaining in the 4.25%-4.50% range during the next two meetings, with a 58% chance of a rate cut in September.

The Summary of Economic Projections (SEP) and updated “dot plot” will reveal how policymakers view inflation, growth, and the likely rate path for the rest of the year. Investors will closely monitor any changes in inflation forecasts and interest rate expectations, as these will shape the outlook for potential rate cuts.

Powell’s tone during the press conference will be key, especially his comments on recent data, global risks, and whether current policy remains appropriate. Dovish signals could weigh on the US Dollar and support Gold, while a hawkish tone may strengthen the Dollar and pressure Gold.

Daily digest market movers: Geopolitics, Fed expectations drive Gold demand.

- Fed policy plays a central role in shaping borrowing costs, investor sentiment, and currency dynamics.

- Any adjustment in tone or projections, particularly around interest rate expectations, can directly influence demand for safe-haven assets, such as gold.

- During periods of economic or geopolitical uncertainty, Gold typically benefits from its perceived safety, intrinsic value, and lack of counterparty risk.

- This role has been further underscored by a notable surge in central bank demand: according to the World Gold Council’s 2025 Central Bank Gold Reserves survey, institutions have purchased over 1,000 tonnes of Gold annually for the past three years—more than double the previous decade’s average.

- Safe-haven flows were further supported by fresh geopolitical tensions following comments from US President Donald Trump.

- On Tuesday, Trump left the G7 summit in Canada early to meet with his national security team in Washington, amid rising speculation over potential US involvement in the Israel–Iran conflict.

- Citing senior officials, the Wall Street Journal reported that while “a strike was just one of the options that was discussed,” no decision had been finalized.

- On Truth Social, Trump asserted, “We now have complete and total control of the skies over Iran,” reiterating his call for Iran’s “unconditional surrender” and dismissing the idea of a ceasefire, instead pushing for a “real end” to Tehran’s nuclear ambitions.

- These developments have elevated geopolitical risk premiums and reinforced Gold’s role as a strategic hedge in volatile market conditions.

Gold technical analysis: XAU/USD bulls defend support ahead of Fed risk, aiming for $3,400

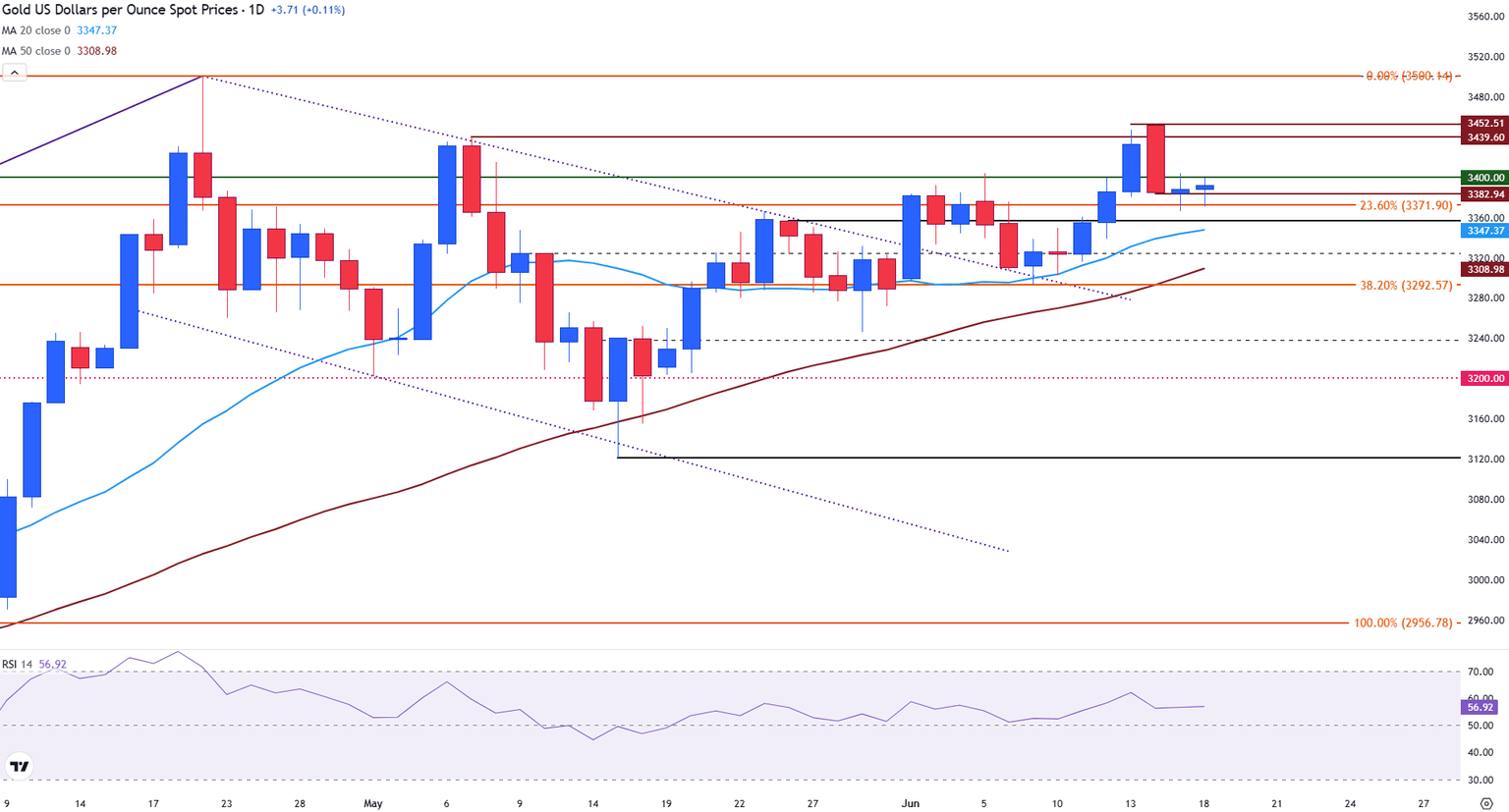

Gold (XAU/USD) is trading slightly higher near $3,392, holding above the key 23.6% Fibonacci retracement level at $3,371.90, drawn from the April low to the April high.

Price action is consolidating just below the $3,400 psychological barrier, with traders positioning cautiously ahead of the Fed rate decision and updated economic projections.

The broader uptrend remains intact, with Gold trading comfortably above both the 20-day Simple Moving Average (SMA) at $3,347 and the 50-day SMA at $3,308, both of which are sloping upward.

Gold (XAU/USD) Daily Chart

A daily close above $3,400 would open the door for a retest of the $3,439–$3,452 resistance zone, which has capped upside this week.

On the downside, a break below $3,371 would expose support at $3,347 (20-day SMA), followed by the 38.2% retracement at $3,292, which aligns with prior structure.

The Relative Strength Index (RSI) is currently at 57, indicating steady bullish momentum without approaching overbought territory.

A dovish surprise from the Fed could push Gold higher toward recent highs, while a hawkish tilt may see price retreat toward key technical support levels.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Economic Indicator

Fed Monetary Policy Statement

Following the Federal Reserve's (Fed) rate decision, the Federal Open Market Committee (FOMC) releases its statement regarding monetary policy. The statement may influence the volatility of the US Dollar (USD) and determine a short-term positive or negative trend. A hawkish view is considered bullish for USD, whereas a dovish view is considered negative or bearish.

Read more.Next release: Wed Jun 18, 2025 18:00

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.