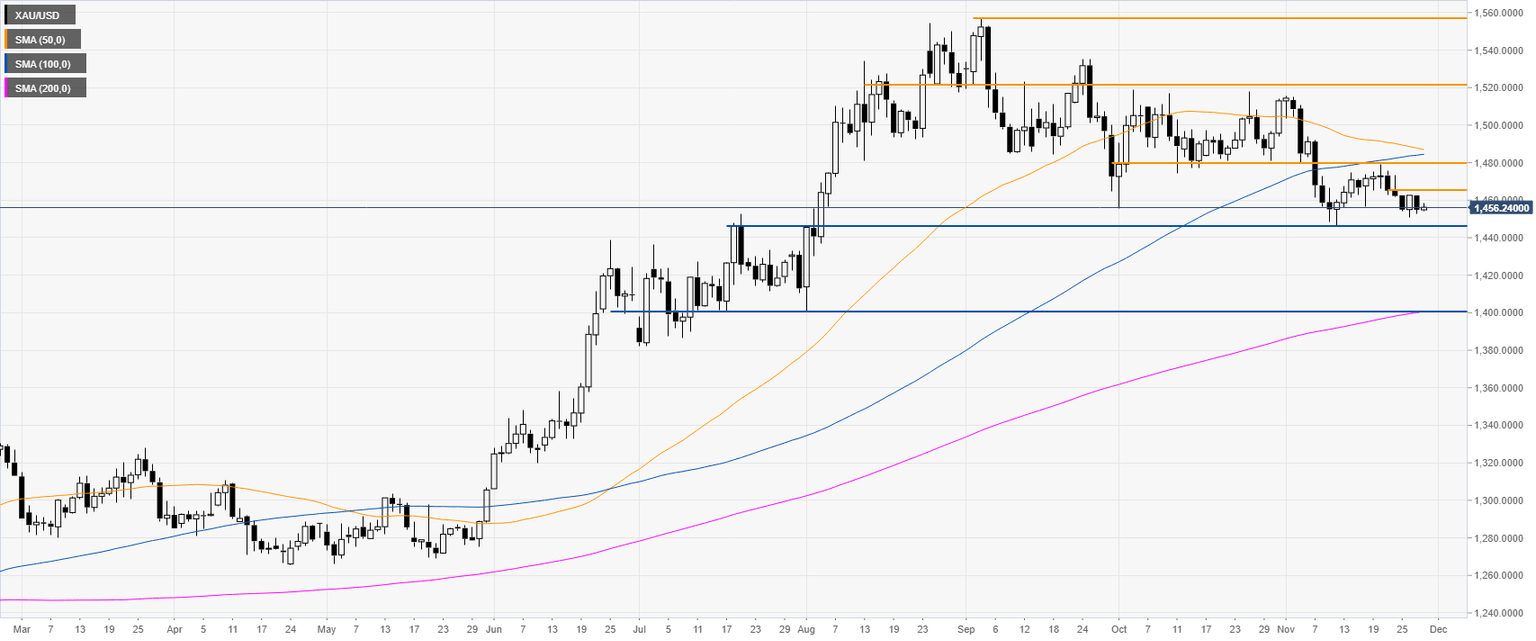

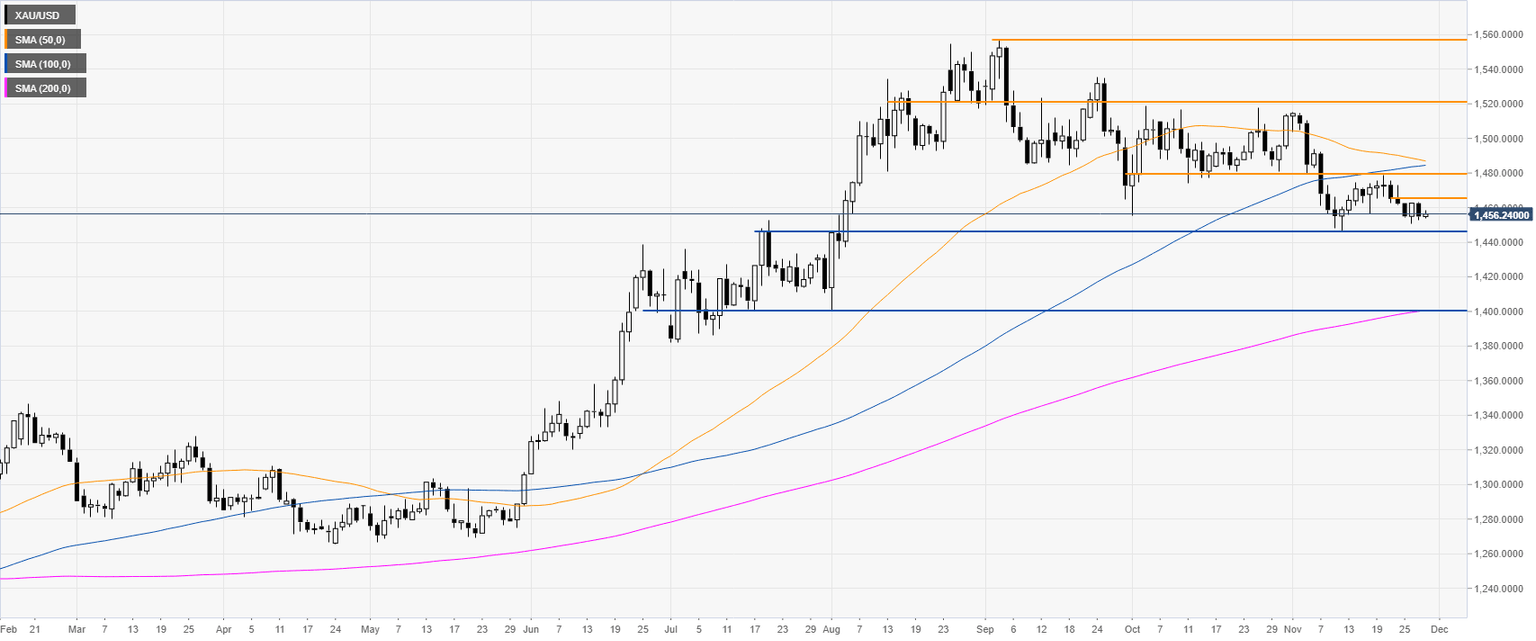

Gold Technical Analysis: The precious metal is under pressure near four-month lows

- The yellow metal remains under bearish pressure as the Thursday’s London session comes to an end.

- The outlook for gold remains slightly bearish in the medium term.

Gold daily chart

Gold four-hour chart

Additional key levels

Author

Flavio Tosti

Independent Analyst