Gold Technical Analysis: Continuing to trip higher up the charts, aimed for $1,280.00

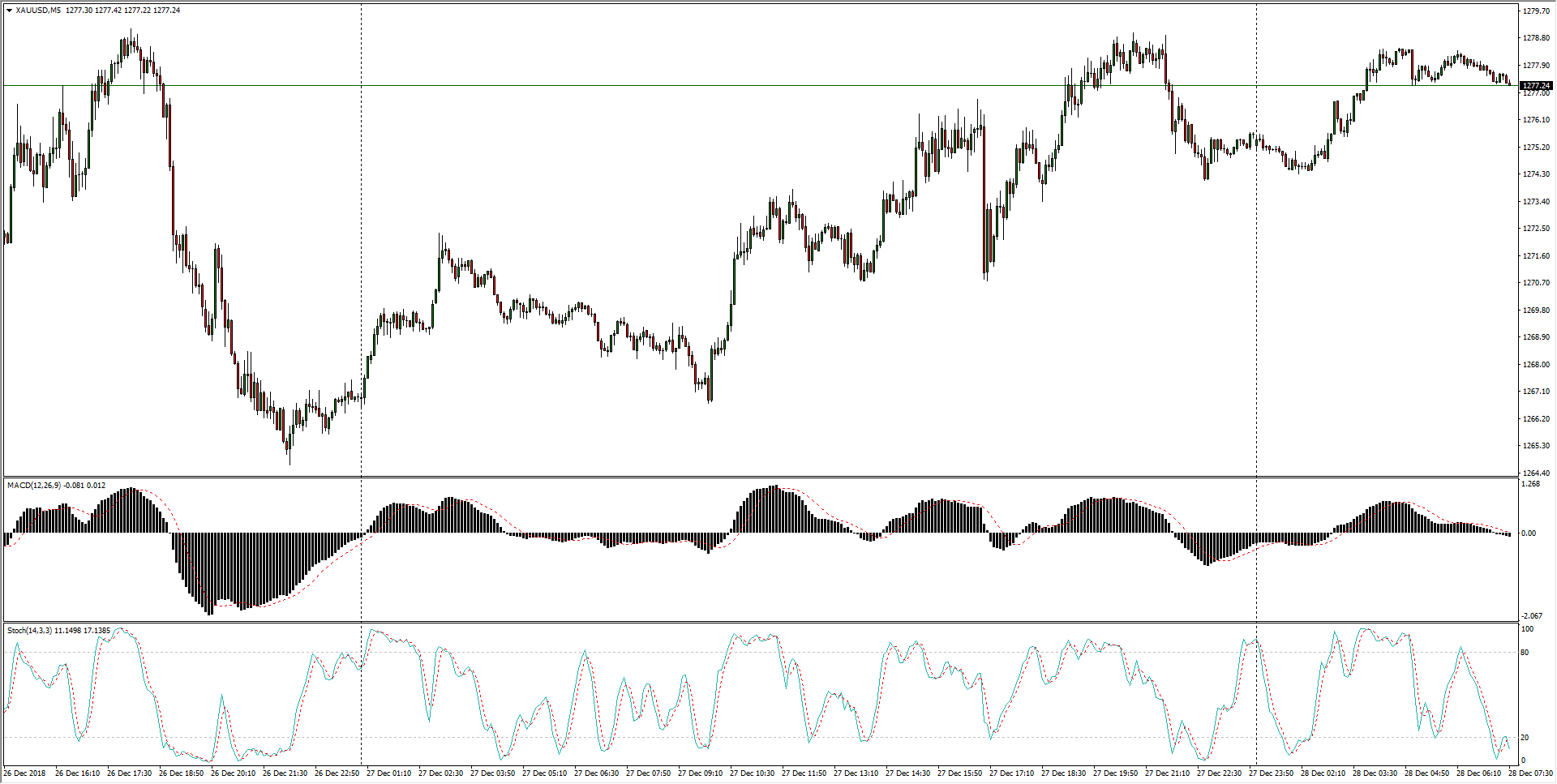

- Intraday bidding action for Gold is seeing the precious metal clip into immediate highs near 1,278.00, and intraday higher lows are propping up XAU/USD for a run higher.

Gold, 5-Minute

- The near-term sees Gold geared for a bullish run higher as broader market sentiment continues to pin into the fearful side, keeping the precious metal well-bid as investors struggle to pick a direction for equities and the greenback.

Gold, 30-Minute

- 4-hour candles have Gold sitting firmly in overbought territory, and with technical indicators firmly pinned to hot readings, a new run-up for XAU/USD could require a retracement to the 1,250.00 region first.

Gold, 4-Hour

XAU/USD

Overview:

Today Last Price: 1277.38

Today Daily change: 2.1e+2 pips

Today Daily change %: 0.166%

Today Daily Open: 1275.26

Trends:

Previous Daily SMA20: 1248.23

Previous Daily SMA50: 1232.06

Previous Daily SMA100: 1218.8

Previous Daily SMA200: 1229.56

Levels:

Previous Daily High: 1279.05

Previous Daily Low: 1265.76

Previous Weekly High: 1266.8

Previous Weekly Low: 1235.85

Previous Monthly High: 1237.4

Previous Monthly Low: 1196.4

Previous Daily Fibonacci 38.2%: 1273.97

Previous Daily Fibonacci 61.8%: 1270.83

Previous Daily Pivot Point S1: 1267.66

Previous Daily Pivot Point S2: 1260.06

Previous Daily Pivot Point S3: 1254.37

Previous Daily Pivot Point R1: 1280.96

Previous Daily Pivot Point R2: 1286.65

Previous Daily Pivot Point R3: 1294.25

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.