Gold stays range-bound as traders await Fed decision

- Gold holds steady as traders stay cautious ahead of Wednesday’s Fed interest rate decision.

- Markets price a 90% chance of a 25 bps cut, but uncertainty grows over the Fed’s guidance into 2026.

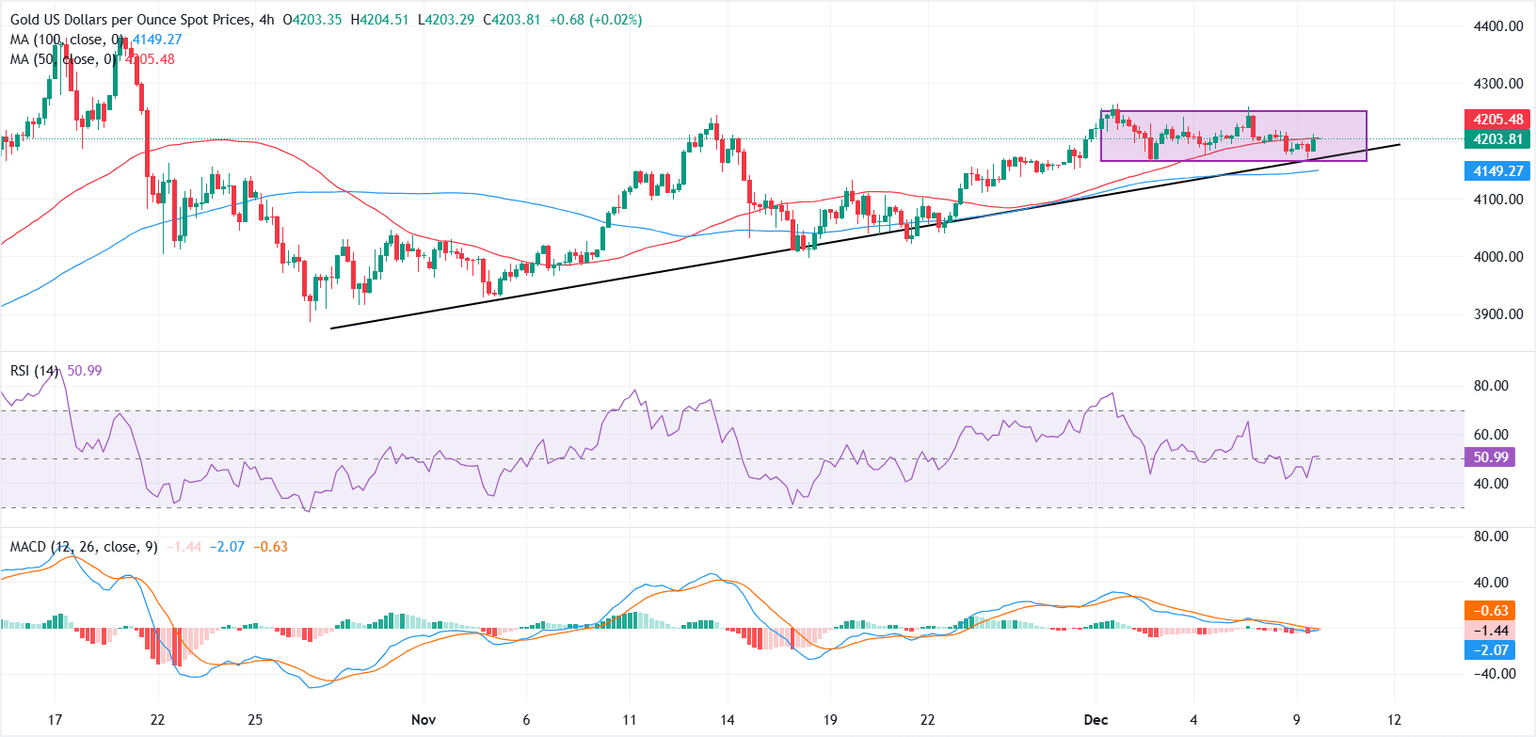

- Neutral technical signals keep XAU/USD range-bound, with $4,250 capping upside and $4,180-$4,200 acting as key support.

Gold (XAU/USD) holds its footing on Tuesday, extending the sideways pattern that has dominated trade for a little over a week as investors stay on the sidelines ahead of the Federal Reserve’s (Fed) interest rate decision on Wednesday.

At the time of writing, the XAU/USD is consolidating around $4,200 after briefly dipping toward $4,170 earlier in the European trading session.

The two-day Federal Open Market Committee (FOMC) meeting begins later on Tuesday, with traders widely anticipating another rate cut following September and October’s back-to-back “risk-management” reductions in response to signs of cooling in the labour market.

Market pricing via the CME FedWatch Tool points to almost a 90% likelihood of a 25 basis point (bps) rate cut, which would lower the Federal Funds Rate to the 3.50%-3.75% range.

The dovish Fed expectation is keeping Bullion broadly supported. However, with the rate cut almost fully priced in, investors will closely watch the forward guidance as speculation of a “hawkish cut” grows, underscoring uncertainty over the monetary policy path heading into 2026.

Market movers: Fed’s next move under scrutiny amid mixed signals

- The US Dollar Index (DXY), which tracks the Greenback against a basket of six major currencies, is trading around 99.27, extending gains after Monday’s modest recovery and exerting mild pressure on Gold.

- Labour-market data released on Tuesday painted a firmer picture, with the ADP 4-week average rising to 4.75K and JOLTS Job Openings for both September and October exceeding expectations. September came in at 7.658 million against a 7.2 million forecast and 7.227 million in the previous month, while October printed 7.67 million compared with a 7.2 million consensus.

- Even with a cut almost fully priced in, policy uncertainty remains elevated. Fed Chair Jerome Powell struck a notably cautious tone at the October post-meeting press conference, stressing that “a further reduction in the policy rate at the December meeting is not a foregone conclusion, far from it.” Powell also noted a “growing chorus” within the Committee suggesting it may be better to wait before making another move.

- There is also a notable division within the Committee, with some officials emphasizing lingering inflation risks while others are concerned about the gradual cooling in the labour market. The latest Personal Consumption Expenditures (PCE) data and mixed labour indicators are adding to the uncertainty, reinforcing the view that the Fed may opt for a more measured approach to additional monetary policy easing as disinflation progress slows.

- Beyond monetary policy, geopolitical risks also remain elevated, with the lack of meaningful progress in the Russia-Ukraine peace negotiations continuing to lend support to Gold. After meeting European leaders in London on Monday, Ukrainian President Volodymyr Zelenskiy said Kyiv will share a revised 20-point peace plan with the United States and stressed that there is still no agreement on the issue of territorial concessions, which Moscow continues to push for.

Technical analysis: Neutral momentum keeps Gold trapped below $4,250

Gold (XAU/USD) continues to trade in a tight range, with buyers repeatedly stepping in around the $4,200-$4,180 area. On the 4-hour chart, the 50-period Simple Moving Average (SMA) is acting as near-term resistance around $4,205, while the 100-period SMA near $4,148 provides a stronger downside floor if bears attempt a decisive break below the $4,200-$4,180 support zone.

On the upside, the $4,250 region remains a tough ceiling, where bulls have struggled to gain traction. A sustained break above this ceiling would shift the bias more decisively in favour of buyers and open the door for a retest of the all-time highs.

Momentum indicators remain neutral. The Relative Strength Index (RSI) is sitting near 50, signalling a neutral tone that fits with the current consolidation. Meanwhile, Moving Average Convergence Divergence (MACD) lines are flat and hovering near the zero mark, signalling a lack of conviction from both bulls and bears as traders wait for a catalyst.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.