Breaking: Gold rallies to fresh record-high as weak NFP fuels dovish Fed outlook

- Gold holds steady around $3,575, consolidating after touching a record high of $3,586 post-NFP.

- The US jobs report showed weaker hiring, higher unemployment and steady wage growth.

- Softer US Dollar and falling Treasury yields continue to cushion bullion, keeping it well supported near record levels.

Gold (XAU/USD) rallies to a fresh all-time high of $3,586 on Friday following the release of disappointing US Nonfarm Payrolls (NFP) data. At the time of writing, the precious metal is trading around $3,580, up nearly 0.95% on the day, as investors pile into safe-haven assets amid broad US Dollar (USD) weakness and falling Treasury yields.

The US economy added just 22K jobs in August, far below the 75K expected, while July’s figure was revised slightly higher to 79K. The Unemployment Rate rose to 4.3% from 4.2%, its highest since late 2021, while Average Hourly Earnings increased 0.3% MoM and 3.7% YoY, both in line with forecasts

Recent labor market indicators have pointed to cooling momentum. ADP private payrolls came out at an increase of 54K in August, below expectations and the previous 106K, while JOLTS Job Openings fell to 7.18 million from 7.36 million. Initial Jobless Claims for the latest week came in at 237K, above both expectations of 230K and the prior 229K, underscoring signs of gradual softening in labor demand. Meanwhile, ISM Employment Indexes for both Manufacturing (43.8) and Services (46.5) remain in contraction territory. The string of weak readings has reinforced the view that the Federal Reserve (Fed) is now more worried about job market risks than persistent inflation.

Taken together, the data underscore a labor market losing momentum, reinforcing expectations that the Federal Reserve (Fed) will ease policy at its September 16-17 meeting. While markets are already pricing in nearly a full 25 basis point (bps) cut, the weak NFP print raises speculation that the central bank could opt for a larger 50 bps move to counter slowing growth. For Gold, the combination of subdued Treasury yields, broad Dollar weakness and a dovish Fed backdrop provides solid support, allowing bullion to trade in uncharted territory at record levels.

Market movers: Gold steadies as the US Dollar weakens, yields slide

- The US Dollar Index (DXY), which measures the Greenback’s value against a basket of six major currencies, falls below 98.00, giving back Thursday’s gains. The Index is hovering near the lower end of the August range around 97.50

- Global bond markets eased after recent spikes, with US Treasury yields retreating across the curve — the benchmark 10-year hovering near its lowest since April 7 at 3.64%, the 30-year slipping near a three-week low around 4.879%, and the rate-sensitive 2-year sliding to 3.48%, also its lowest since April 7. Lower yields reduce the opportunity cost of holding non-interest-bearing bullion, cushioning Gold’s downside.

- On Friday, US President Donald Trump signed an executive order lowering tariffs on Japanese auto imports to 15% from 27.5%, effective in seven days and retroactive to early August. The move is part of a broader US-Japan economic package that includes a $550 billion Japanese investment commitment in the US infrastructure, energy, and semiconductor projects, as well as an agreement for Tokyo to expand purchases of Alaskan LNG. While the tariff relief excludes aircraft and parts, the deal is seen as a significant boost for Japanese automakers.

- On Thursday, Fed nominee Stephen Miran told a Senate panel he is “not at all” Trump’s puppet, pushing back against concerns over political influence at the central bank. Miran plans to take unpaid leave from his White House advisory role if confirmed, a move critics say still blurs the Fed’s independence. Beyond the independence debate, Miran pledged to act on macro-economic analysis and remain committed to the Fed’s dual mandate.

- Chicago Fed President Austan Goolsbee said on Thursday that he is unsure if an interest-rate cut would be appropriate at the Fed's September 16-17 meeting because of continued uncertainty about how much tariffs may accelerate inflation and how much they may be weighing on the labor market.

Technical analysis: XAU/USD surges to fresh ATH post-NFP

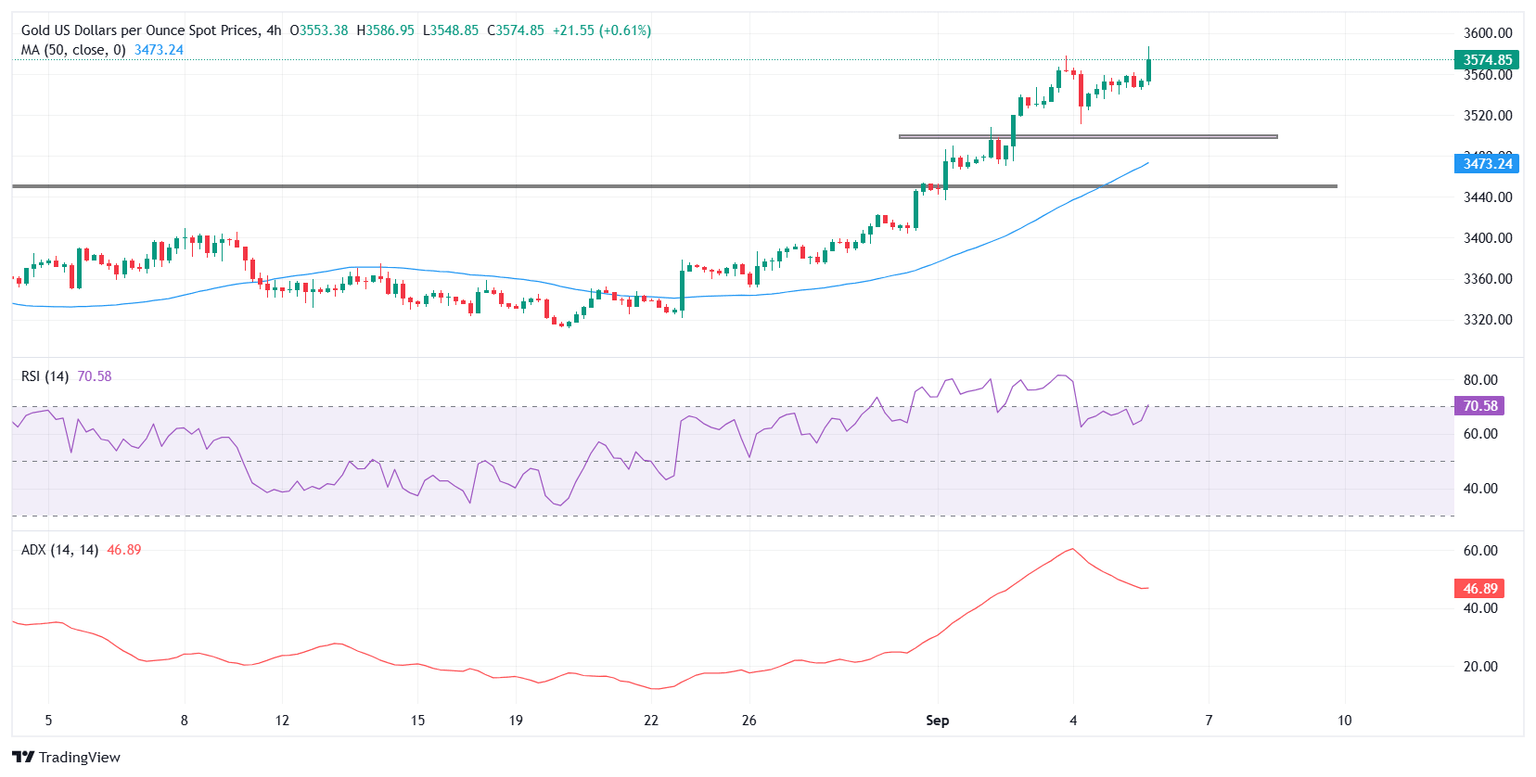

XAU/USD printed a fresh all-time high at $3,586 on Friday before easing slightly, and it is now consolidating just below record highs around $3,575. The price action suggests healthy digestion of gains, with the yellow metal holding comfortably above the 50-period Simple Moving Average (SMA) on the 4-hour chart at $3,473, which acts as a strong support base.

Momentum indicators remain constructive. The Relative Strength Index (RSI) is near overbought levels at 70, showing bulls remain in control. The Average Directional Index (ADX) at 46 reflects a strong uptrend, though its recent dip signals slowing momentum in the short term.

On the downside, immediate support is at $3,550, followed by the breakout zone near $3,450. On the upside, a decisive break above the $3,586 ATH would open the door to the $3,600 psychological level and potentially higher.

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months' reviews and the Unemployment Rate are as relevant as the headline figure. The market's reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Read more.Next release: Fri Sep 05, 2025 12:30

Frequency: Monthly

Consensus: 75K

Previous: 73K

Source: US Bureau of Labor Statistics

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.

Author

FXStreet Team

FXStreet