Gold trims gains after bright ADP employment data

- Gold retreats from highs after a strong ADP Employment Report.

- The US economy grew at a 2.8% pace in the third quarter with personal consumption at strong levels.

- XAU/USD rally looks overextended, with the RSI showing a bearish divergence.

Gold price (XAU/USD) is pulling back after having reached fresh record highs Wednesday. The US ADP Employment report has beat expectations, tackling investors' doubts triggered by Tuesday's JOLTS Job Openings report and giving a fresh boost to the US Dollar

Somewhat later the US Gross Domestic Product (GDP) showed a 2.8% yearly growth, below the 3% expected but still at levels consistent with healthy growth. Apart from that, Personal Consumption maintains a strong growing pace, which confirms that the economy remains solid.

The positive US data has pushed US Treasury yields higher, although the outlook on the Federal Reserve's (Fed) monetary policy plans did not change. The market is nearly fully pricing a 25 bps rate cut next week, and most likely another one in December.

Daily digest market movers: Gold consolidates gains with investors pricing two more Fed rate cuts in 2024

- US economy produced 233K new private payrolls in October, according to data released by the ADP employment report. These figures beat the market expectations of 115K, while September's reading has been revised up to a 159K increment from the previously estimated 143K.

- These figures have eased concerns triggered by the US JOLTS Job openings which showed a 7.44 million reading in September, their weakest record in more than three years.

- US GDP grew at a 2.8% pace in Q3, below the 3% level forecasted by the analysts, but still at levels comparatively stronger than the rest of the major economies.

- Core Personal Consumption Expenditures increased at a 2.2% pace, below last quarter's 2.8% reading but above the 2.1% expected. These figures suggest that Americans keep consuming, which supports economic growth and pushes inflation higher.

- The CME Group’s Fed Watch tool shows a 96.3% chance of a quarter-point rate cut by the Fed next week, up from 92% on Tuesday. The chances of another 25 bps cut in December have declined below 70% from 76.6% before the data releases.

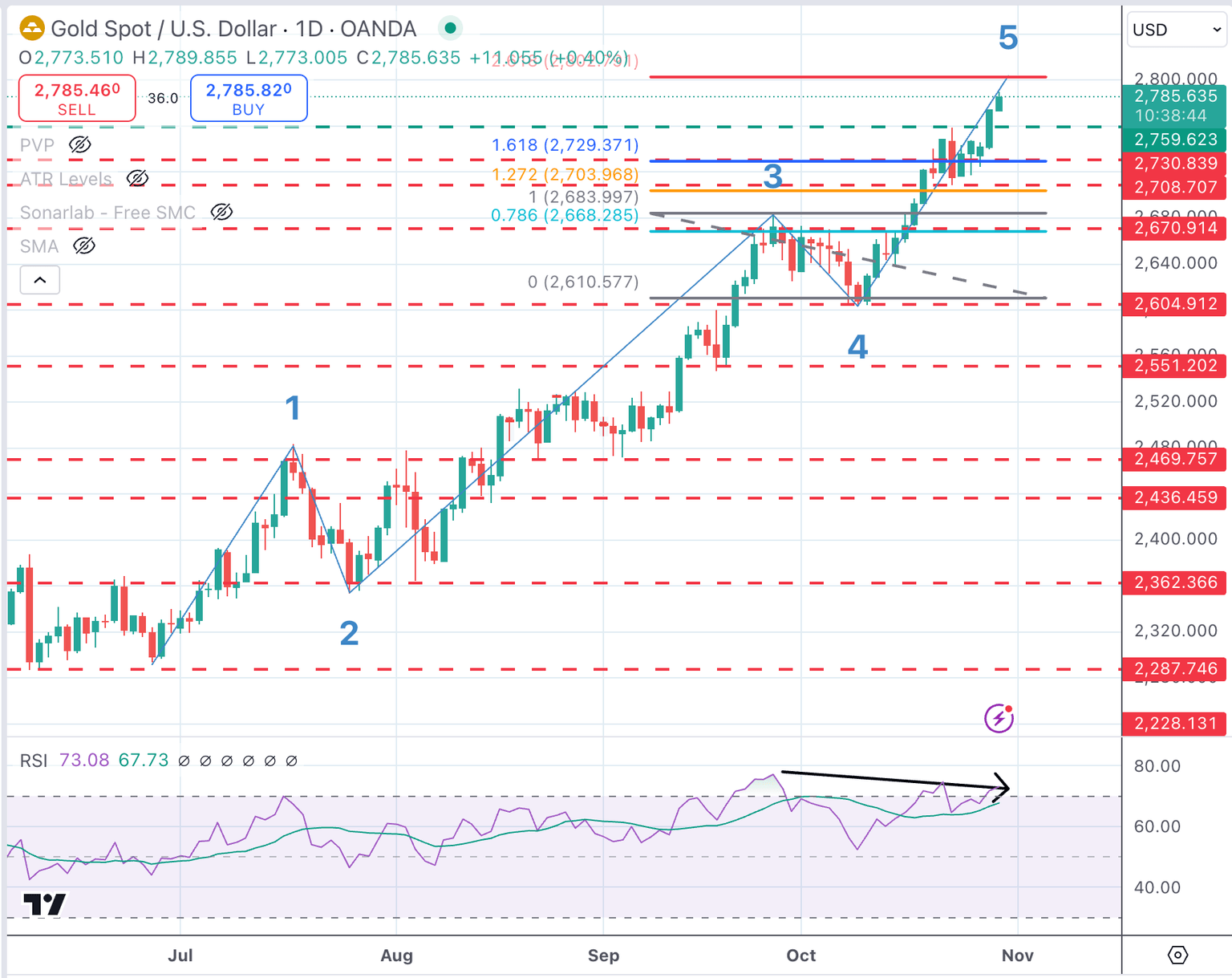

Technical analysis: XAU/USD’s rally looks overstretched near $2,800

Gold is on a bullish trend amid a supportive fundamental backdrop, but the technical picture is showing signs of a potential correction. The RSI is at overbought levels in most time frames, with the 4-hour chart showing a bearish divergence, which often anticipates a corrective reaction.

Immediate resistance is the intra-day high at $2,780, ahead of the $2,800 level. Support levels are the previous top at $2,760 and $2,730.

The daily chart shows the pair likely to be at the end of a 5-wave (Elliot Wave) impulse, with the 261.8% retracement of the 4th wave, in the $2,800 area, as a potential pivot point.

XAU/USD Daily Chart

GDP FAQs

A country’s Gross Domestic Product (GDP) measures the rate of growth of its economy over a given period of time, usually a quarter. The most reliable figures are those that compare GDP to the previous quarter e.g Q2 of 2023 vs Q1 of 2023, or to the same period in the previous year, e.g Q2 of 2023 vs Q2 of 2022. Annualized quarterly GDP figures extrapolate the growth rate of the quarter as if it were constant for the rest of the year. These can be misleading, however, if temporary shocks impact growth in one quarter but are unlikely to last all year – such as happened in the first quarter of 2020 at the outbreak of the covid pandemic, when growth plummeted.

A higher GDP result is generally positive for a nation’s currency as it reflects a growing economy, which is more likely to produce goods and services that can be exported, as well as attracting higher foreign investment. By the same token, when GDP falls it is usually negative for the currency. When an economy grows people tend to spend more, which leads to inflation. The country’s central bank then has to put up interest rates to combat the inflation with the side effect of attracting more capital inflows from global investors, thus helping the local currency appreciate.

When an economy grows and GDP is rising, people tend to spend more which leads to inflation. The country’s central bank then has to put up interest rates to combat the inflation. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold versus placing the money in a cash deposit account. Therefore, a higher GDP growth rate is usually a bearish factor for Gold price.

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.