Gold slips despite trade war escalation as Trump is open to talks

- Gold eases as Trump hints at dialogue with Europe and others.

- Trump imposes 30% tariffs on EU and Mexico, eyes 100% on Russia.

- Traders await US CPI, Retail Sales, and fresh Fed commentary this week.

Gold price slides some 0.19% on Monday as the trade war escalates despite ongoing meetings with several fronts between the White House and trade partners, which now include the European Union (EU) and Mexico. At the time of writing, the XAU/USD trades at $3,347.

On Saturday, US President Donald Trump applied tariffs of 30% to EU and Mexican goods imported to the US. This rattled the markets, pushing Gold prices toward their daily high of $3,374. Nevertheless, recent statements by Trump indicating his openness to trade talks, including those with Europe, weighed on Bullion prices.

Although geopolitics had taken a backseat, Trump said that he would send more weapons to Ukraine and threatened “100% tariffs” on Russia unless they agreed to a ceasefire of 50 days, as revealed by Bloomberg.

Traders' eyes shift to the release of inflation numbers in the United States (US) and Retail Sales data. Alongside this, Federal Reserve (Fed) officials will be grabbing the headlines.

Daily digest market movers: Gold edges lower as the Greenback climbs

- Gold price has consolidated within the $3,300-$3,350 area during the last few days as trade tensions rose after Trump imposed tariffs on several countries, including USMCA trade partners Canada, Mexico and the EU.

- The Greenback’s strength is pressuring Bullion prices. The US Dollar Index (DXY), which tracks the performance of the Dollar’s value against a basket of six currencies, rises 0.25% to 98.10.

- Another reason for XAU weakness is that US Treasury yields are rising, with the 10-year T-note up one basis point to 4.427%.

- Investors are awaiting the release of June’s Consumer Price Index (CPI) in the United States. The CPI is expected to jump from 2.4% to 2.7% YoY. The underlying print is foreseen at 3% YoY, up from 2.8%, well above the Fed’s 2% goal. This justifies the current monetary policy stance by the Fed, which repeatedly said that tariffs are inflation prone, triggering another wave of inflation.

- This would exert pressure on the Fed, which so far has witnessed a sudden change of views about the current monetary policy. Governors Waller and Bowman and San Francisco Fed President Mary Daly leaned to the dovish side, expecting at least two rate cuts in 2025.

- Data from the CBOT suggests that market players are expecting 47 basis points of easing by the Fed toward the end of 2025. Data from the Chicago Board of Trade revealed that market players are eyeing 49 basis points (bps) of easing in 2025.

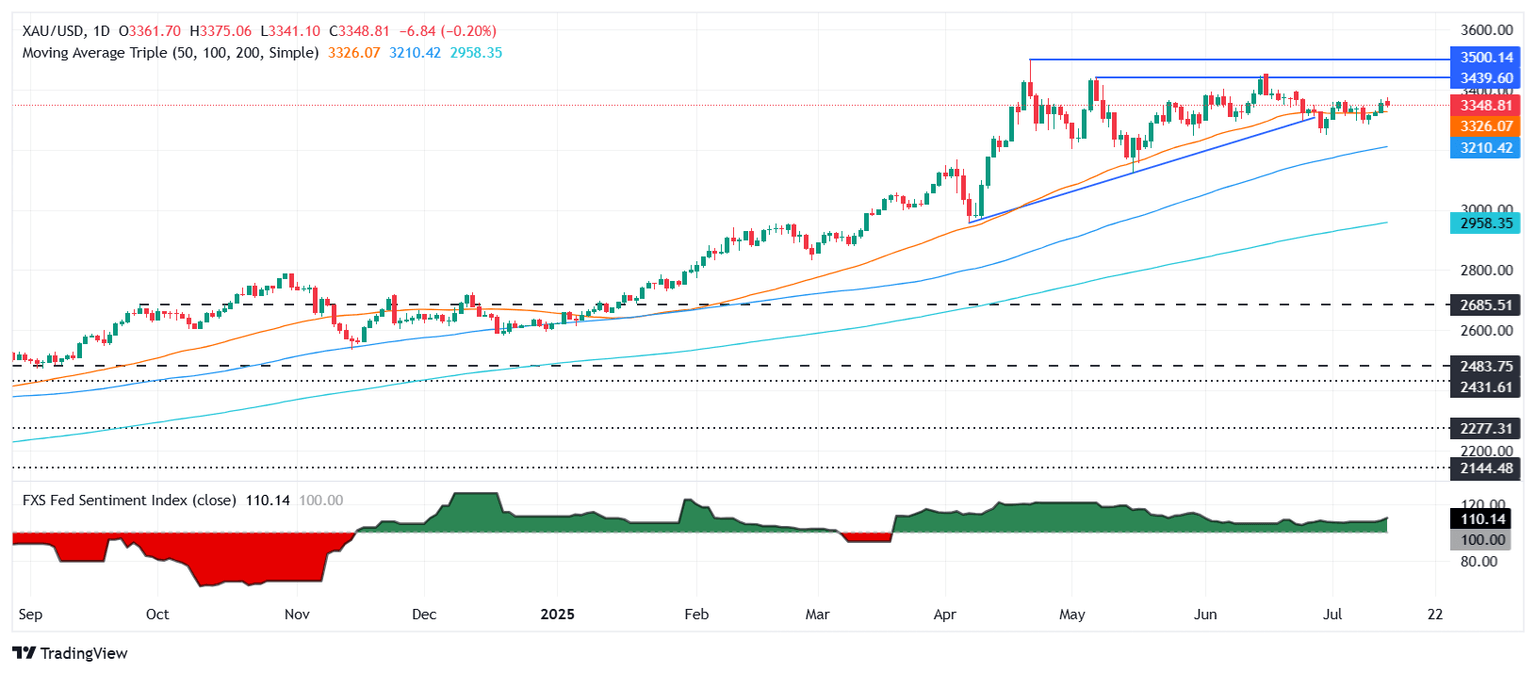

XAU/USD technical outlook: Gold price rallies toward $3,350

Gold price remains consolidated at the top of the $3,300-$3,350 range, with buyers gathering some momentum. The Relative Strength Index (RSI) turned bullish, but the market structure suggests that the yellow metal remains consolidated.

If Gold climbs past $3,350, the next resistance would be $3,400. A breach of the latter exposes the $3,450 mark, ahead of the record high of $3,500. Conversely, a drop below $3,300 would pave the way to test the 100-day SMA at $3,246, followed by $3,200.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.