Gold swings back up higher after Trump says 80% tariff on China seems right

- Gold price gains back on initial losses and trades back above $3,335 on Friday.

- The US-UK trade agreement is labeled as half-baked, not a ‘full and comprehensive’ trade deal as President Trump promised.

- Gold sees safe-haven recovery ahead of the high-stakes China-US meeting over the weekend.

Gold (XAU/USD) edges up near 1.0% on Friday and heads back above $3,335 at the time of writing. The additional leg higher comes after United States (US) President Donald Trump called upon China to open its markets for the US, adding that an 80% tariff on Chinese goods 'seems right', Trump added. The precious metal’s price already edging higher in early trading as markets call the trade deal announced on Thursday between the United States (US) and the United Kingdom (UK) an 'empty shell’. The US-UK trade deal gives the US better market access and a faster customs process for exports to Britain, but falls short of a "full and comprehensive" agreement.

The fact that this initial trade deal for the US is so ill-conceived raises big questions and uncertainties just ahead of the China-US summit that is set to take place in Switzerland over the weekend. In the run-up to that meeting, the Chinese Minister of Commerce has again expressed its demands that tariffs must be unwound before trade talks can occur. Meanwhile, US President Donald Trump hinted overnight that people should head out and buy stocks now, Reuters reports.

Daily digest market movers: Tariffs incentive

- President Trump also said overnight that he believed that the trade talks this weekend with China would result in tangible progress. The president said he would consider lowering the 145% tariff he has imposed on many Chinese goods if the discussions went well. Beijing, meanwhile, reiterated its calls for the US to cancel unilateral duties on China, Bloomberg reports.

- People familiar with preparations for the talks, which are due to begin in Geneva on Saturday, led by US Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng, say the US side has set a target of reducing tariffs below 60% as a first step that they feel China may be prepared to match. Progress in two days of scheduled discussions could see those cuts being implemented as soon as next week, they said, Bloomberg reports.

- "Buying Gold on dips is still in vogue, which is so far limiting the downside moves despite safe-haven demand drying up to a degree on the US-UK trade deal," KCM Trade Chief Market Analyst Tim Waterer said, Reuters reports.

Gold Price Technical Analysis: Not done yet

The stakes just got high for this weekend, after President Trump told people to go out and buy stocks when talking about the US-UK trade deal, as it would be the first of many. I'm unsure if the suggestion was linked to the US-China negotiations this weekend, though Trump is clearly seizing this one-deal event as a jumping board to get momentum going. However, questions all around should support the safe haven demand due to growing uncertainty.

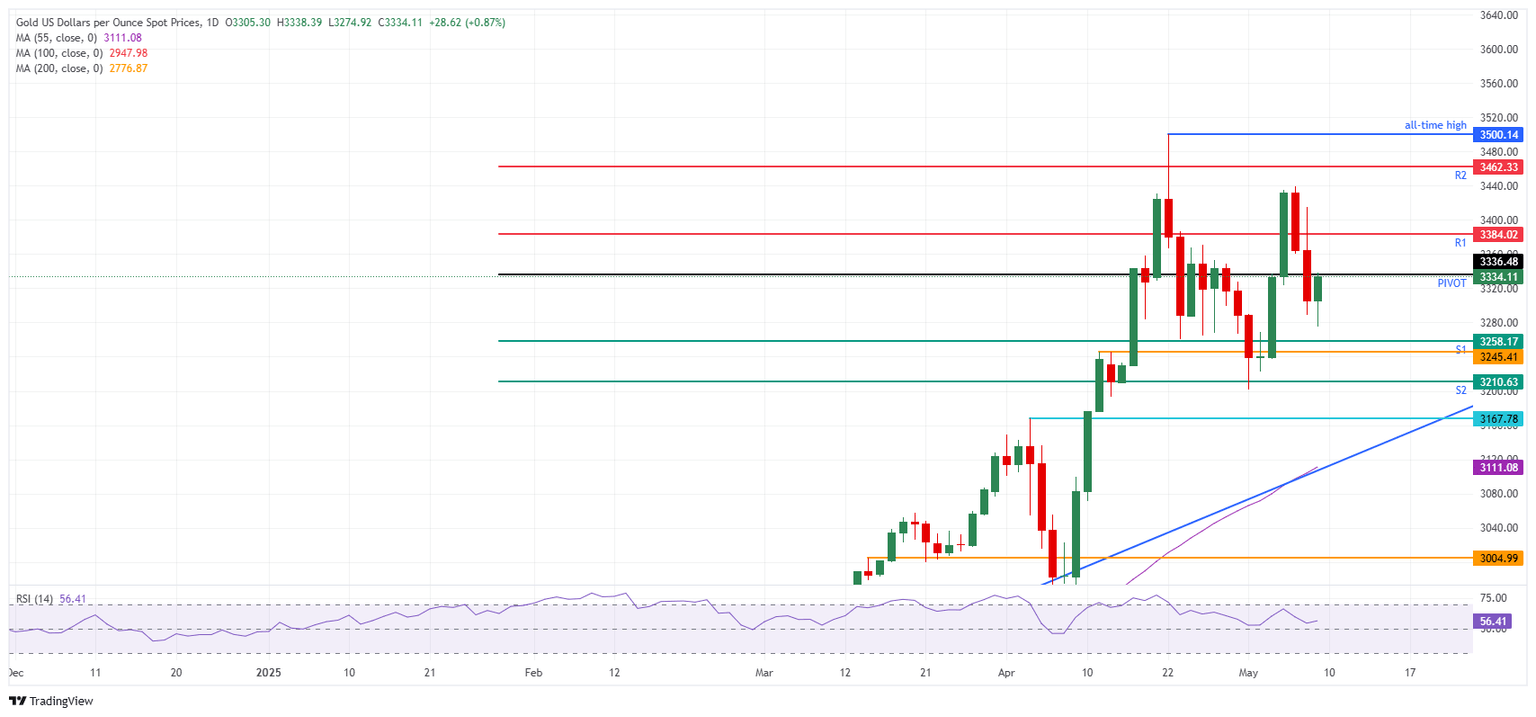

First hurdle on the upside this Friday comes in at the daily Pivot Point at $3,336. Should more follow-through appear later in the day, look for the intraday R1 resistance at $3,384. The R2 resistance upside target at $3,462 might be a bit too far for today’s price action.

On the downside, the S1 support at $3,258 is the first line of defence. The watchdog level, which is near $3,245, is a much stronger floor from a technical standpoint. In case it does break under pressure, $3,210, which is the S2 support, should come into play.

XAU/USD: Daily Chart

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.