Gold price recovers as Fed Independence takes focus

- Gold price rebounds after reports emerge that President may remove Fed Powell from office

- US Dollar retreats with trade talks and political uncertainty weighing on the greenback.

- XAU/USD recovers above $3,350 with $3,400 back in focus.

Gold price action is reacting to another critical US inflation report on Wednesday as price action remains sensitive to shifting interest rate expectations and movements in the US Dollar.

At the time of writing, the XAU/USD is above $3,350, as traders digest inflation reports and shift focus to concerns related to Fed independence.

The June PPI came in softer than expected, with the monthly headline figure coming in unchanged, below forecasts of a 0.2% increase. On an annual basis, headline PPI rose 2.3%, also underperforming expectations of 2.5% and marking a decline from May’s 2.6%.

Core PPI, which excludes food and energy, followed a similar trend, coming in at 0.0% MoM and 2.6% YoY, below both forecasted and previous readings.

However, Industrial Production rose 0.3%, beating forecasts of a 0.1% increase, easing concerns of a stagnant US economy.

The weaker-than-expected numbers suggest easing price pressures at the producer level, potentially reviving market hopes for a more dovish shift in Federal Reserve (Fed) policy and offering near-term support for Gold prices.

Daily digest market movers: Gold price reacts to inflation, trade tensions, and talk of replacing Fed Powell

- Policymakers at the Fed remain hesitant to pivot away from their restrictive stance without clearer signs of disinflation. This hawkish tone has weighed on Gold, which typically moves inversely to both interest rates and the US Dollar.

- Tuesday’s Consumer Price Index (CPI) report beat expectations, showing headline inflation rising at an annual rate of 2.7% in June, and core inflation also ticked higher, printing at 2.9% YoY. The data reduced market hopes for a near-term Fed rate cut, reinforcing a more hawkish stance and putting pressure on Gold.

- Trade tensions and geopolitical risks remain present, but they’ve taken a back seat to concerns about inflation and monetary policy.

- Growing speculation around Jerome Powell’s potential termination has introduced a new layer of uncertainty into the markets. With inflation still running hot and the Fed maintaining a restrictive stance, leadership instability could unsettle investor confidence and rattle rate expectations.

- President Trump said Treasury Secretary Scott Bessent is “an option” for the role of the Fed Chair on Tuesday, while he acknowledged Bessent was not his top candidate. Meanwhile, Bessent stated that Trump has no intention to fire Powell but signaled that Trump has begun a formal process to identify Powell’s eventual successor.

- While the Fed has acknowledged that tariffs could pose inflationary risks, questions about its independence have surfaced amid political pressure and broader economic concerns.

Trump announced a bilateral agreement that sets tariffs on goods imported from Indonesia at 19%, lowered from a threatened 32%. In exchange, Indonesia has committed to purchasing 50 Boeing jets and increasing US energy and agricultural imports. - According to the CME FedWatch Tool, the probability of a rate cut at the September meeting currently stands at 56.1%, while the prospects of the Fed leaving rates unchanged at the same meeting has fallen to 42.5%, down from 42.5% on Tuesday.

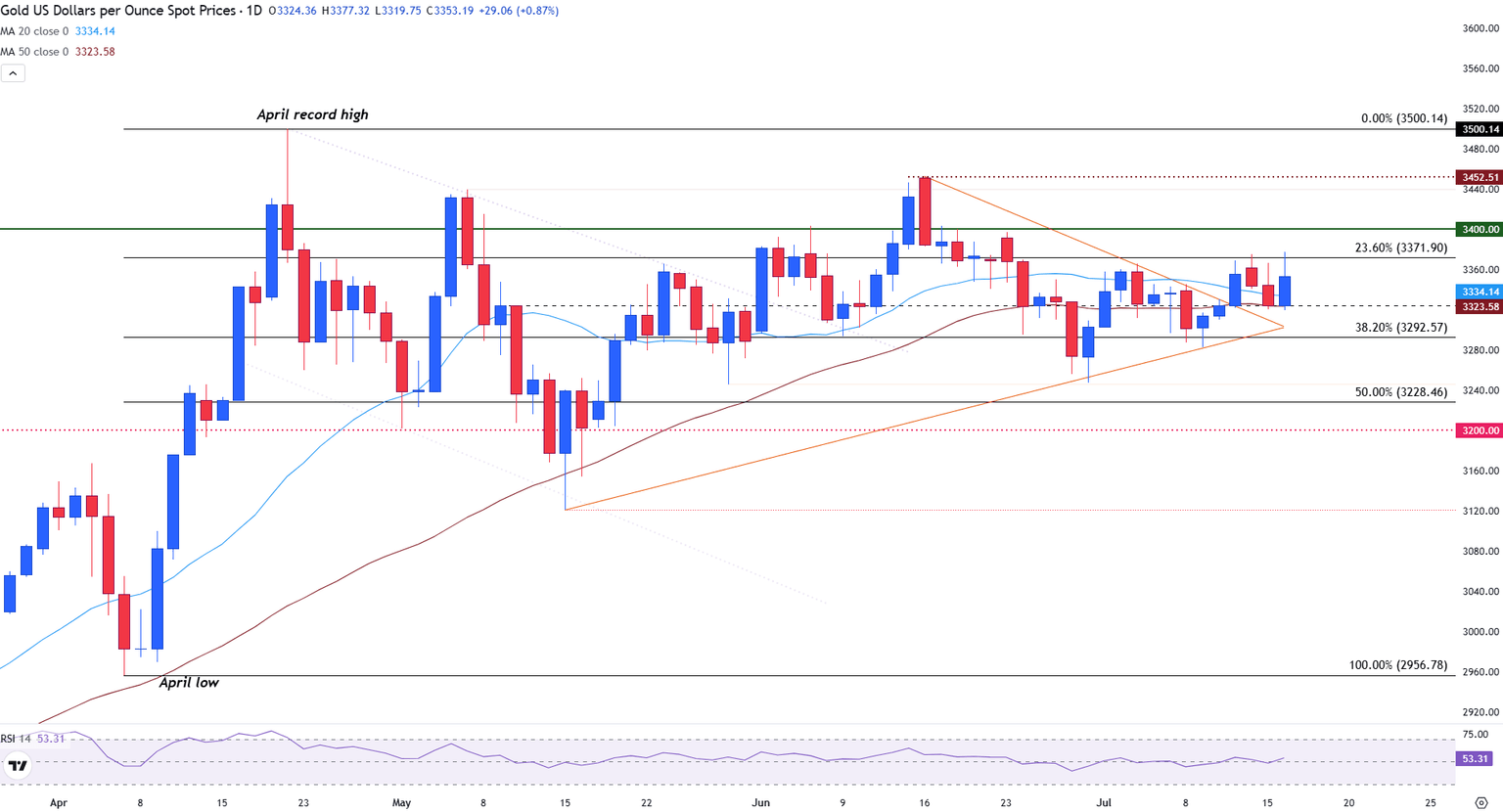

Technical analysis: Gold price recovers above $3,350

Gold (XAU/USD) extended gains on Wednesday, climbing 0.88% to close at $3,353.48, pushing decisively above both the 20-day and 50-day Simple Moving Averages (SMA), now clustered near $3,333. This marks a clear bullish signal as price reclaims ground above key short-term trend indicators.

The move lifts Gold further off the 38.2% Fibonacci retracement of the April rally at $3,292, reinforcing that zone as solid support. Immediate resistance stands at $3,371 (23.6% Fib), followed by the psychological $3,400 level. A breakout above $3,400 could open the door to a retest of the $3,452 swing high and eventually the April record peak near $3,500.

The Relative Strength Index (RSI) at 53 is trending upward, suggesting recovering bullish momentum without flashing overbought conditions.

With gold back above its moving averages and volatility returning after a tight consolidation phase, focus now shifts to macro catalysts, including rate cut expectations, inflation data, and political uncertainty tied to Fed leadership—to determine if bulls can extend the rally beyond $3,400.

Gold (XAU/USD) daily chart

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.