Gold price surrenders major part of intraday gains to all-time high ahead of Powell's testimony

- Gold price advances further beyond $2,900 and hits a fresh all-time peak on Tuesday.

- Trump’s new tariffs and geopolitical risks continue to boost the safe-haven commodity.

- A modest USD strength prompts some intraday profit-taking around the XAU/USD pair.

Gold price (XAU/USD) surrenders a major part of its intraday gains to a fresh record high and trades near the lower end of the daily range during the first half of the European session on Tuesday. The commodity, however, holds comfortably above the $2,900 mark amid worries about a global trade war. US President Donald Trump announced tariffs on commodity imports and also plans to impose reciprocal tariffs on other countries. This, along with geopolitical risks, continues to benefit the traditional safe-haven bullion.

Furthermore, expectations that Trump's protectionist policies would boost inflation turn out to be another factor that benefits the Gold price, which is seen as a hedge against rising prices. Meanwhile, speculations that the Federal Reserve (Fed) will hold interest rates steady in the wake of a still resilient US labor market and inflationary concerns lift the US Dollar (USD) to over a one-week high. This might hold back bulls from placing fresh bets around the non-yielding yellow metal amid overbought conditions.

Gold price drifts lower as modest USD strength prompts some profit-taking

- US President Donald Trump signed two proclamations on Monday, introducing 25% tariffs on metals and ending all exclusions on steel and aluminum tariffs first imposed during his first tenure from 2016 to 2020.

- Adding to this, Trump told reporters that he would announce reciprocal tariffs on other countries in the next two days, propelling the safe-haven Gold price to a fresh record high during the Asian session on Tuesday.

- Commenting on Middle East tensions, Trump said that Hamas should release all hostages held by midday Saturday, or he would propose canceling the Israel-Hamas ceasefire and "let all hell break loose."

- The US Dollar advances to over a one-week high amid expectations that Trump's protectionist policies would reignite inflation in the US and force the Federal Reserve to stick to its hawkish stance and hold rates steady.

- A stronger USD, along with overbought conditions on the daily chart, prompts some profit-taking around the XAU/USD amid some repositioning ahead of Fed Chair Jerome Powell's congressional testimony.

- Powell's remarks will be closely scrutinized for cues about the Fed's rate-cut path, which, in turn, will influence the near-term USD price dynamics and provide a fresh directional impetus to the commodity.

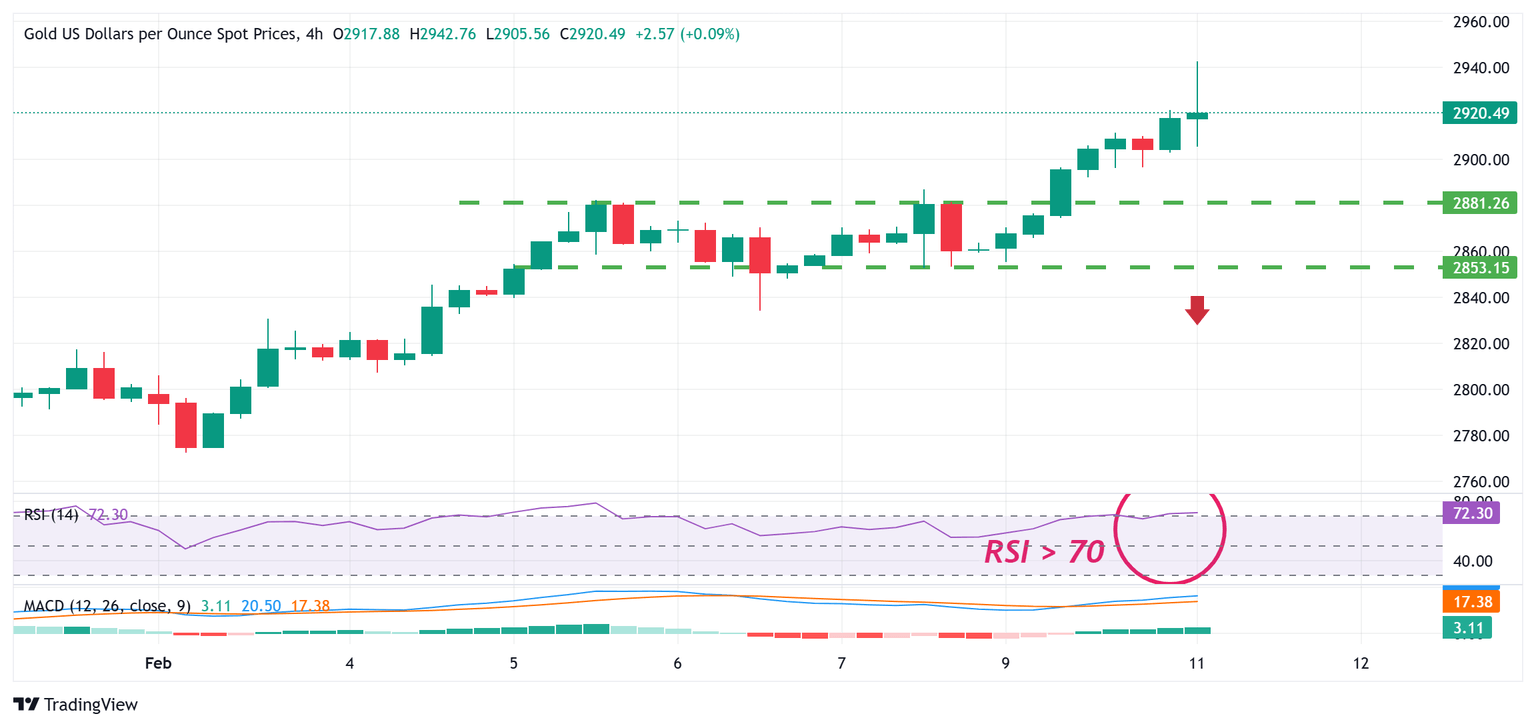

Gold price is likely to attract some dip-buying near the $2,886-$2,882 support

From a technical perspective, a slide below the $2,900 mark is likely to find some support near the $2,886-2,882 horizontal zone. Some follow-through selling could drag the Gold price further towards the $2,855-2,852 intermediate support en route to the $2,834 region. Any further decline could be seen as a buying opportunity and is more likely to remain limited near the $2,800 mark. The latter should act as a key pivotal point, which, if broken decisively, should pave the way for deeper losses.

On the flip side, the Asian session swing high, around the $2,842-2,843 region, now seems to act as an immediate strong barrier. Bulls are likely to pause near the said barrier amid the overbought Relative Strength Index (RSI) on the daily chart, which makes it prudent to wait for some near-term consolidation or a modest pullback before positioning for the next leg up. Nevertheless, the broader technical setup suggests that the path of least resistance for the Gold price remains to the upside and supports prospects for an extension of a well-established uptrend witnessed over the past two months or so.

Economic Indicator

Fed's Chair Powell testifies

Federal Reserve Chair Jerome Powell testifies before Congress, providing a broad overview of the economy and monetary policy. Powell's prepared remarks are published ahead of the appearance on Capitol Hill.

Read more.Next release: Tue Feb 11, 2025 15:00

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.