Gold price sticks to intraday gains near two-week top, trades above $3,300 mark

- Gold price scales higher for the third straight day amid sustained USD selling bias.

- US fiscal concerns and Fed rate cut bets drag the USD to a nearly two-week trough.

- US-China trade tensions and geopolitical risks further benefit the XAU/USD pair.

Gold price (XAU/USD) retains its positive bias above the $3,300 mark and trades near a one-and-a-half-week top through the first half of the European session on Wednesday. The US Dollar (USD) selling bias remains unabated in the wake of bets that the Federal Reserve (Fed) will cut interest rates further in 2025 and US fiscal concerns. This, in turn, is seen as a key factor pushing the commodity higher for the third straight day.

Meanwhile, Fed officials adopted a cautious tone on the US economic outlook. Apart from this, a surprise downgrade of the US government's sovereign credit rating last Friday, persistent geopolitical risks, and renewed US-China trade tensions further underpin the safe-haven Gold price. This, along with the overnight breakout above the $3,250-3,255 hurdle and a subsequent move beyond the $3,300 mark, favors the XAU/USD bulls.

Daily Digest Market Movers: Gold price remains well supported by a weaker USD and renewed safe-haven buying

- US President Donald Trump pushes the House GOP to pass his sweeping tax bill, which could add $3 trillion to $5 trillion to the country’s already hefty debt pile. This comes after Moody’s downgraded the US government’s credit rating last Friday, citing escalating deficits, which continue to weigh on the US Dollar and lift the Gold price above the $3,300 mark on Wednesday.

- Federal Reserve officials on Tuesday raised concerns around the US economic outlook amid the uncertainty tied to Trump’s trade policies. In fact, Cleveland Fed President Beth Hammack sees rising odds of a stagflation scenario and said that the uncertainty over US government trade policies makes it increasingly difficult for policymakers to manage the economy.

- Separately, St Louis Fed President Alberto Musalem noted that businesses and households are holding back from decisions amid uncertainty, which could affect the economic outlook. Adding to this, Atlanta Fed President Raphael Bostic warned that the US economy is going to see a slowdown in activity, and how consumers will respond to another round of inflation.

- Data released last week pointed to signs of easing inflation, while the disappointing US monthly Retail Sales figure increased the likelihood of several quarters of sluggish growth. This should allow the Fed to stick to its policy easing bias. Moreover, traders are currently pricing in the possibility of at least two 25-basis-point rate reductions by the end of this year.

- China accused the US of abusing export control measures and said that the Trump administration is violating Geneva trade agreements. In fact, the US issued guidance warning companies not to use Huawei's Ascend AI chips. China’s Commerce Ministry said this Wednesday that US measures on advanced chips are ‘typical of unilateral bullying and protectionism.’

- CNN, citing several US officials aware of the developments, reported on Tuesday that fresh intelligence gathered by the US indicates that Israel is preparing for potential strikes on Iran's nuclear sites. This keeps geopolitical risks in play, which should provide an additional boost to the XAU/USD pair and support prospects for a further near-term appreciating move.

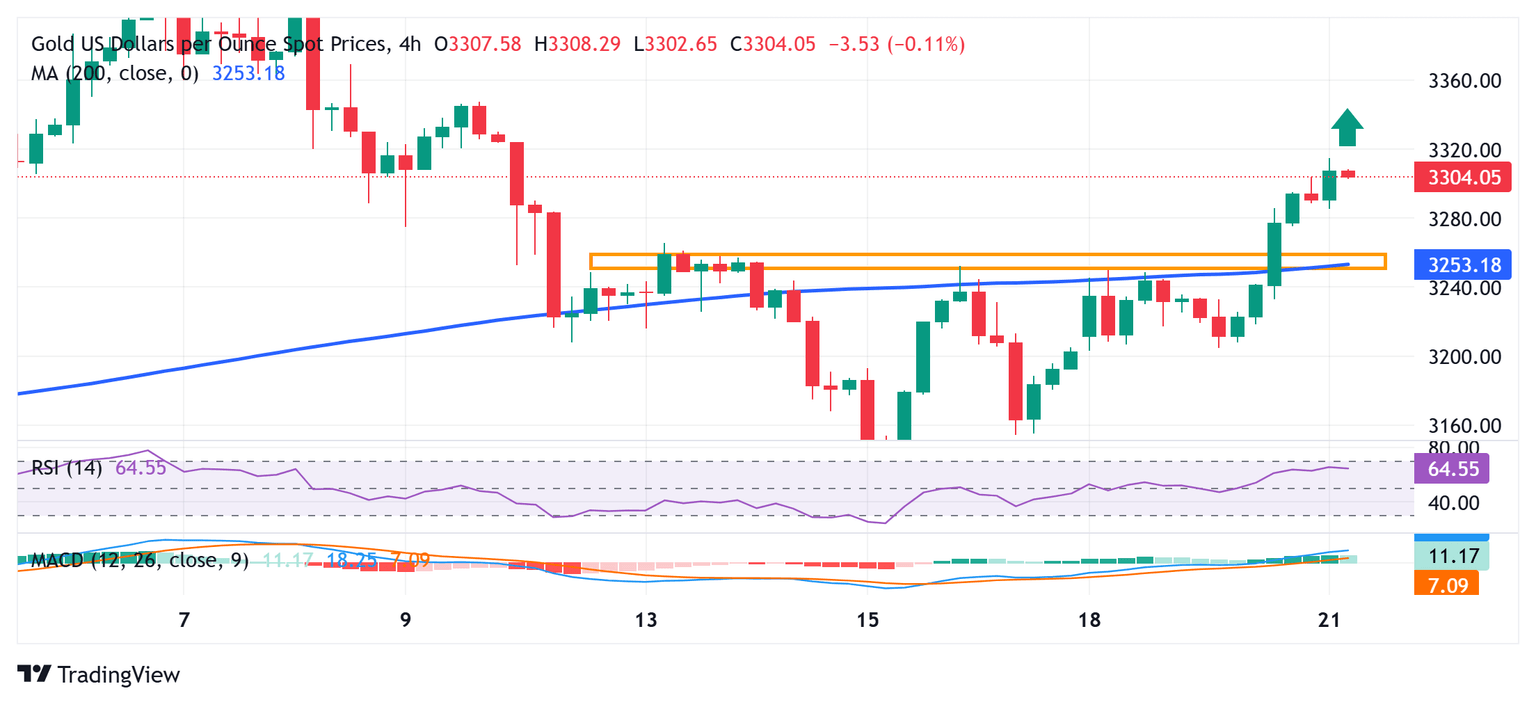

Gold price seems poised to appreciate further following the overnight breakout through the $3,250-3,255 barrier

From a technical perspective, the overnight sustained breakout above the $3,250-3,260 region, which coincided with the 200-period Simple Moving Average (SMA) on the 4-hour chart, was seen as a key trigger for bullish traders. A subsequent move beyond the $3,300 mark and positive oscillators on hourly/daily charts validate the near-term constructive outlook for the Gold price. Hence, some follow-through strength towards testing the next relevant hurdle, around the $3,360-3,365 horizontal zone, looks like a distinct possibility. The momentum could extend further and allow the XAU/USD pair to reclaim the $3,400 round figure.

On the flip side, weakness below the Asian session low, around the $3,285 region, is more likely to attract fresh buyers and remain limited near the $3,260-3,250 resistance-turned-support. A convincing break below the latter, however, might prompt some technical selling and drag the Gold price to the $3,200 mark. This is closely followed by the $3,178-3,177 support, below which the XAU/USD could accelerate the fall towards last week's swing low, around the $3,120 area, or the lower level since April 10, en route to the $3,100 mark.

US-China Trade War FAQs

Generally speaking, a trade war is an economic conflict between two or more countries due to extreme protectionism on one end. It implies the creation of trade barriers, such as tariffs, which result in counter-barriers, escalating import costs, and hence the cost of living.

An economic conflict between the United States (US) and China began early in 2018, when President Donald Trump set trade barriers on China, claiming unfair commercial practices and intellectual property theft from the Asian giant. China took retaliatory action, imposing tariffs on multiple US goods, such as automobiles and soybeans. Tensions escalated until the two countries signed the US-China Phase One trade deal in January 2020. The agreement required structural reforms and other changes to China’s economic and trade regime and pretended to restore stability and trust between the two nations. However, the Coronavirus pandemic took the focus out of the conflict. Yet, it is worth mentioning that President Joe Biden, who took office after Trump, kept tariffs in place and even added some additional levies.

The return of Donald Trump to the White House as the 47th US President has sparked a fresh wave of tensions between the two countries. During the 2024 election campaign, Trump pledged to impose 60% tariffs on China once he returned to office, which he did on January 20, 2025. With Trump back, the US-China trade war is meant to resume where it was left, with tit-for-tat policies affecting the global economic landscape amid disruptions in global supply chains, resulting in a reduction in spending, particularly investment, and directly feeding into the Consumer Price Index inflation.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.