Gold price plunges over $100 as US-China deal fuels USD rally

- XAU/USD plunges over 3% to $3,225 as improved risk sentiment and surging DXY weigh heavily on Bullion.

- US-China agree to 90-day tariff rollback; DXY jumps 1.25% to 101.74, pressuring Gold prices sharply.

- US Treasury yields rise as Fed cut bets cool; traders now expect only two cuts in 2025.

- Eyes now on US CPI, PPI and Retail Sales data for fresh policy direction.

Gold prices tumbled over 3% on Monday, following improvements in risk appetite after weekend discussions between the US and China, which agreed to a 90-day tariff reduction. At the time of writing, the XAU/USD trades at $3,225, having hit a daily high of $3,326.

Wall Street registers gains in the aftermath of the US-China deal, in which both countries lowered duties and agreed to sustain further talks to reach a trade agreement following a meeting in Switzerland.

Washington and Beijing agreed to lower duties from 145% to 30% and from 125% to 10%, respectively, as revealed in a joint statement released.

Consequently, Bullion, used as a hedge amid times of uncertainty, plummeted to over $100 due to the appreciation of the US Dollar. The US Dollar Index (DXY), which tracks the performance of the Greenback’s value versus six currencies, surged over 1.25% to 101.74.

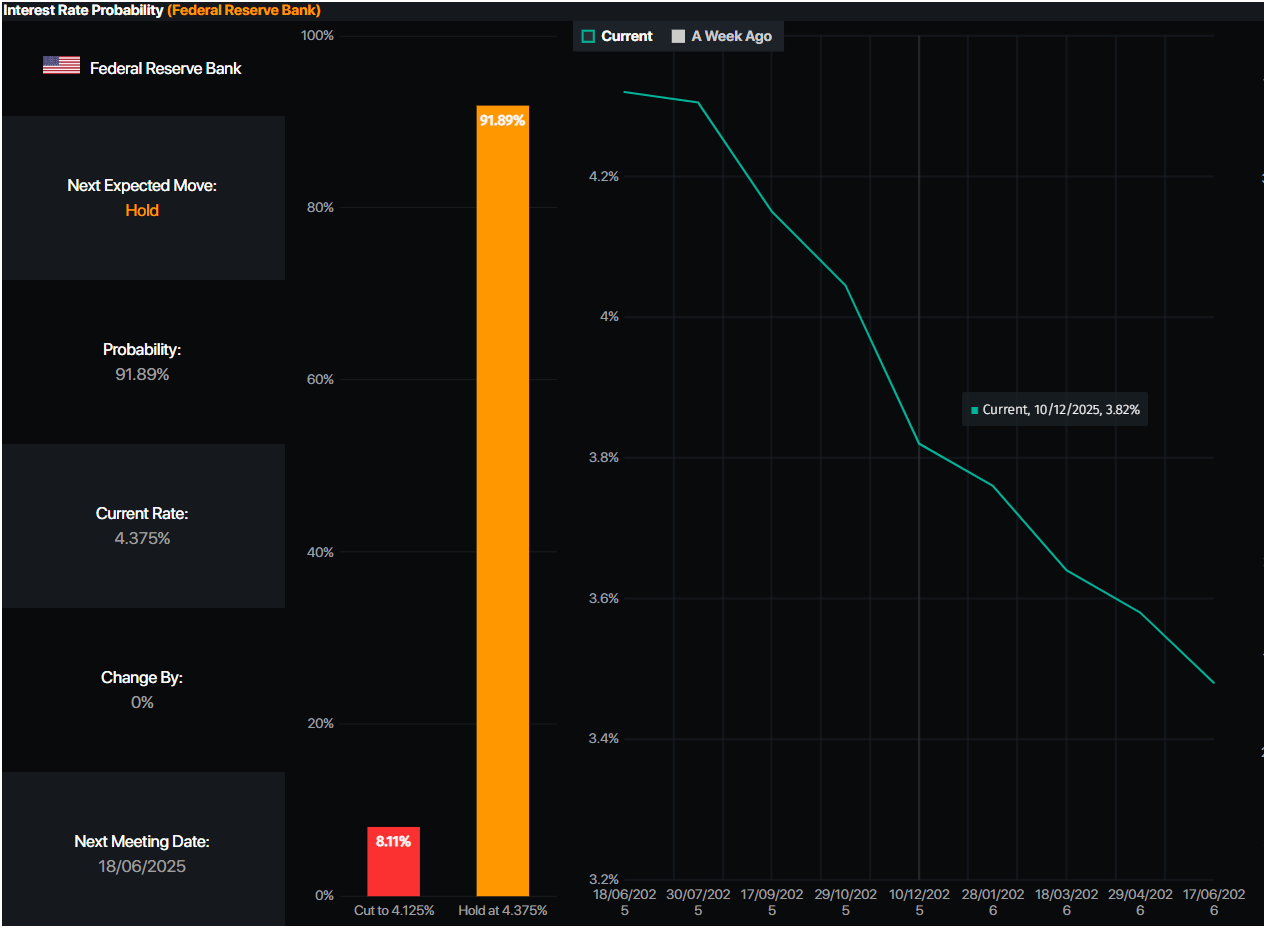

Rising US Treasury yields sent Gold slumping. Meanwhile, traders lowered their bets that the Federal Reserve (Fed) would cut rates just twice instead of three, according to data revealed by Prime Market Terminal.

Source: Prime Market Terminal

Investors' attention shifts to the release of the US Consumer Price Index (CPI) report on Tuesday, followed by the Producer Price Index (PPI) and Retail Sales reports.

Daily digest market movers: Gold prices pressured by high US Treasury yields

- US Treasury bond yields are rising, with the US 10-year Treasury note yield surging seven basis points to 4.453%. Meanwhile, US real yields are also steady at 2.163%, as indicated by the US 10-year Treasury Inflation-Protected Securities yields.

- US CPI in April is expected to remain unchanged at 2.4% YoY, according to economists. Excluding volatile items, the so-called core CPI is projected to remain unchanged at 2.8% YoY.

- The World Gold Council revealed that the People’s Bank of China (PBoC) added 2 tonnes to its Gold reserves in April – for the sixth consecutive month. The National Bank of Poland (NBP) increased by 12 tonnes in April to 509 tonnes; while the Czech National Bank increased its reserves by 2.5 tonnes in April.

- Swap markets have so far priced in the Fed’s first 25 basis points (bps) rate cut for the July meeting, and they expect one additional reduction toward the end of the year.

XAU/USD technical outlook: Gold price tanks below $3,250 as sellers target $3,200

Gold price uptrend halted as the non-yielding metal is about to test the May 1 daily low of $3,202, which, once cleared, could send XAU/USD prices tumbling toward testing the 50-day Simple Moving Average (SMA) at $3,137. A breach of the latter will expose $3,100.

Conversely, If XAU/USD edges back above $3,300, buyers will face the next resistance at $3,350. If surpassed, the next ceiling level would be $3,400 and beyond.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.