Gold Price News and Forecast: XAU/USD on a bearish footing as markets wind in the panic

Gold Price Analysis: Bounces from $1,670, but bias remains bearish

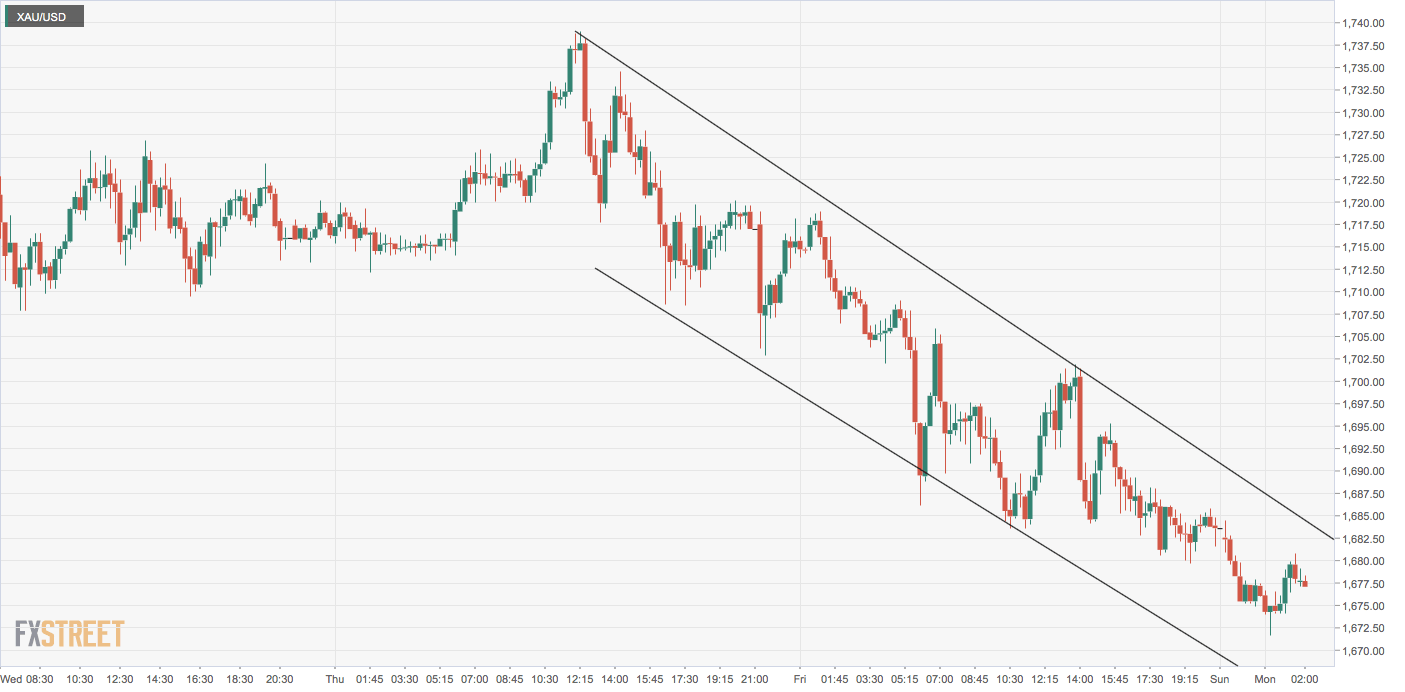

Gold is currently trading near $1,678 per ounce, having printed a session low of $1,670 an hour ago. The bias remains bearish despite the price bounce, as the hourly chart bearish channel is intact. Additionally, the daily chart is reporting a bearish doji reversal pattern, which comprises a doji candle near or at market tops, a sign of bull fatigue, and a bearish follow through in the form of a red candle on the following day.

The yellow metal created a doji candle on Thursday and fell by over 2% on Friday to confirm a bearish doji reversal. All in all, the path of least resistance appears to be on downside and prices could fall to $1,650 in the short-term. That said, the long-term bias remains constructive with the metal likely to pick up a bid on potential coronavirus-led risk aversion.

Gold on a bearish footing as markets wind in the panic

Gold is starting out the week on the same bearish footing as it left off last week and trading below a 61.8% Fibonacci retracement and into a high volume node. On a fundamental basis, the Federal Reserve's massive QE program and uncertainty pertaining to COVID-19, gold will likely be at attractive levels on dips.

What You Need to Know For Markets Opening: There will be a keener focus on macroeconomics now

At the time of writing, gold is trading at $1,676.90 having travelled between $1,690.20 and $1,675.10 the low after a 3% fall last week. Risk sentiment was on the up following US President Donald Trump and reports suggesting a potential coronavirus treatment and that the US businesses will get back to work soon. with plans to ease lockdown measures.

Author

FXStreet Team

FXStreet