Gold Price News and Forecast: XAU/USD is bullish by inflation expectations [Video]

![Gold Price News and Forecast: XAU/USD is bullish by inflation expectations [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Crosses/XAUUSD/finance-17367445_XtraLarge.jpg)

Gold prices hold steady as all eyes turn to the Fed [Video]

Gold prices hovered near two-week highs on Wednesday as traders await the outcome of the U.S Federal Reserve's two-day policy meeting. Since the Fed’s last policy meeting in January, a lot has changed. The U.S. Senate passed President Joe Biden’s massive $1.9 trillion stimulus bill. Treasury yields have surged to pre-pandemic levels and inflation has now taken over from COVID as the biggest risk to the market. Read more...

Gold Price Analysis: XAU/USD is bullish by inflation expectations

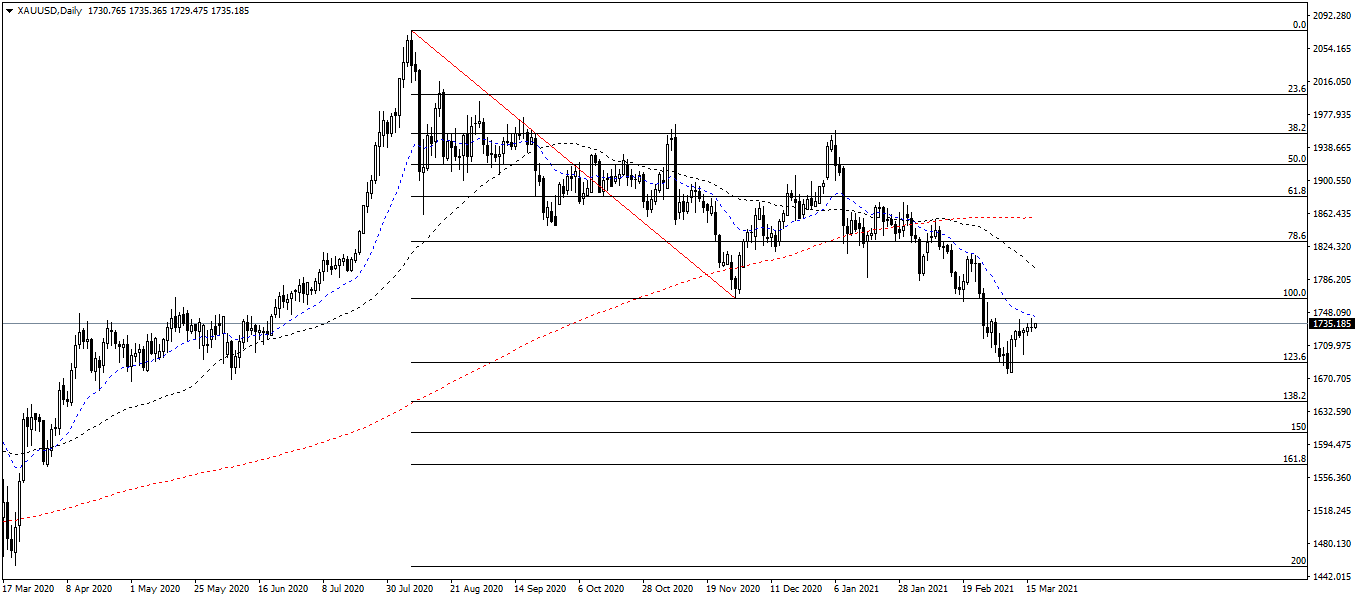

Last week, gold created a new bottom at $1680/oz, the lowest level in the last 10 months. Gold was sold strongly due to the positive news about the economic recovery as well as the expectation of highly vaccinated projects around the world. However, the downtrend did not last long, the economic stimulus package worth 1900 billion USD was approved at the end of last week, causing inflation expectations among investors. The market immediately makes drastic cash flow changes: Wall Street rose, led by technology corporations and heavy industries; gold increased sharply from the bottom of $1680/oz to $1730/oz.

The DXY - US Dollar Index is moving around 91.6 to 91.9. This shows the carefulness of investors in the impact of the recent bailout package and the expectation of a positive economic recovery shot by the FOMC meeting today. Read more...

Gold Futures: Room for extra gains

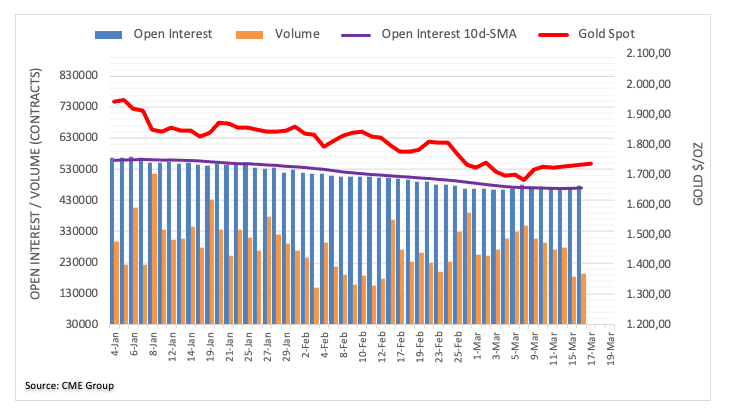

Open interest in Gold futures markets increased for the second session in a row on Tuesday, this time by around 6.2K contracts according to preliminary figures from CME Group. In the same line, volume advanced by nearly 8.7K contracts.

Tuesday’s inconclusive price action in gold was amidst rising open interest and volume, allowing for further upside in the very near-term. That said, the next interim hurdle emerges at the February 19 low around $1,760 per ounce troy. Read more...

Author

FXStreet Team

FXStreet