Gold Price Forecast: XAUUSD juggles above $1,700 ahead of US midterm elections outcome

- Gold price is oscillating above $1,700.00 while the risk-off impulse has attempted a rebound.

- Long-term US Yields are holding 4.14% support as investors are divided over the extent of Fed’s rate hike.

- A decline in consumer spending is expected to weigh on October’s inflation report.

Gold price (XAUUSD) has shifted into a rangebound profile as investors are awaiting the outcome of the US mid-term elections. The precious metal is displaying back-and-forth moves above the psychological support of $1,700.00.

Meanwhile, the risk profile has turned cautious as the market is expecting a win of Republicans in the House of Representatives and is divided on the outcome for the House of Senate, reported Reuters. The US dollar index (DXY) has inched higher to 109.73 while S&P500 futures have trimmed their Tuesday’s gains marginally.

Also, the 10-year US treasury yields have sensed a cushion of around 4.14% as the CME FedWatch tool indicates that investors are divided over the expectations for 50 basis points (bps) or 75 bps rate hikes in December monetary policy.

Going forward, October’s Consumer Price Index (CPI) report will play a pivotal role. Projections are pointing to easing inflationary pressures as consumer spending remained lower in the last quarter at 1.4% vs. the prior release of 2.0%. A slowdown in the inflation rate would extend a rally for gold prices.

Gold technical analysis

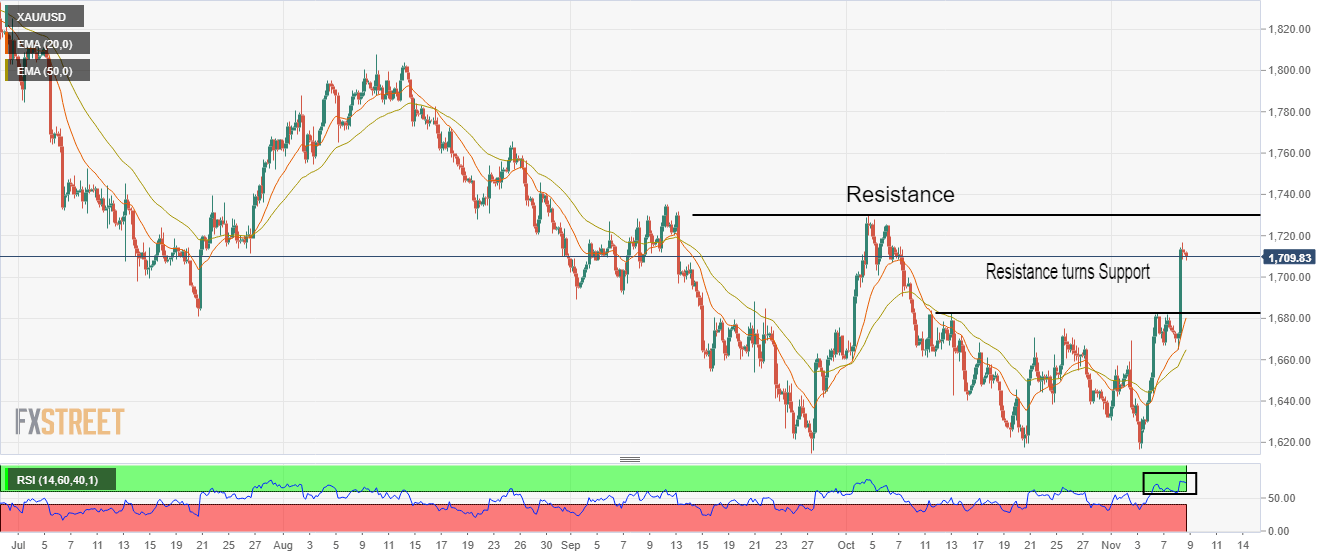

On a four-hour scale, the gold price is marching towards the critical resistance of $1,730.00 placed from the October 4 high. The precious metal witnessed a juggernaut rally after surpassing the critical hurdle of $1,679.00 placed from the October 13 high.

Advancing 20-and 50-period Exponential Moving Averages (EMAs) at $1,680.00 and $1,664.70 respectively, add to the upside filters.

Meanwhile, the Relative Strength Index (RSI) (14) has shifted into the bullish range of 60.00-80.00, which indicates more upside ahead.

Gold four-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.