Gold Price Forecast: XAU/USD rises to highs since December ahead of labor market figures from the US

- The XAU/USD is currently trading at $2,115, its highest since early December.

- The underlying strength in gold stems from softer US inflation numbers and soft economic data reported last week.

- Investors are discounting higher odds for the Fed’s easing cycle to start in June.

- Labor market figures from the US will continue modeling the expectations.

The XAU/USD is currently trading multi-month highest around $2,115 as investors continue digesting last week’s weak inflation and economic activity figures from the US. As for now Market anticipations for a rate cut only start to heighten moving closer to May and significantly by June. The non-yielding yellow metal is benefitting ahead of the critical labor market data from the US expected this week, even though the general tone of data remains firm which would justify the delay of the easing cycle from the Federal Reserve (Fed).

The yellow metal started gaining momentum last Thursday, after the report of soft Core Personal Consumption Expenditures (PCE) figures from January and followed on Friday after the release of weak Institute for Supply Management (ISM) Manufacturing Purchasing Managers Index (PMI) for February which raised concerns on an economic slowdown. However, the Fed officials, remain firm, and attach themselves to the rhetoric of three rate cuts in 2024, starting most likely in June. If markets reaffirm their bets on the easing starting in June, the US Treasury yield may get a boost, which could limit the upside to the metal.

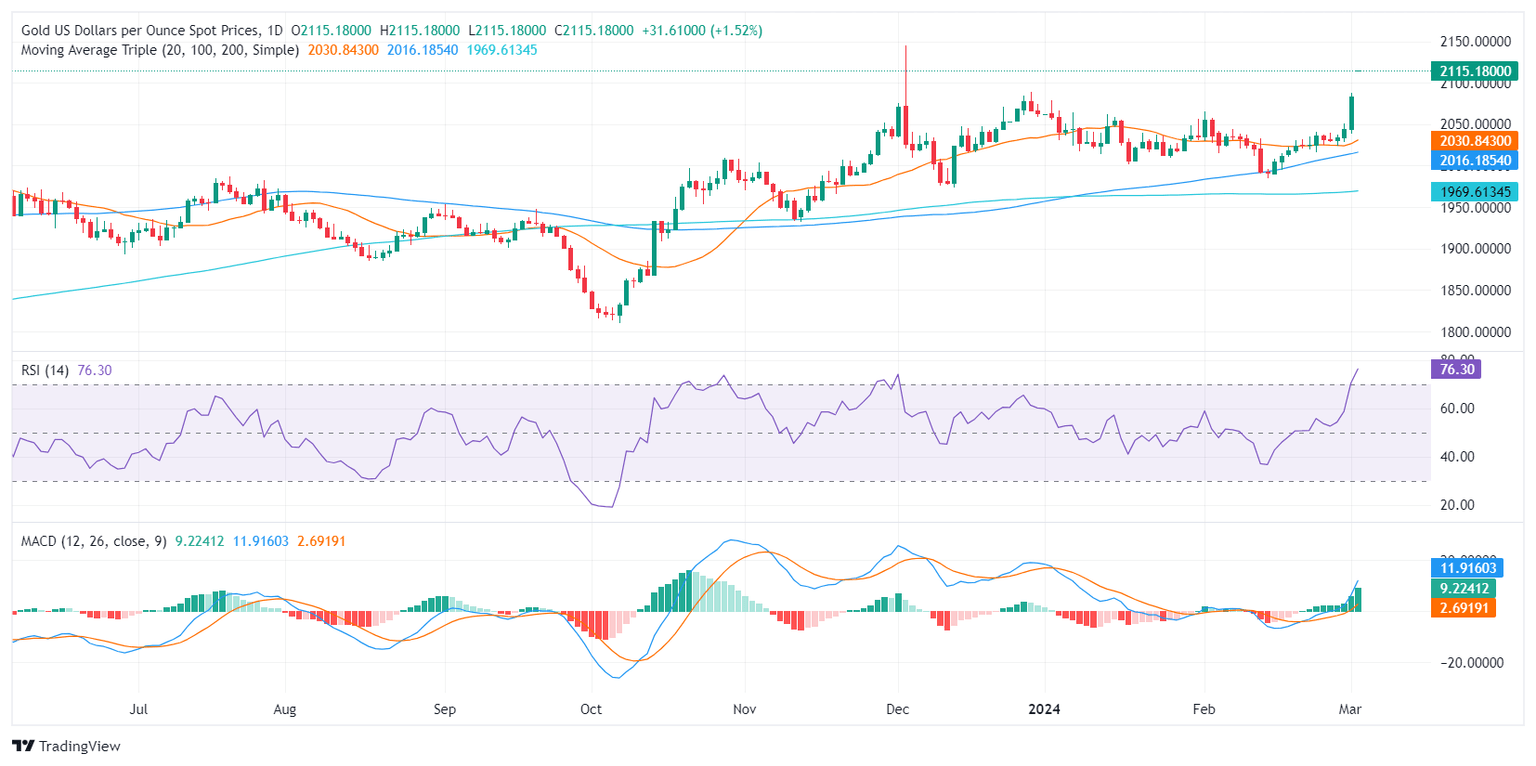

XAU/USD technical analysis

On the daily chart for the XAU/USD, the bulls are clearly in command with the Relative Strength Index (RSI) being stationed in the overbought territory. The Moving Average Convergence Divergence (MACD) with rising green bars supports this bullish outlook, indicating increased positive momentum. However, as the price starts to hint at overbought signals, a correction may be forthcoming to consolidate recent gains. In the wider context, the XAU/USD pair remains above the 20,100 and 200-day Simple Moving Averages (SMAs), signifying that bullish sentiment still prevails in the long term.

XAU/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.