Gold Price Forecast: XAU/USD resumes its uptrend with $3,440 on focus

- Risk aversion has boosted Gold to fresh monthly highs.

- A rush for safety after Israel's attack on Iran has triggered a rush for safety on Friday.

- XAU/USD bulls are focusing on $3440 and the $3495 all-time high.

Gold (XAU/USD) appreciates for the third consecutive day on Friday, and is on track for a weekly rally beyond 3%. Israel’s attack on Iran has crushed an already fragile market sentiment on Friday, triggering a rush for safety that has boosted Gold and all the traditional safe assets.

Israel attacked Iran with unprecedented strength earlier on Friday, pounding nuclear sites and killing high-ranking Revolutionary Guard Officials. Iran retaliated with a drone attack and leaving the nuclear negotiations with the US. Fears of a full-blown war in the region have fuelled an intense risk-off mood.

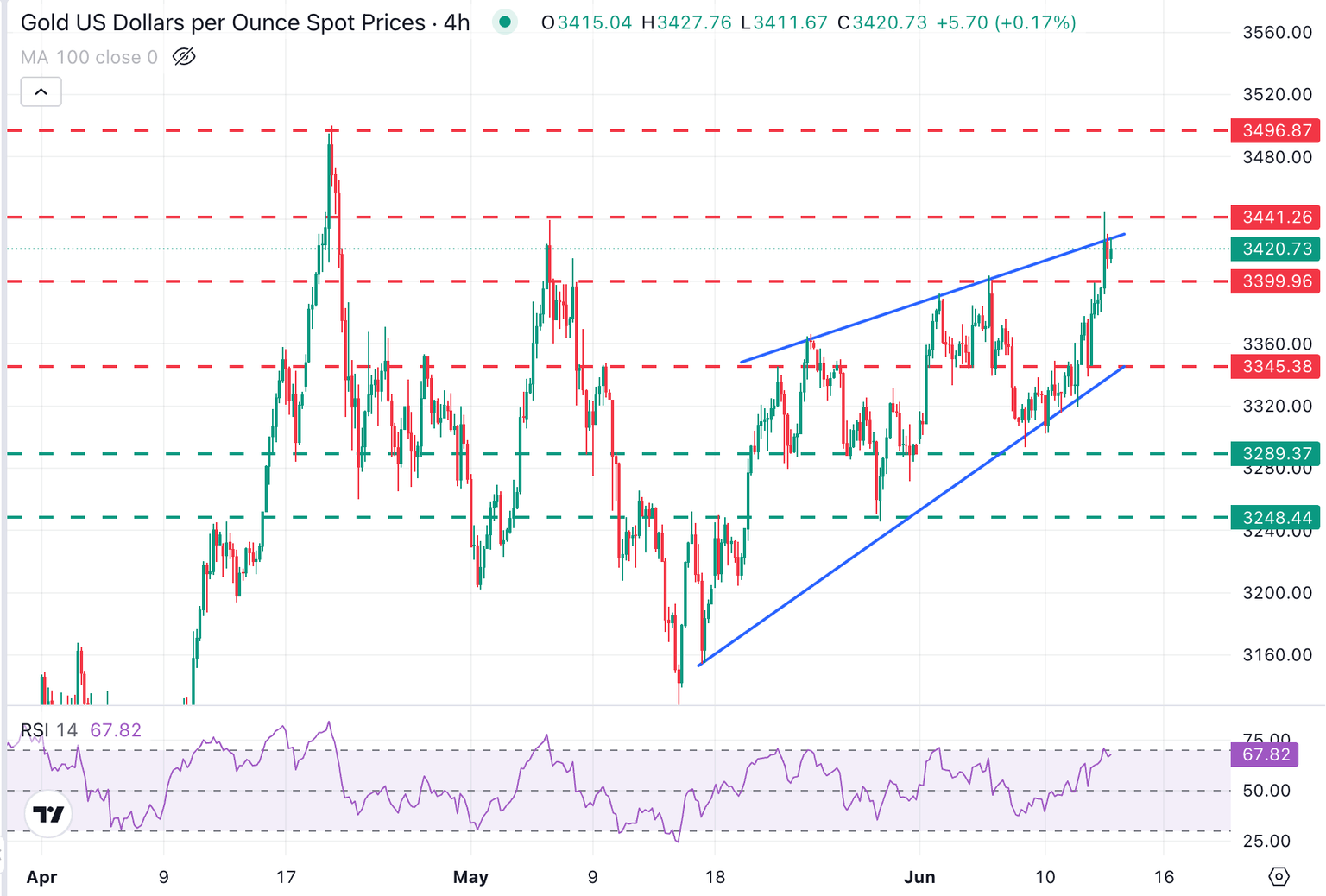

Technical analysis: XAU/USD bulls aim for $3,440 ahead of the $3,495 record high

Technical indicators are pointing higher again. RSI studies in the 4-hour chart are high but still below overbought territory. The fundamental background is supportive, despite generalised USD strength, and bearish attempts remain limited so far.

The precious metal is trading at the top of a wedge pattern with trendline resistance at $3,425 is holding bears ahead of the May 6 high, at $3,440. Bulls need to clear these levels before shifting their focus to the $3,495 all-time high hit in late April.

On the downside, bears are being held above the $3,400 previous resistance (Jun 5 high). A pullback below here would bring the June 12 low and the bottom of the wedge pattern, both around $3,345, into focus.

XAU/USD 4-Hour Chart

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.