Gold Price Forecast: XAU/USD is on a bullish correction targeting the $3,365 area

- Gold pared some losses favoured by broad-based US Dollar weakness.

- Trump's attacks on the Fed's independence are undermining confidence in the US Dollar and boosting demand for Gold.

- XAU/USD is on a bullish correction towards $3,365, with the broader bearish trend from mid-June highs intact.

Gold’s rebound from Tuesday’s lows suggests that there is a strong support area at the $3,290-$3,300. The precious metal is trimming previous losses on Thursday, buoyed by a more favourable context, with US Treasury yields and the US Dollar tumbling.

The easing geopolitical concerns have undermined demand for the safe-haven Gold this week, but the yellow metal is drawing support on Thursday from US Dollar weakness on the back of increasing concerns about the Federal Reserve's independence.

US President Donald Trump called Fed Chairman an “average mentally person”, after Powell reaffirmed his cautious stance towards further monetary easing, and aired the possibility of announcing his replacement way before the end of his term. The market has seen this move as a clear threat to the bank’s independence, which has brought the “Sell America” trade back to the table.

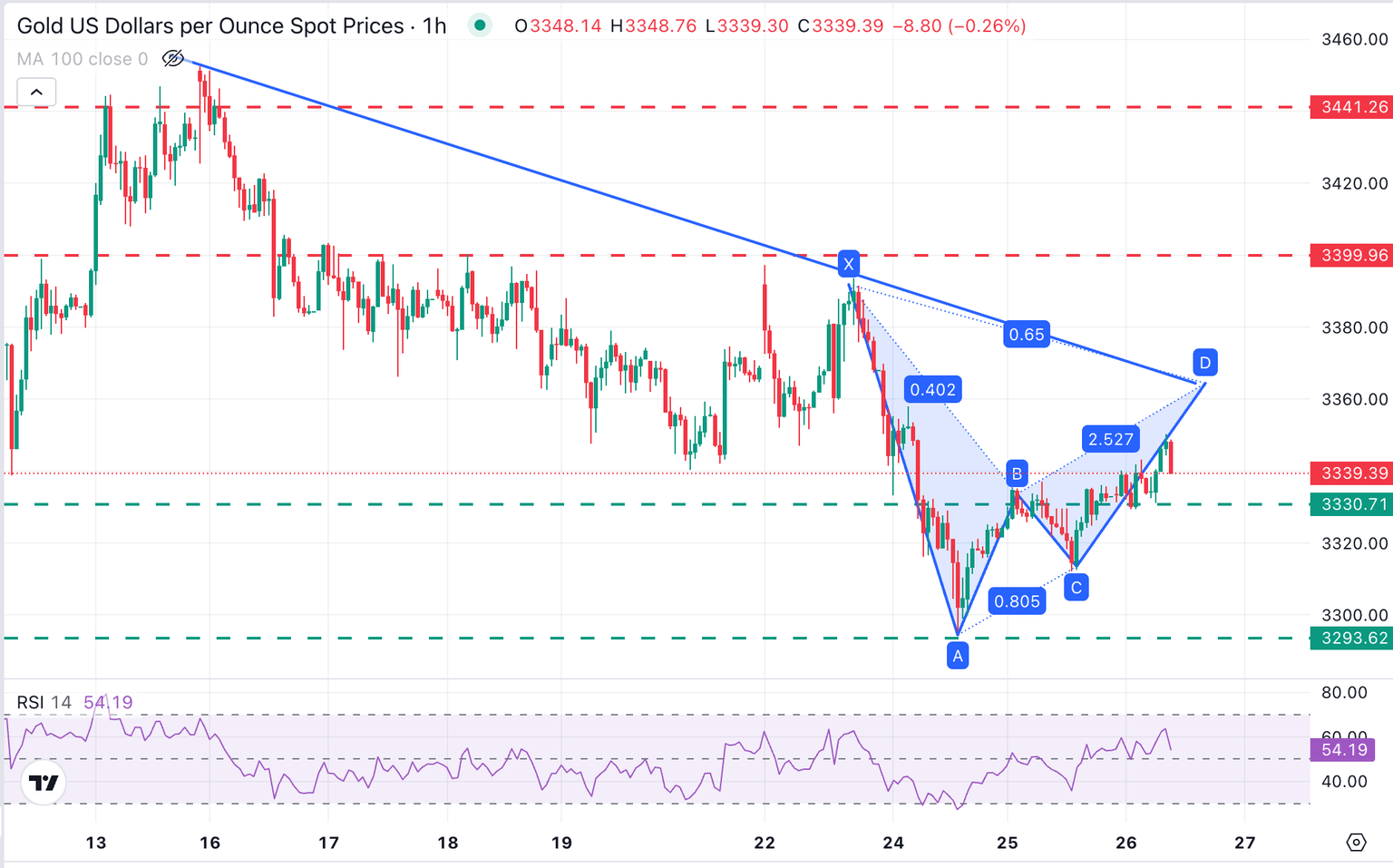

Technical analysis: In a bullish correction within a broader bearish trend

The rebound from Tuesday’s lows at $3,295 has extended beyond the $3,340 previous support (June 20 lows), confirming a deeper bullish correction. The pair night be on a C-D leg of a small Gartley pattern, heading to the descending trendline resistance from mid-June highs, at $3,450, now at $3,365.

A confirmation above this level would signal a trend shift and move the focus towards the $3,400 area, which capped bulls on June 17, 18, and 22.

On the downside, a rejection at the mentioned trendline might seek support at the intraday low $3,330 ahead of the previously mentioned $3,295 (June 9,24 lows)

(This story was corrected on June 26 at 11:19 GMT to say that the gold is targeting $3,365 in the title, and $3,300 in the first paragraph and not $3.365 and $3.300, as previously reported.)

XAU/USD Hourly Chart

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.