Gold Price Forecast: XAU/USD finds short-term cushion above $1,940, more downside looks solid

- Gold price has found a short-term cushion near $1,943.00, however, more downside seems favored.

- The USD Index is expected to climb above 104.00 as the odds of one more interest rate hike by the Fed are extremely solid.

- Gold price witnessed an intense sell-off after a mean-reversion move to near the 200-period EMA at $1,977.32.

Gold price (XAU/USD) has found an intermediate support of around $1,943.00 in the early European session. The downside in the precious metal has intervened for the short-term, however, more losses are still in the pipeline as the Federal Reserve (Fed) is expected to raise interest rates further to keep pressure on stubborn United States inflation.

S&P500 futures have trimmed some losses generated in Asia, indicating a recovery in the risk appetite of the market participants. US equities remained in the bullish trajectory on Friday despite the release of the better-than-anticipated Nonfarm Payrolls (NFP) data.

The US Dollar Index (DXY) is continuously trading sideways around 104.00 after a stellar rally. It seems that the USD Index is gathering strength for further upside. Higher odds of one more interest rate hike from the Federal Reserve (Fed) have also fueled fresh blood into US Treasury yields. The yields offered on 10-year US Treasury bonds have climbed strongly above 3.74%.

After the seventh straight contraction in US factory activity, investors are shifting their focus towards the release of the US ISM Services PMI data. US Manufacturing PMI has been failing in reclaiming the 50.0 threshold for the past seven months, however, the Services PMI is performing critically better than the manufacturing sector. As per the preliminary report, US Services PMI is seen declining to 51.5 vs. the prior release of 51.9. New Orders Index that displays forward demand is seen advancing to 56.5 against the former release of 56.1.

Gold technical analysis

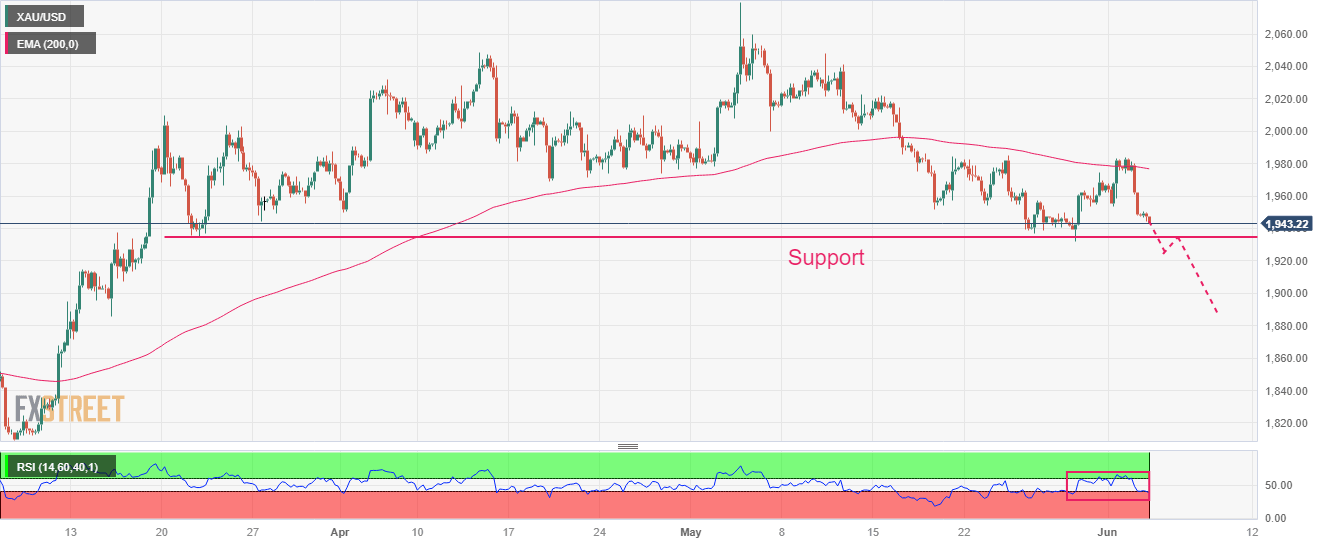

Gold price witnessed an intense sell-off after a mean-reversion move to near the 200-period Exponential Moving Average (EMA) at $1,977.32 on a four-hour scale. The precious metal is declining toward the key support plotted from March 22 low at $1,934.34.

The Relative Strength Index (RSI) (14) is hovering near the 40.00 edge. A breakdown in the same will be followed by the activation of the bearish momentum.

Gold four-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.