Gold Price Forecast: XAU/USD bulls remain poised to test $1,831 and $1,837 – Confluence Detector

- Gold bulls take a breather before resuming the post-US inflation uptrend.

- US inflation confirms a March Fed rate hike, DXY traders ‘sell the fact’.

- Gold 2022 Outlook: Correlation with US T-bond yields to drive yellow metal.

Gold price is consolidating near weekly highs, as the US dollar attempts a bounce in tandem with the Treasury yields this Thursday. The greenback got smashed on ‘sell the fact’ trading after the 7% rise in the US annualized inflation in December cemented a March Fed rate hike, which was almost priced in by the market. Despite the pullback in gold price, the upside bias remains intact, courtesy of a bullish technical setup on the daily chart.

Read: US Consumer Inflation Soars: Federal Reserve March rate hike looms

Gold Price: Key levels to watch

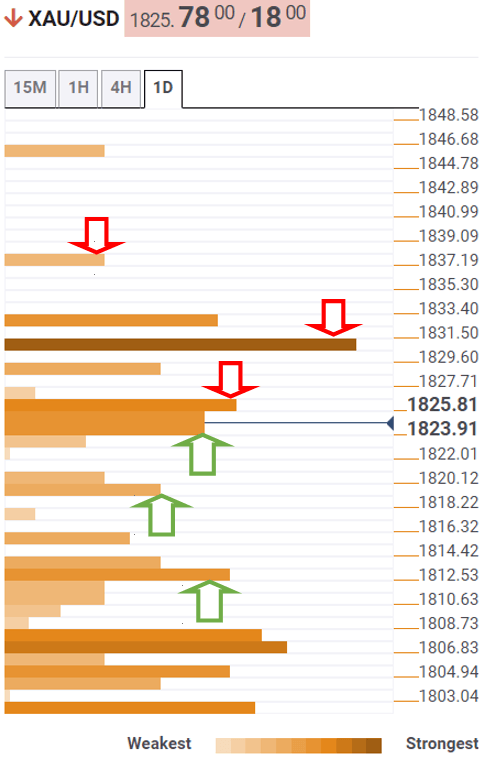

The Technical Confluences Detector shows that the gold price needs to crack strong resistance at $1,826, the Fibonacci 23.6% one-day.

The next critical upside hurdle is pegged at the previous month high of $1,831, above which bulls will aim for the pivot point one-day R2 at $1,837.

A firm break above the latter will open gates for a rally towards the pivot point one-day R3 at $1,845.

On the flip side, the Fibonacci 38.2% one-day at $1,821 is seen capping immediate pullbacks.

The confluence of the SMA10 four-hour, pivot point one-day S1 and Fibonacci 61.8% one-day at $1,819 will be on the sellers’ minds.

Further down, the previous day’s low of $1,815 could be retested, opening floors for a test of $1,812, where the Fibonacci 23.6% one-month and Fibonacci 61.8% one-week coincide.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.