US Consumer Inflation Soars: Federal Reserve March rate hike looms

- Annual consumer prices rise 7% in December, core prices gain 5.5%.

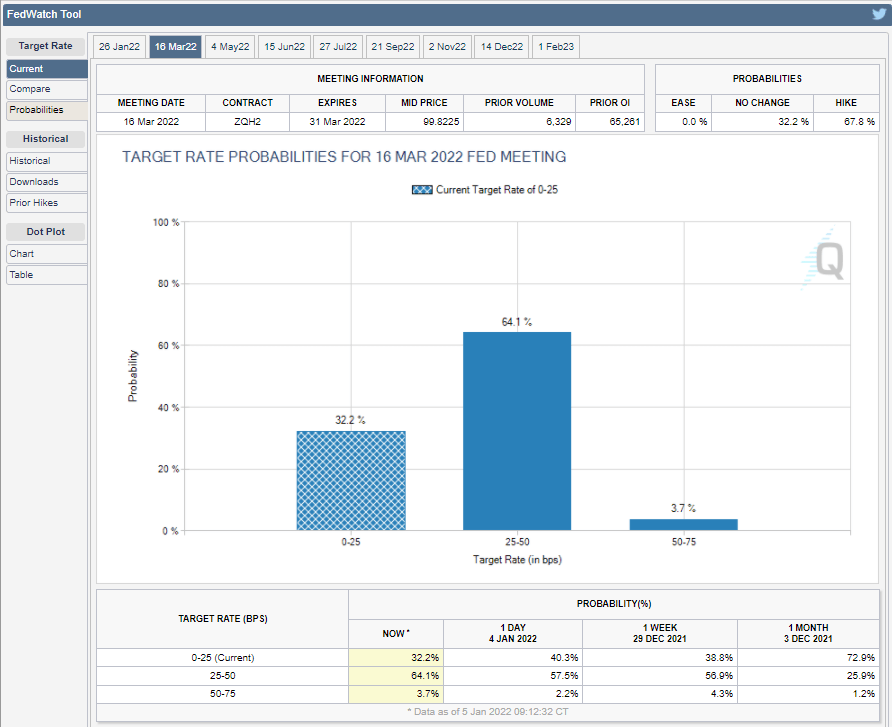

- Markets pricing the first fed funds hike in March.

- US workers' wages fall victim to raging inflation.

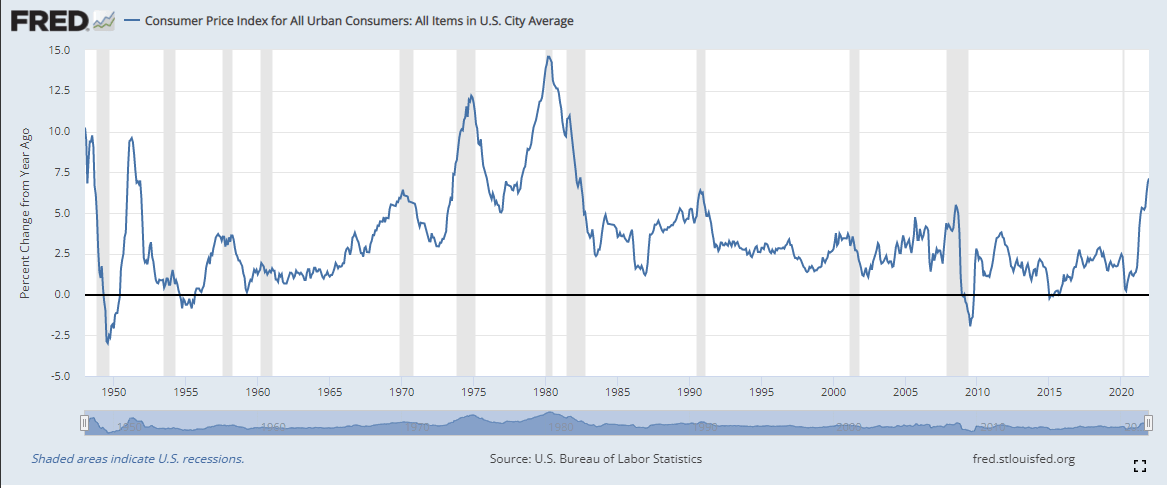

The numbers are daunting. Consumer prices in December raced higher at the fastest pace in four decades. Ronald Reagan was President, Leonid Brezhnev led the Soviet Union, Germany was two countries and over half of Americans now alive were not born the last time inflation was this high in June 1982.

The Consumer Price index (CPI), a gauge that goes back to 1947, rose 7% last month, reported the Bureau of Labor Statistics (BLS) on Wednesday. For the month prices increased 0.5%. Analysts had predicted the yearly gain and a 0.4% jump on the month, after the 6.8% and 0.8% increases in November.

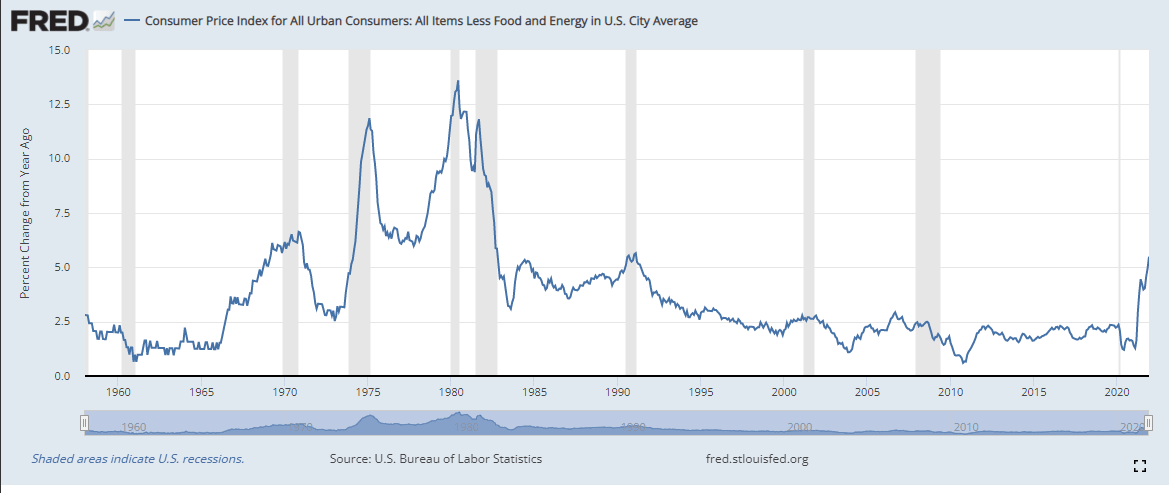

Core CPI, which excludes energy and food prices, rose 5.5% on the year, up from 4.9% in November and beating its 5.4% forecast. It was the largest core rate in nearly 30 years, since February 1991. Monthly gains were 0.6% on a 0.5% forecast and the same November rate.

Prices have been increasingly volatile since crossing 5% in May. For the year CPI rocketed 500%, from 1.4% in January to December’s 7%. Core prices jumped 392%, from 1.4% at the start of the year to 5.5%. Both increases are the fastest on record for 12 months.

Supply chain and manufacturing delays have been exacerbated by shortages of components, materials and workers, the last made far worse by the lightning spread of the Omicron variant through the United States. On Tuesday, 1.46 million new cases were diagnosed, the most ever, in any country.

Government spending and Federal Reserve liquidity have sent unprecedented amounts of cash coursing through the economy, making the price distortion from product scarcity worse.

Markets

Despite the rapid price gains markets were little disturbed as CPI was largely as forecast.

Equities closed modestly higher with the Dow adding 38.30 points, 0.11% to 36,290.23. The S&P 500 climbed 13.28 points to 4,726.35 and the NASDAQ rose 34.94 points to 15,188.39, its third positive day in a row. The dollar lost ground in all the major pairs. The EUR/USD closed at 1.1450, its highest against the dollar since November 12.

Treasury rates were slightly improved. The yield on the 10-year note closed higher at 1.757%, just below its 2022 and pandemic high finish of 1.78% on Monday.

10-year Treasury yield

CNBC

Price details and wages

The cost of housing, which in this context means both rental and purchase, rose 0.4% in December and 4.1% on the year. That was the fastest annual rate since February 2007 and the housing bubble that led to the financial crisis.

Used car prices increased 3.5% in December, as component shortages continue to limit new vehicle production. Prices are 37.3% higher than one year ago.

Energy costs fell slightly losing 0.4%, with fuel oil down 2.4% and gasoline off 0.5%. Energy prices are 29.3% higher on the year and gasoline, a staple for most American families, is 49.6% more expensive than it was in December 2020.

Inflation has eliminated wage gains. Average Hourly Earnings rose 0.6% in December but CPI subtracted 0.5%. Over the year real earnings (Average Hourly Earnings -CPI) decreased 2.4%.

Conclusion: Federal Reserve

The astonishing increase in US consumer prices in 2021 is the base case for markets and the Fed.

In the last three months, the Federal Reserve has abandoned its labor market focus for inflation. Though the Fed uses the Personal Consumption Expenditure Price Index for its guide, that measure has shown the same rapid price increases as CPI.

The December Federal Reserve Market Committee (FOMC) meeting doubled the monthly reduction in the $120 billion bond program to $30 billion, ending the purchases in two months.

The governors are widely expected to initiate an anti-inflation series of rate hikes at the meeting on March 16. Fed Funds Futures have the odds of a 0.25% increase at 78.7%.

Fed Chair Jerome Powell, at his confirmation hearing on Tuesday before the Senate Banking Committee, said that as long as current inflation conditions exist rate hikes can be expected.

CBOE

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.

-637776331903093020.png&w=1536&q=95)