Gold Price Forecast: XAU/USD sticks to gains above $1,810 level, over one-week high

- Gold keeps Friday’s recovery, grinds higher around intraday top.

- US jobs report propelled yields, USD but concerns over Fed, cautious optimism in markets weigh on bond coupons of late.

- US inflation becomes a key weekly event, risk catalysts are important too.

- Gold Weekly Forecast: XAU/USD indecisive as investors assess central banks' rate outlook

Update: Gold built on Friday's bounce from the $1,792 area and gained some follow-through traction on the first day of a new week. The XAU/USD maintained its bid tone through the first half of the European session and was last seen trading around the $1,812 region, just below the one-and-half-week high touched earlier today.

The US dollar, so far, has struggled to capitalize on the post-NFP bounce from a near three-week high and was seen oscillating in a range amid retreating US Treasury bond yields. This, in turn, was seen as a key factor that extended some support to the dollar-denominated gold. Apart from this, the cautious market mood further benefitted the safe-haven precious metal, though expectations for a larger Fed rate hike at the March policy meeting capped the upside.

Investors seem convinced that the Fed would adopt a more hawkish policy response to contain stubbornly high inflation. The speculations were further fueled by the mostly upbeat US jobs data on Friday. Hence, the market focus will remain on the release of the latest US CPI report, due on Thursday. In the meantime, bulls might refrain from placing aggressive bets around gold, warranting some caution before positioning for any further appreciating move.

Previous update: Gold (XAU/USD) stays mildly bid around $1,810, extending Friday’s rebound amid the early Monday morning in Europe.

While the US dollar’s lack of ability to track the strong Treasury yields favored gold buyers the previous day, the metal’s latest upside could be linked to the pullback in bond coupons from a multi-day high.

That said, the US Dollar Index (DXY) rebounded from a three-week low after the monthly employment data released on Friday. Even so, the greenback gauge closed on the negative side as far as the weekly chart is concerned, up 0.12% around 95.55 at the latest.

On the other hand, the US 10-year Treasury yields snap two-day run-up to ease from the highest levels since January to 1.91% at the latest.

Mixed concerns over the inflation and the Fed’s next move in March become the key hurdle for the US Treasury yields. Although upbeat US jobs report propelled bond coupons to the fresh multi-day high on Friday, indecisive figures of inflation expectations, as measured by the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, tested bulls afterward.

As per the latest US jobs report, the headline Nonfarm Payrolls (NFP) rose by 467K versus the median forecast for a 150K rise and 510K revised prior while the Unemployment Rate rose to 4.0% from 3.9% in December, compared to expectations for a no-change figure. It’s worth noting, however, that the U6 Underemployment Rate extended the south-run to 7.1% from 7.3% previous readouts. Also encouraging was Average Hourly Earnings that jumped strongly to 5.7% versus 4.9%.

Adding to the bullish bias could be the upbeat performance of Chinese equities and a light calendar ahead of Thursday’s US Consumer Price Index (CPI) for January. Also important to watch are concerns over Russia and China.

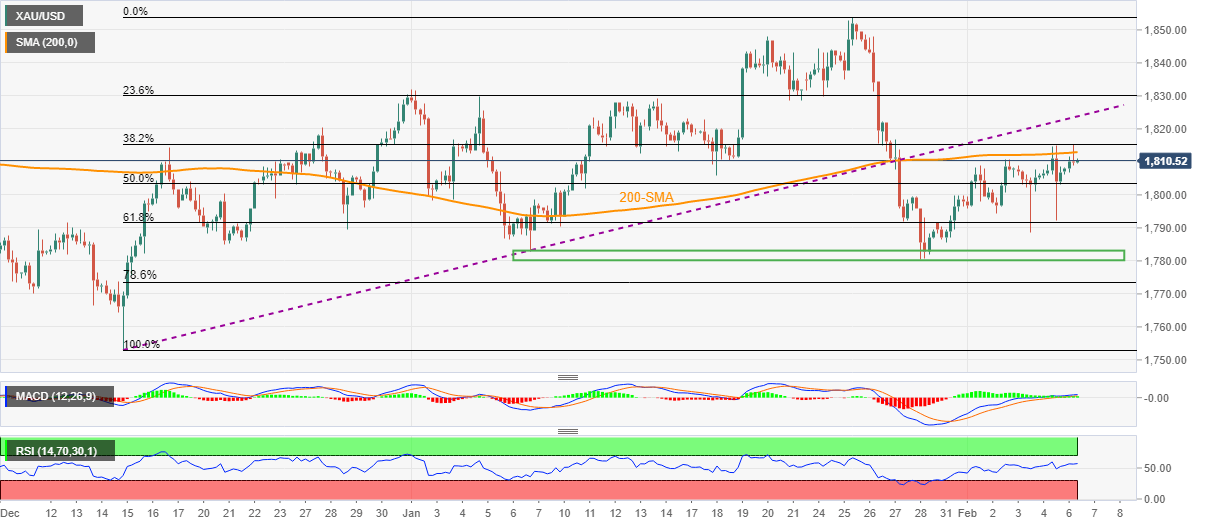

Technical analysis

A clear bounce from the monthly horizontal support joins firmer oscillators to keep gold buyers hopeful around 200-SMA, near $1,813 at the latest.

Adding to the upside filters is the previous support line from December 15 and 23.6% Fibonacci retracement (Fibo.) level of December-January upside, respectively around $1,824 and $1,830.

Meanwhile, a downside break of the stated horizontal support zone, near $1,783-80, will be crucial for the gold seller’s return.

Following that, the 78.6% Fibo. near $1,761 may test gold bears before directing them to December’s low of $1,753.

It’s worth noting that bullish MACD joins higher-low of the gold prices and RSI to keep buyers positive of late.

Gold: Four-hour chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.