Gold Price Forecast: XAU/USD approaches $1,880 again on reports of Ukrainian firing

- Gold price gets a fresh lift from the sudden risk-off move, despite the USD bid.

- Ukraine’s armed forces reported firing grenades and mortars at four LPR localities.

- Less hawkish Fed minutes add to the upside in gold while geopolitical tensions underpin.

Gold price is seeing a buying resurgence and looks to challenge the three-month highs of $1,880 once again, as a fresh wave of risk-aversion hit markets on the Ukrainian firing reports.

The Russian media agency, Sputnik, reported that the Ukrainian military forces shot mortars and grenades in four Luhansk People's Republic (LPR) localities.

The LPR is located in Luhansk Oblast in the Donbas region, which is internationally recognized to be a part of Ukraine but run by Russian-backed separatists.

On the above headlines, gold price jumped from daily lows of $1,868 to reach highs at $1,876 before retracing slightly to $1,875, where it now wavers.

Markets continue pricing in a war situation sooner (than later), as the US refuses to believe Russia’s claim of troops’ withdrawal while adding that Moscow has added 7000 troops along the Ukrainian border.

To add, the latest reports will only firm up their belief, keeping the risk-off trades intact while pinning gold towards $1,900.

Further, less hawkish-than-expected January Fed meeting’s minutes added to the bullish sentiment around gold price. The FOMC minutes disappointed the hawks by not offering any hints on aggressive and faster Fed’s tightening this year, in the face of soaring inflation.

Looking ahead, the risk flows will continue to dominate amid renewed Russia-Ukraine tensions, although gold bulls could face an uphill battle as the US dollar finds safe-haven bids as well.

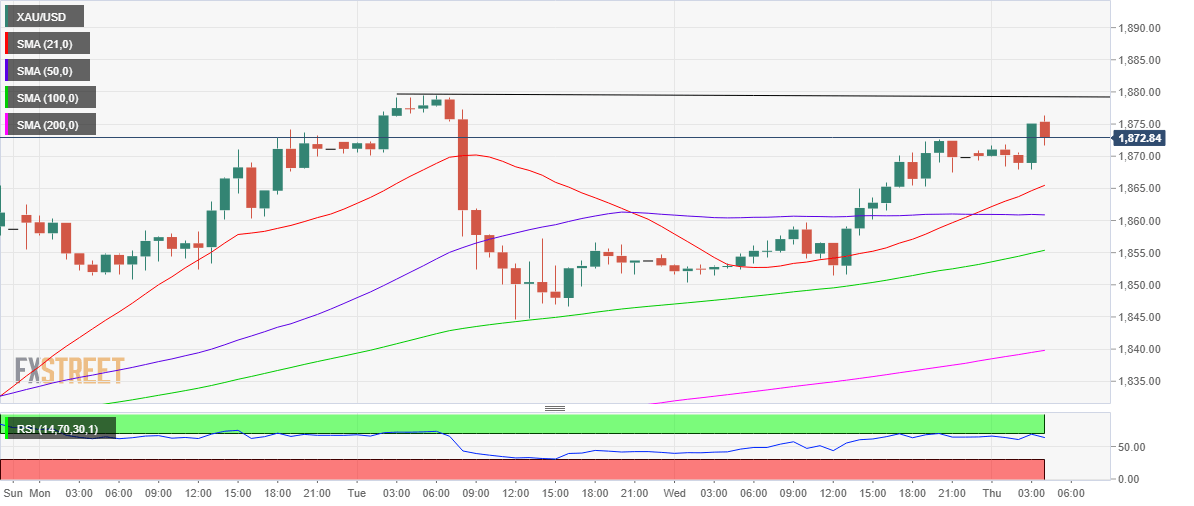

Gold Price Chart: Four-hour

Technically, gold price needs a sustained break above the horizontal trendline resistance at $1,880 to seek the much-needed boost towards $1,900.

The Relative Strength Index (RSI) is seeing a fresh downtick, capping the upside in gold for now.

But the leading indicator holds above the midline, keeping buyers hopeful.

Further retracement could retest the daily lows, below which the bullish 21-Simple Moving Average (SMA) at $1,864.

Gold Price additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.