Gold price traders seem non-committed and opt to wait for more details from US-China trade talks

- Gold price attracts some dip-buyers on Tuesday, though the uptick lacks bullish conviction.

- The USD sticks to modest intraday gains and caps the XAU/USD pair amid trade optimism.

- Fed rate cut bets, US fiscal concerns, and geopolitical risks lend support to the commodity.

Gold price (XAU/USD) struggles to capitalize on its modest intraday bounce from the $3,300 neighborhood and remains below the overnight swing high through the first half of the European session on Tuesday. Traders now seem reluctant and opt to wait for more details from the ongoing US-China trade talks before placing fresh directional bets. In the meantime, a modest US Dollar (USD) strength acts as a headwind for the bullion.

However, bets that the Federal Reserve (Fed) will cut interest rates further in 2025 and concerns about the worsening US fiscal situation hold back the USD bulls from placing aggressive bets. Apart from this, persistent geopolitical risks and market nervousness might continue to act as a tailwind for the safe-haven Gold price. Nevertheless, the mixed fundamental backdrop warrants some caution for aggressive traders.

Daily Digest Market Movers: Gold price lacks firm intraday direction amid mixed fundamental cues

- Chinese and US officials extend the new round of trade talks in London to a second day on Tuesday, fueling hopes for a deal between the world's two largest economies. This remains supportive of a generally positive risk tone and prompts some intraday selling around the safe-haven Gold price on Tuesday.

- A stronger-than-expected US Nonfarm Payrolls (NFP) report released on Friday dampened hopes for imminent interest rate cuts by the Federal Reserve this year. This assists the US Dollar to regain positive traction and turns out to be another factor acting as a headwind for the non-yielding yellow metal.

- However, the CME Group's FedWatch Tool indicates that traders are still pricing in a nearly 60% chance that the US central bank will cut interest rates at its September monetary policy meeting. This, along with concerns about the US government's financial health, fails to assist the USD to capitalize on its intraday move higher.

- On the geopolitical front, Russia launched a massive airstrike on Ukraine and fired nearly 500 drones and missiles. This marks a further escalation of the conflict in the three-year-old war and might hold back the XAU/USD bears from placing aggressive bets in the absence of any relevant market-moving economic data from the US.

- The US Consumer Price Index (CPI) and the Producer Price Index (PPI) are due for release on Wednesday and Thursday, respectively. The crucial inflation figures should provide some cues about the Fed's future rate-cut path, which, in turn, will drive the USD demand and provide some meaningful impetus to the commodity.

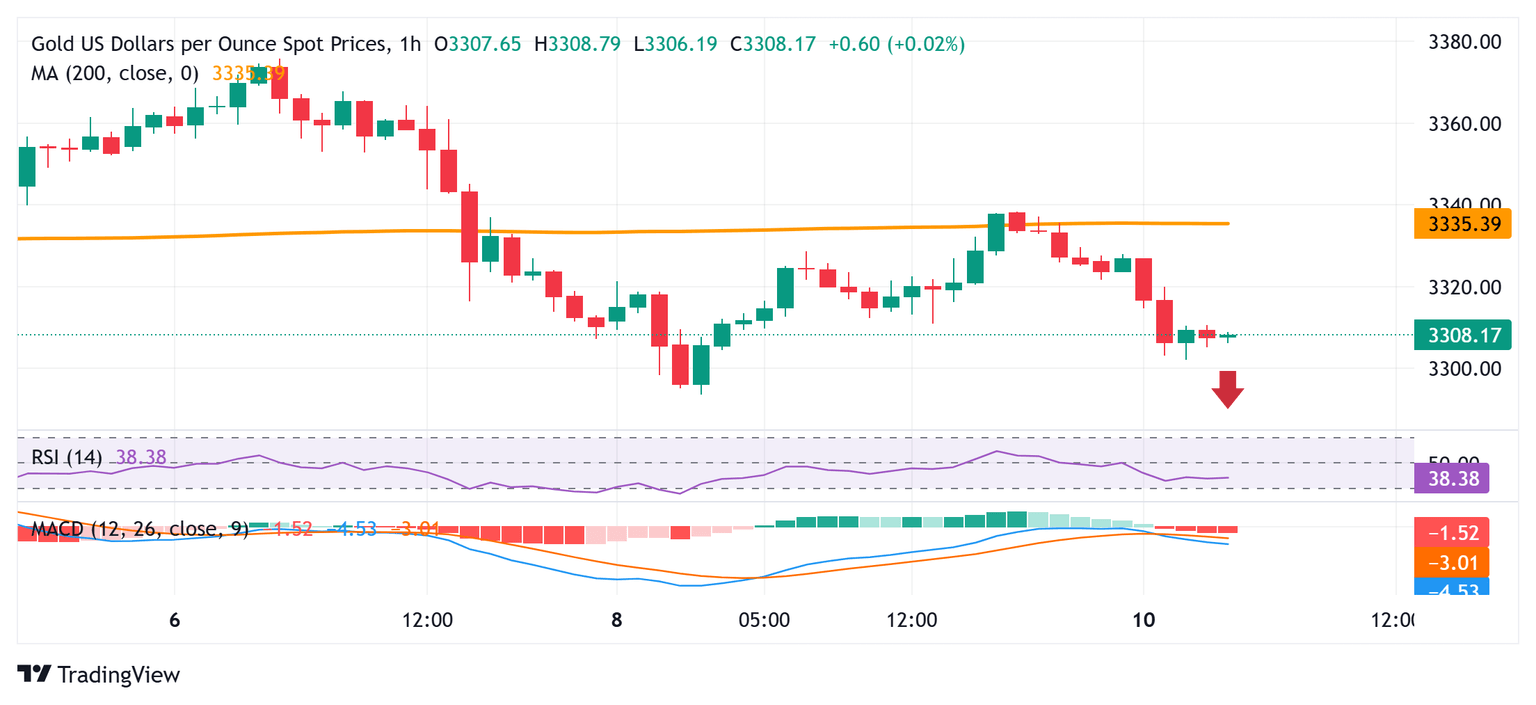

Gold price could accelerate the move higher once the 200-hour SMA hurdle near $3,333-3,334 is cleared

From a technical perspective, the overnight failure to find acceptance above the 200-hour Simple Moving Average (SMA) and the subsequent slide favors the XAU/USD bears. Moreover, oscillators on hourly charts have been gaining negative traction and back the case for further intraday losses. Some follow-through selling below the $3,294-3,293 area, or the overnight swing low, will reaffirm the bearish outlook and make the Gold price vulnerable to accelerate the fall towards the $3,246-3,245 area (May 29 swing low) en route to the $3,200 neighborhood.

On the flip side, the 100-hour SMA, currently pegged near the $3,333-3.334 area might continue to act as an immediate hurdle. A sustained strength beyond could trigger an intraday short-covering move and lift the Gold price to the $3.352-3,353 hurdle. The momentum could extend further towards the $3,377-3,378 resistance, which if cleared should allow the XAU/USD to make a fresh attempt to conquer the $3,400 round figure.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.