Gold falls from daily highs, finishes week up over 2%

- Gold price peaks at $2,477 before falling to $2,430, down 0.60%.

- US Nonfarm Payrolls miss expectations, Unemployment Rate rises, and Average Hourly Earnings dip.

- Weak economic data fuels speculation of Fed rate cuts in September, with US 10-year Treasury yield dropping to 3.815%.

Gold prices are under pressure after hitting a two-week high of $2,477 earlier during the North American session. Data showed that the US jobs market feels the effects of higher borrowing costs set by the Federal Reserve as the number of Americans applying for work dipped. This bolstered the golden metal, which rallied over 1% before retreating. The XAU/USD trades at $2,430, down 0.60%.

Wall Street’s trade with substantial losses, as most equity indices plunged at least 2.20% after the US Bureau of Labor Statistics (BLS) revealed that July’s Nonfarm Payrolls (NFP) figures missed the mark, while June data was revised downward.

Given the backdrop of a dismal Manufacturing PMI report revealed by the Institute of Supply Management (ISM) on Thursday, which was still digested by traders, along with today’s NFP figures, the chances that the Fed might lower interest rates at the September meeting are increasing.

Additional data showed that the Unemployment Rate ticked higher, while Average Hourly Earnings (AHE), a measure of wage inflation, edged lower.

After the data, US Treasury bond yields plummeted sharply, with the US 10-year benchmark note falling 16 basis points to 3.815%, its lowest level since March. and a tailwind for Bullion prices.

Consequently, the US Dollar Index (DXY), a measure of the dollar’s performance against other six currencies, dropped over 1% to 103.23.

US data in the last two days justified Fed Chairman Jerome Powell's statement that the federal fund rates could be cut in September if the US economy cools down.

Another reason driving precious metals prices is geopolitical risks. Tensions in the Middle East remain high as Israel awaits a response from Iran and Lebanon following the assassination of the Hamas leader earlier in the week.

Daily digest market movers: Gold price stumbles amid recession fears

- The Federal Reserve decided to hold rates unchanged but indicated that favorable data on inflation and further weakening in the labor market could prompt action.

- The US Department of Labor revealed that Nonfarm Payrolls (NFPs) were 114K in July, missing estimates of 175K, with previous figures revised downward from 206K to 179K.

- The US Unemployment Rate increased from 4.1% to 4.3%, and Average Hourly Earnings dipped from 0.3% to 0.2%.

- After the data, most banks began to price in more aggressive monetary policy easing by the Fed. Bank of America expects the first cut in September instead of December, while Citi and JP Morgan expect the Fed to lower rates by 50 bps in September and November.

- The CME FedWatch tool shows the odds for a 50 bps Fed rate cut at the September meeting at 70%.

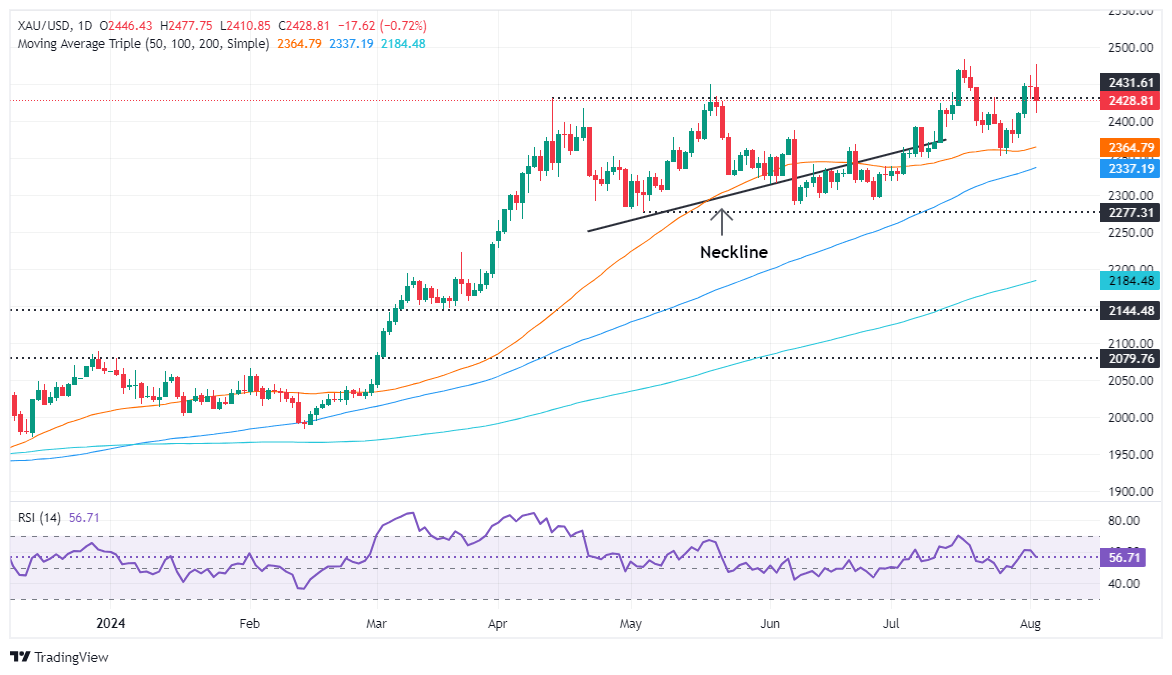

Technical analysis: Gold price retraces from daily highs, below $2,450

Gold price has retreated toward the July 31 lows of $2,404-$2,410, which could be attributed to profit-taking ahead of the weekend, as US yields and the Greenback remain at weekly lows.

From a technical standpoint, XAU/USD is set to remain bullish, and if buyers achieve a daily close above $2,450, this could exacerbate a challenge towards the all-time high, ahead of the $2,500 mark.

On further weakness, prices could fall below $2,400, which could pave the way for a pullback to the 50-day moving average (DMA) at $2,364, before testing the 100-DMA at $2,337.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.