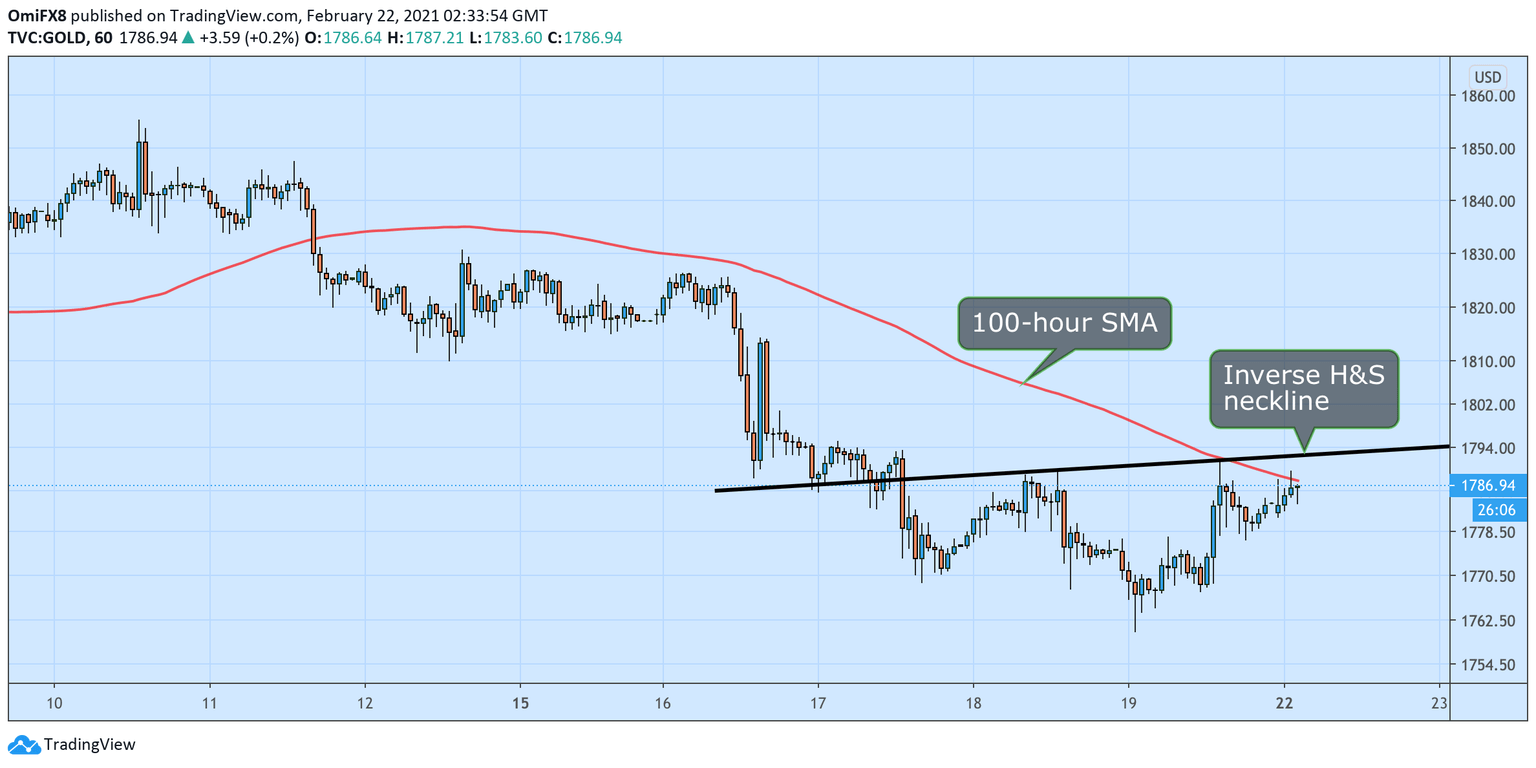

Gold Price Analysis: XAU/USD stays below 100-hour SMA

- Gold's bounce from recent low has stalled near the 100-day SMA.

- The metal has carved out an inverse head-and-shoulders pattern.

Gold is currently trading near $1,786 per ounce, having failed to keep gains above the 100-hour Simple Moving Average (SMA) early Monday. The average failed to take out the hurdle on Friday.

Repeated rejection could bring in more chart-driven selling, yielding a re-test of the recent low of $1,760.

The immediate bias will turn bullish if the yellow metal crosses above the hourly chart inverse head-and-shoulders neckline hurdle of $1,792.

A breakout would create room for a rally to above $1,820 (target as per the measured move method).

Hourly chart

Trend: Bullish above $1,792

Technical levels

Author

Omkar Godbole

FXStreet Contributor

Omkar Godbole, editor and analyst, joined FXStreet after four years as a research analyst at several Indian brokerage companies.