Gold Price Analysis: XAU/USD sellers remain hopeful below $1880 after Trump’s stimulus blow – Confluence Detector

Gold (XAU/USD) is nursing losses after three consecutive days of declines, although remains in a familiar range above $1850. The renewed concerns about a $900 billion COVID-19 relief package could likely keep gold on the back foot. US President Donald Trump asked for an amendment to the pandemic relief package.

However, broad-based US dollar retreat cushions the downside in gold. Brexit deal optimism and disappointing US Consumer Confidence data weigh negatively on the greenback. Pre-Christmas thin trading conditions will continue to play out ahead of the US economic releases.

How is gold positioned on the charts?

Gold Price Chart: Key resistances and supports

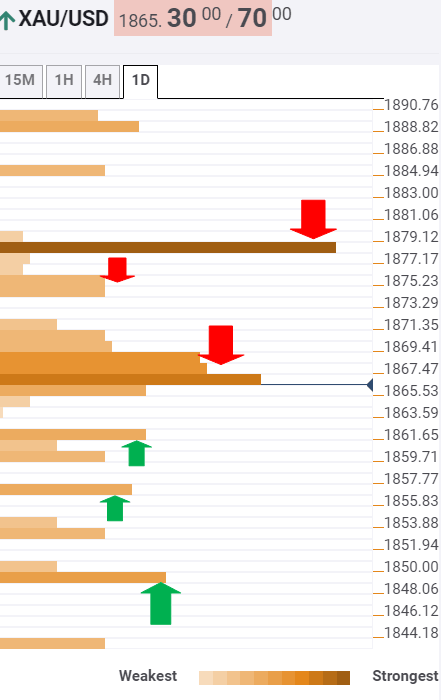

The Technical Confluences Indicator shows that the XAU/USD pair is struggling to overcome a dense cluster of resistance levels stacked up around the $1867-69 region.

That area is the confluence of the Fibonacci 38.2% one-week, SMA5 four-hour and the previous high four-hour.

A firm break above the latter could expose a minor cap at $1874, which is the convergence of the SMA5 one-day and Fibonacci 61.8% one-day.

Up next, the bulls are likely to challenge the critical barrier at $1880, the intersection of the Pivot Point one-day R1, Fibonacci 23.6% one-week and Bollinger Band four-hour Middle.

To the downside, minor support awaits at $1861, where the SMA200 one-hour coincides with SMA50 four-hour and the previous low four-hour.

The SMA10 one-day at $1856 is the next relevant downside target, below which the Pivot Point one-day S1 of $1852 could be probed.

The bears need a break below the $1850 barrier to reviving the bearish bias. The Fibonacci 61.8% one-week is aligned at that level.

Here is how it looks on the tool

About Confluence Detector

The TCI (Technical Confluences Indicator) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.