Gold Price Analysis: XAU/USD rally extends into $2,040 as Fedspeak sparks Fed pivot bets

- Spot Gold is lurching higher as broad markets go risk-on, tipping into $2,040.

- Fedspeak is bolstering market bets that interest rates will be coming down sooner than expected.

- Fed Governor Waller sparked investor expectations of a pivot in the Fed's rate outlook.

Gold prices climbed on Tuesday in their best single-day performance in over six weeks, climbing 1.5% on the day and settling at a seven-month peak of $2,044.

Markets saw a risk rally as investor sentiment bid up assets across the board, sparked by Dovish Fed comments in the early US market session that sent Gold climbing on the day.

Fed's Waller sees no need to insist on high rates

Federal Reserve (Fed) Governor Christopher Waller noted on Tuesday that as long as inflation continues to fall back towards Fed targets, there's no reason to continue forcing rates to remain higher for longer.

The offhand comment made during a conversation with Michael Strain, Director of Economic Policy Studies, at the American Enterprise Institute was all it took to spark a risk bid in US markets, sending Gold, equities, and risk assets climbing while the US Dollar declined.

Fedspeak is sparking bets that the Fed will be pivoting from their "higher for longer" stance on interest rates, increasing market hopes for an accelerated path towards Fed rate cuts sooner rather than later.

XAU/USD Technical Outlook

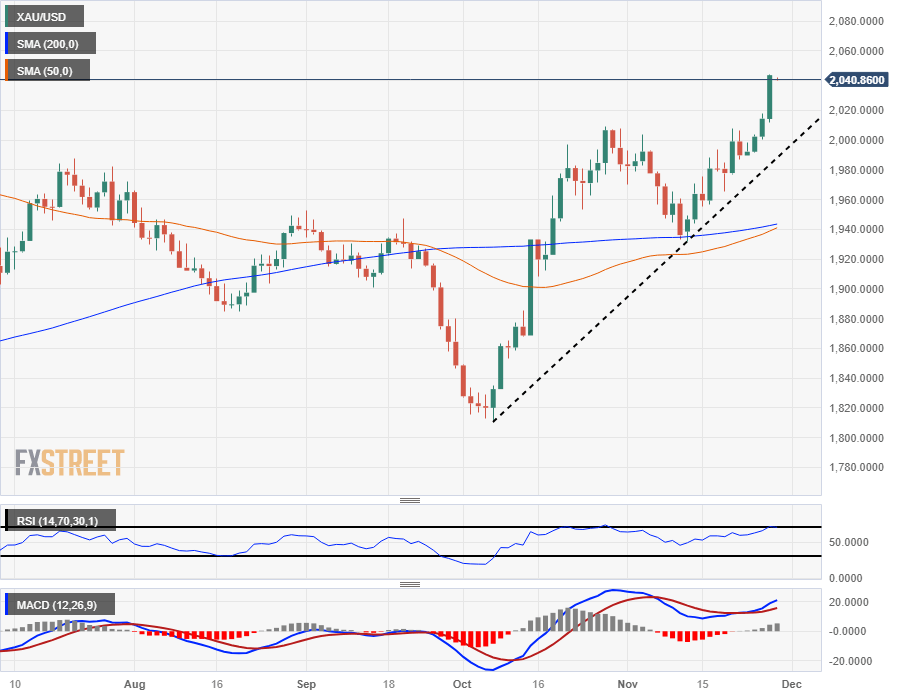

Spot Gold has tipped into seven-month highs above $2,040 and has climbed almost 13% from October's lows near $1,810.

XAU/USD continues to rally after catching a bounce from the 200-day Simple Moving Average (SMA) near $1,940, and a bullish lean in average price gains is pushing the 50-day SMA into a bullish crossover of the 200-day SMA.

The last higher low is etching in a rising trendline from October's lows, and sellers will need to break through rising technical support in order to challenge near-term bullish momentum.

XAU/USD Daily Chart

XAU/USD Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.