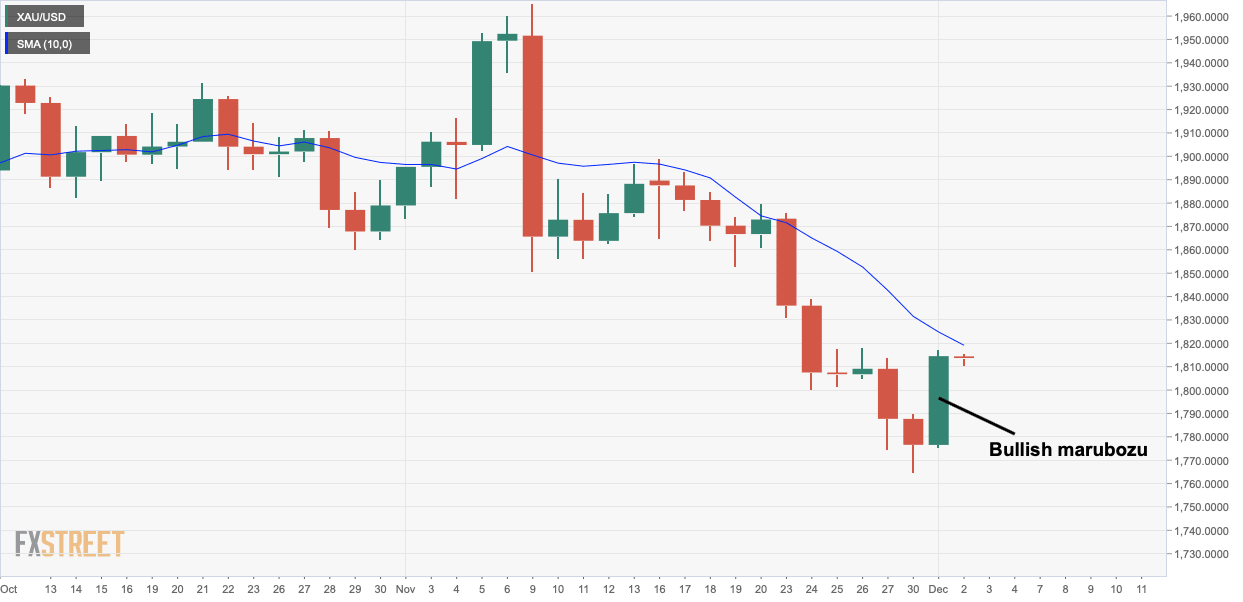

Gold Price Analysis: XAU/USD eyes 10-day SMA hurdle

- Gold looks north after Tuesday's bullish marubozu candle.

- The 10-day SMA is likely to offer resistance ner $1,819.

Gold is currently trading largely unchanged on the day near $1,814 per ounce.

The yellow metal could test and possibly break above the descending 10-day Simple Moving Average (SMA) at $1,819, as Monday's bullish marubozu candle shows buyers have regained control.

A bullish marubozu occurs when buyers control the price action from the opening bell to the closing bell. More substantial gains often follow the candlestick pattern.

Acceptance above the 10-day SMA would shift the focus to the former support-turned-hurdle at $1,850. Alternatively, a failure to beat the 10-day SMA resistance would strengthen the odds of a re-test of Tuesday's low of $1,775.

Daily chart

Trend: Bullish

Technical levels

Author

Omkar Godbole

FXStreet Contributor

Omkar Godbole, editor and analyst, joined FXStreet after four years as a research analyst at several Indian brokerage companies.