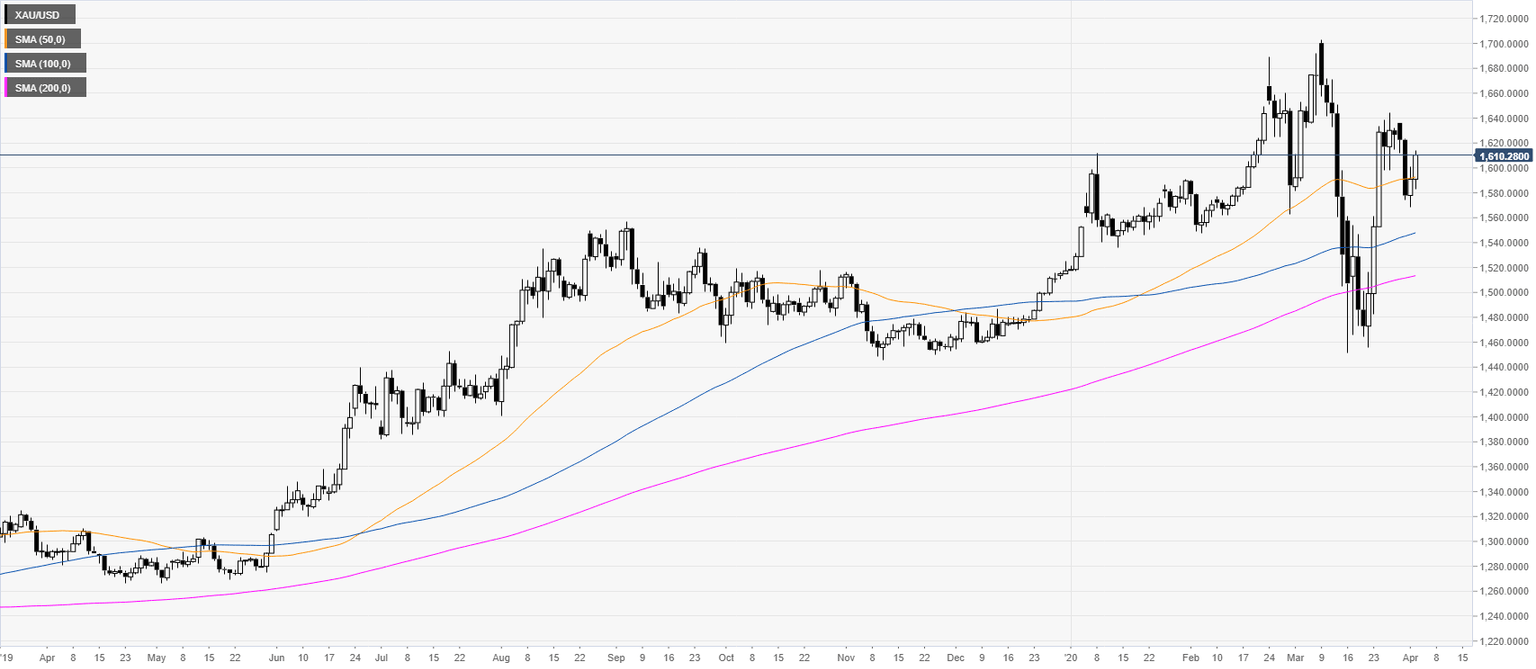

Gold Price Analysis: XAU/USD bounces and challenges $1615/oz

- XAU/USD consolidates after the massive bull-run seen in the last weeks.

- XAU/USD regains the 1600 mark after a short-lived dip below it.

XAU/USD daily chart

XAU/USD four-hour chart

Additional key levels

Author

Flavio Tosti

Independent Analyst