Gold Price Analysis: Sell the bounce as Trump raises doubts about ‘peaceful transition’ – Confluence Detector

Gold (XAU/USD) remains under pressure on Wednesday, having faced rejection once again at $1900. The first US Presidential election debate was chaos and weighed on the market mood, which helped the safe-haven US dollar recover from weekly lows. US President Donald Trump warned of a delay in the election and the eventual 'peaceful transition'. Meanwhile, the odds of Joe Biden winning propped up, which didn’t go down too well with the investors.

Attention returns to the US fiscal stimulus and a raft of key economic releases, including the critical US employment and GDP. How is gold positioned technically?

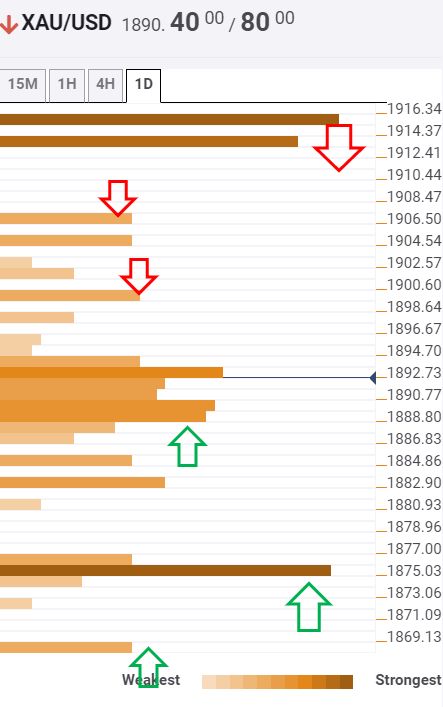

Gold: Key resistances and supports

Following the latest leg down, the Technical Confluences Indicator shows that Gold is trying hard to recapture a dense cluster of resistance levels between $1890/92, which is the convergence of the Bollinger Band one-hour Middle, SMA50 and 5 on four-hour.

The next relevant barrier is placed at $1894, the Fibonacci 23.6% one-day. A break above the latter could trigger a minor rally towards the previous day high at $1899.

Acceptance above that critical level is needed to revive the recovery momentum from two-month lows of $1848. The buyers will then look to test the powerful resistance near $1913/15, where the Fibonacci 61.8% 1W coincide with the Fibonacci 23.6% one-month.

Alternatively, the immediate cushion is seen at $1882, the intersection of the pivot point one-day S1 and Bollinger Band one-hour Lower.

Selling pressure could intensify below the latter, opening floors towards the robust support at $1875, the confluence of the Fibonacci 23.6% one-week and SMA5 one-day.

Further south, the bears will challenge the pivot point one-day S2 at $1869

Here is how it looks on the tool

About Confluence Detector

The TCI (Technical Confluences Indicator) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.