Gold climbs above $3,300 amid growing fears on US debt and geopolitics

- Gold rises as traders brace for vote on Trump’s debt-heavy tax bill.

- Moody’s downgrade and falling US Dollar fuel safe-haven demand for Gold.

- Middle East unrest offsets easing US-China trade tensions, keeping risk appetite muted.

Gold prices advance by over 0.50% and remain above the $3,300 mark as traders grow increasingly nervous about the United States (US) tax bill vote, along with escalating tensions in the Middle East. XAU/USD trades at $3,317 after bouncing off a daily low of $3,285.

The market mood remains downbeat as major US equity indices post losses while US Treasury bond yields rise. Market participants are awaiting the approval of President Trump’s tax-cut bill, which, according to the Congressional Budget Office (CBO), would add nearly $3.8 trillion to the US national debt.

The approval could underpin US stocks higher. However, the Greenback’s reaction is uncertain following Moody’s downgrade of US government debt last Friday, which triggered a USD sell-off, as depicted by the US Dollar Index (DXY).

The DXY, which tracks the performance of the American currency against six others, declines 0.52% to 99.49, a tailwind for bullion prices.

Heightened tensions in the Middle East boosted Gold prices, even though China-US tensions de-escalated as Beijing and Washington substantially reduced tariffs for 90 days to kick off negotiations to achieve a trade deal.

This week, traders will eye Fed speeches, Flash PMIs, housing data and Initial Jobless Claims.

Gold daily market movers: Gold rallies amid high US Treasury bond yields, weak US Dollar

- US Treasury bond yields are skyrocketing as the US 10-year Treasury note yield climbs nine and a half bps to 4.58%. Meanwhile, US real yields are also up nine and a half basis points at 2.229%.

- Bullion prices are rising due to concerns about the increase in US debt. Last week, Moody’s, the international rating agency, downgraded the US government rating from AAA to AA1, propelling Gold prices higher as the US Dollar got ditched and the US fiscal position worsened.

- On Tuesday, Federal Reserve (Fed) policymakers commented that monetary policy is appropriate, acknowledging that rising US import tariffs are inflation-prone and warrant holding rates.

- Gold price could extend its gains, boosted by geopolitical news. On Tuesday, CNN news, citing multiple sources, revealed that Israel is preparing to attack Iranian nuclear facilities.

- Data from the Chicago Board of Trade (CBOT) suggests that traders are pricing in 48.5 basis points of easing towards the end of the year.

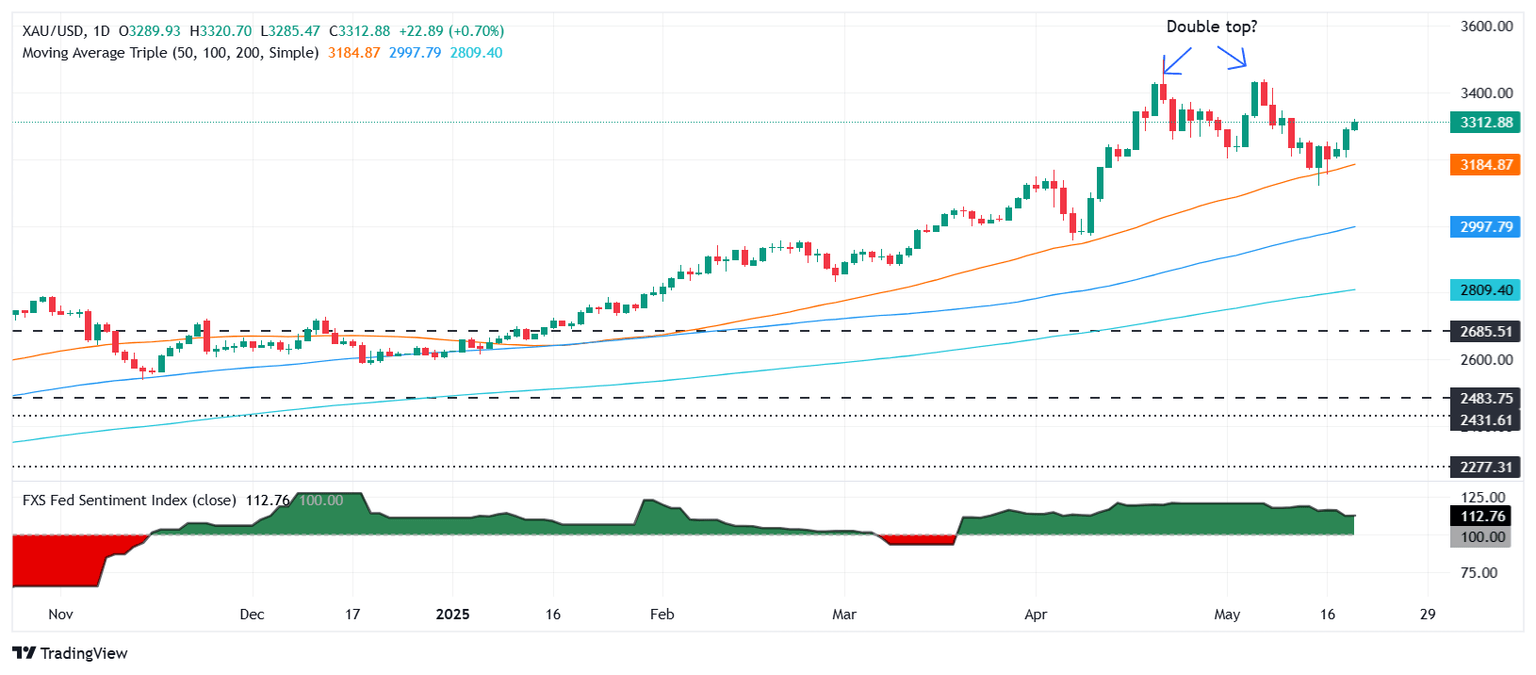

XAU/USD technical outlook: Gold poised to test $3,350 as bulls gather steam

Gold price rally extended for the third straight day, as price action has printed successive days of higher highs and higher lows, with buyers eyeing key resistance levels. Momentum, as depicted by the Relative Strength Index (RSI), suggests that the uptrend will continue before the RSI gets to overbought territory, which could warrant a pause lying ahead.

Therefore, Gold's first resistance would be the $3,350 psychological level. Once surpassed, the next target would be $3,400, followed by the May 7 daily high of $3,438, before testing the all-time high (ATH) at $3,500.

For a bearish reversal, Gold bears must drag spot prices below $3,300. Once cleared, immediate support emerges at a May 20 daily low of $3,204, ahead of the 50-day Simple Moving Average (SMA) at $3,184.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.